Why E-Verify for Contractors is Critical for Federal Business Success

The FAR E-Verify Clause: Who Needs to Comply?

Federal Acquisition Regulation (FAR) Subpart 22.18 says federal agencies may only award covered contracts to employers that use E-Verify for contractors. Whether you need to enroll comes down to four simple triggers.

Is Your Federal Contract Covered?

A contract is subject to the FAR clause when all of these conditions are met:

- Value – the prime contract is over $150,000.

- Duration – performance will run 120 days or longer.

- Location – the work takes place inside the United States (all 50 states and territories).

- Award date – the contract, or a modification adding the clause, is on or after 9 Sep 2009.

IDIQ contracts can be modified to add the clause if six or more months remain on the schedule. When that happens, the contractor has 30 calendar days to enroll.

For the exact language, see the official FAR E-Verify clause. If you need step-by-step help, review our guide to E-Verify employer requirements.

Key Exemptions and Exceptions

You may still be excused from the rule if any of these apply:

- COTS items and most bulk food or agricultural products.

- Short-term contracts under 120 days.

- Work performed entirely outside the U.S.

- Institutions of higher education, state or local governments, tribal governments, and sureties may verify only employees assigned to the contract.

- Supply-only subcontracts do not trigger E-Verify.

Evaluate every award carefully, because the burden to claim an exemption rests on you.

Navigating E-Verify for Contractors: Requirements and Timelines

Once the contract is signed, the clock starts. Missing a single deadline can put the entire award at risk, so let’s keep the timeline crystal-clear.

Enrollment and Setup Deadlines

- Within 30 days of award – submit your enrollment, sign the Memorandum of Understanding, and list every hiring site in the E-Verify portal.

- If you are already enrolled, update your account so every U.S. hiring location is covered. Partial coverage is not enough under the FAR clause.

Our automated eligibility verification system can complete the setup in a fraction of the usual time.

Employee Verification Timelines

- New hires – create an E-Verify case no later than 3 business days after the start date.

- Existing staff assigned to the contract – run cases within 90 days of enrollment. You may optionally verify your entire workforce instead of tracking assignments, a choice many contractors find simpler.

Need help deciding which approach is best? Our I-9 verification assistance team can weigh the trade-offs with you.

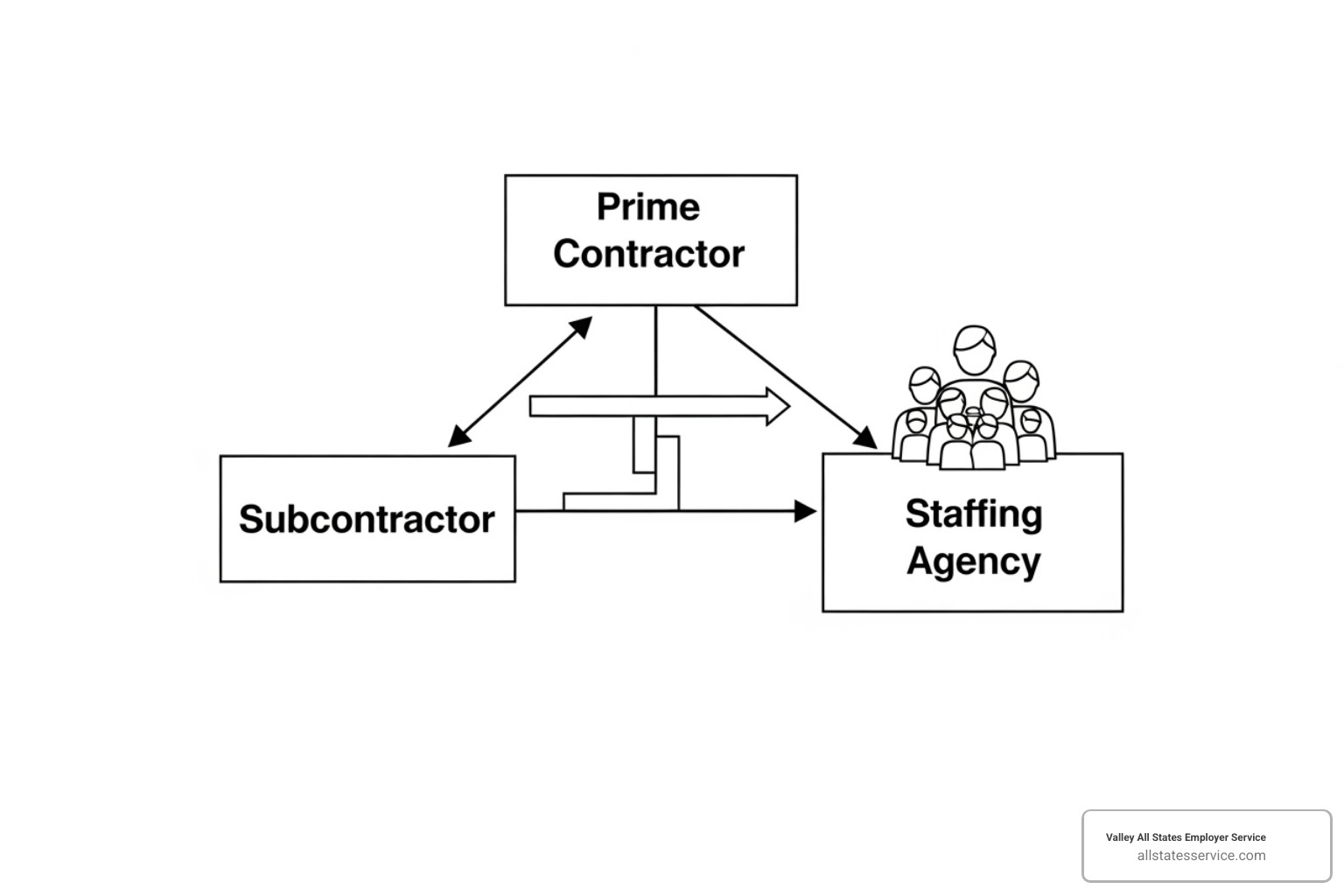

The Ripple Effect: E-Verify for Subcontractors, Temps, and Independent Contractors

When you win a federal contract with the E-Verify clause, you’re not just taking on compliance responsibilities for your own workforce. The E-Verify for contractors rule creates a ripple effect that flows down through your entire contractor network, touching subcontractors, temporary workers, and even independent contractors in certain situations.

Think of it like a compliance chain reaction. Once that FAR E-Verify clause lands in your prime contract, it doesn’t stop there. It keeps flowing down through layers of subcontractors, creating verification requirements that can catch many businesses off guard.

E-Verify Requirements for Subcontractors

The E-Verify requirement flows down to subcontractors when four specific conditions align perfectly. Your subcontractor must comply when the prime contract contains the FAR E-Verify clause, the subcontract involves commercial or noncommercial services or construction (not just supplies), the subcontract value exceeds $3,500, and the work happens in the United States.

Here’s where it gets interesting: subcontractors who only provide supplies get a free pass. The rule recognizes that suppliers typically don’t have employees directly performing work under the contract. They’re shipping products, not providing labor.

But if you’re a subcontractor providing services or construction work, you’re in the same boat as the prime contractor. You need to enroll in E-Verify within 30 days of your subcontract award and verify employees just like any other federal contractor.

Prime contractors carry oversight responsibilities that go beyond their own workforce. You must ensure all covered subcontracts at every tier include the full FAR E-Verify clause (FAR 52.222-54). You’re also responsible for general oversight to confirm subcontractor compliance. If you knowingly continue working with non-compliant subcontractors, you could face fines and penalties.

Smart subcontractors provide their prime contractors with proof of E-Verify enrollment by printing their “Maintain Company” page directly from the E-Verify system. This simple step can prevent compliance headaches down the road.

For comprehensive guidance on these requirements, check out the official guidance on subcontractors, independent contractors, and affiliates.

Handling Temporary Workers and Staffing Agencies

Temporary workers create a unique compliance situation that trips up many contractors. When you use temporary workers from staffing agencies, the staffing agency is responsible for E-Verify verification, not you. But here’s the catch: you need to make sure this verification actually happened.

Your compliance process should include contacting the staffing agency to confirm they’ve verified your temporary workers in E-Verify. Request proof of enrollment by asking the staffing agency to print their Company Information page from E-Verify. Then document the verification by keeping records that show the staffing agency’s E-Verify participation.

If you prefer more control over the process, you can enroll as an E-Verify Employer Agent. This allows you to create E-Verify cases for temporary employees provided by staffing agencies, but you’ll need access to each employee’s Form I-9. Some contractors find this approach gives them better oversight of their compliance obligations.

The FAQ on verifying temporary workers from an outside agency provides specific guidance for navigating these situations.

What About Independent Contractors and the Self-Employed?

Independent contractors occupy a gray area that confuses many federal contractors. Generally, employers aren’t required to complete Form I-9 or use E-Verify for independent contractors. The key word here is “generally” because the E-Verify requirement can flow down to independent contractors when they’re acting as subcontractors under a covered federal contract.

Self-employed individuals working as subcontractors don’t need to complete Form I-9 on themselves or enroll in E-Verify, even under a covered federal contract. They’re only responsible for verifying their own employees, if they have any.

But there’s an important caveat: you cannot use an independent contractor if you know they’re an unauthorized alien. This prohibition comes from employer sanction rules and applies regardless of E-Verify requirements.

Sole proprietorship employees create another layer of complexity. If an independent contractor operates as a sole proprietorship with employees, they must complete Form I-9 for each employee they hire and use E-Verify if required under the federal contract.

The distinction between employee and contractor becomes crucial here. Getting worker classification wrong can create compliance problems that extend far beyond E-Verify requirements.

For more information on handling various worker classifications and verification requirements, explore our E-Verify background checks resource.

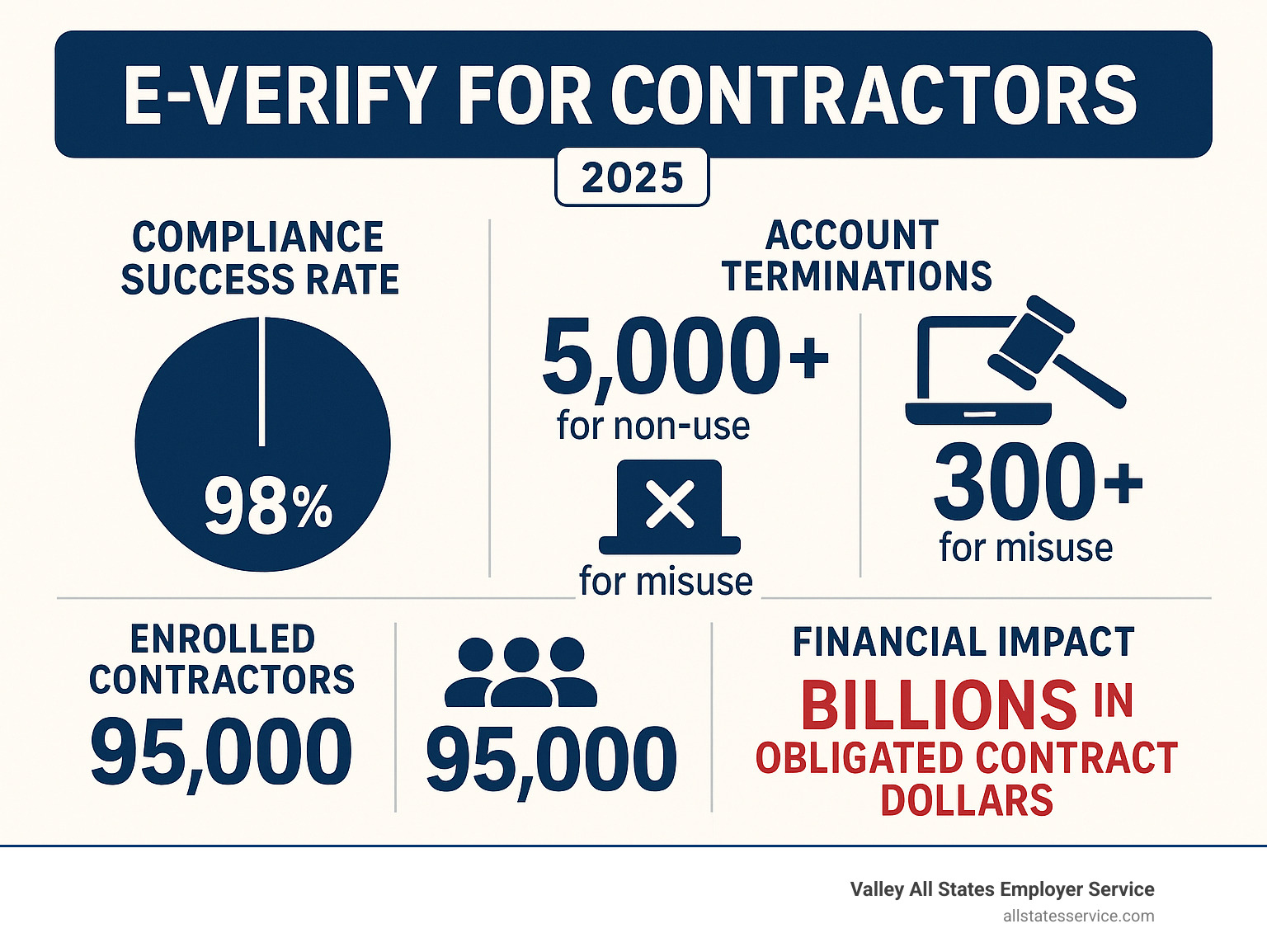

The Stakes are High: Consequences of Non-Compliance

USCIS can, and regularly does, shut down contractor accounts. From 2020 through early 2023 it terminated nearly 300 for misuse and over 5,000 for non-use. A closed account means you can’t verify anyone, making it impossible to honor an active FAR clause.

Potential Penalties

- Account termination – immediate loss of E-Verify access.

- Contract suspension or termination – agencies may halt work or cancel the award.

- Debarment – long-term ban on future federal contracts.

The financial hit is far bigger than any fine. Lost revenue and legal fees add up fast. If you are unsure of your current standing, schedule an I-9 self-audit before an agency auditor does it for you.

Staying Compliant

- Record the E-Verify case number on every Form I-9 and keep documentation for the required retention period.

- Post the E-Verify Participation and Right to Work posters in a spot easily seen by applicants and employees.

- Watch for contract modifications that add the FAR clause, especially on IDIQ awards.

- Never run a case before day one, never pre-screen applicants, and never pick and choose which employees to verify.

For a practical checklist, download our E-Verify best practices guide.

Your Toolkit for Success: E-Verify Resources for Contractors

Navigating E-Verify for contractors doesn’t have to feel like solving a puzzle blindfolded. The right resources and support can transform compliance from a headache into a streamlined process that protects your federal contracts.

Think of this as building your compliance toolkit. You wouldn’t tackle a construction project without the right tools, and E-Verify compliance deserves the same thoughtful preparation.

Official Government Resources

E-Verify.gov serves as your primary command center for everything E-Verify related. This isn’t just another government website buried in bureaucratic language. It’s actually designed to help contractors like you succeed with clear enrollment instructions, user manuals that make sense, and system status updates that keep you informed about maintenance schedules.

The E-Verify Supplemental Guide for Federal Contractors goes deeper than the basic website resources. This comprehensive guide walks you through the specific requirements that apply to federal contractors, covering everything from enrollment procedures and timelines to employee verification processes and subcontractor obligations.

When you’re stuck on a specific question, the Federal Contractors Q&As page often has the answer you’re looking for. This resource tackles the most common questions about contract coverage determination, enrollment procedures, employee verification requirements, and subcontractor responsibilities.

Training and webinars from USCIS provide invaluable opportunities to learn directly from E-Verify experts. These sessions cover new requirements and updates, share best practices for compliance, highlight common errors and how to avoid them, and offer Q&A sessions where you can get answers to your specific situations.

Don’t miss the chance to register for upcoming USCIS webinars for federal contractors. These sessions can save you from costly mistakes and keep you current on changing requirements.

Expert Support and Services

Sometimes the best investment you can make is getting professional help. E-Verify Employer Agents bring expertise that can dramatically reduce your compliance burden while improving accuracy.

Professional E-Verify services offer error reduction through expert processing that minimizes mistakes, administrative efficiency by outsourcing the burden from your internal team, compliance assurance through professional oversight, and scalability to handle fluctuating workforce needs.

The benefits become even more apparent when you consider the speed and reliability. Professional services often process verifications within 24 hours, reduce your risk of compliance violations, provide expert guidance on complex situations, and integrate smoothly with your existing HR processes.

At Valley All States Employer Service, we understand that federal contractors need reliable, compliant workforce verification without the administrative headaches. Our E-Verify services are specifically designed for contractors who need expert, impartial, and efficient processing.

Professional support makes the most sense when you’re dealing with high-volume hiring or verification needs, managing complex subcontractor relationships, juggling multiple federal contracts with varying requirements, working with limited internal HR resources, or recovering from previous compliance challenges.

The investment in professional E-Verify support often pays for itself through avoided penalties, faster processing times, and the peace of mind that comes with knowing your compliance is handled by experts who understand the federal contractor landscape.

For ongoing guidance and support beyond just processing, explore our E-Verify customer support options that keep you informed and compliant as requirements evolve.

Frequently Asked Questions about E-Verify for Contractors

Can I use our HR database instead of Form I-9 for E-Verify?

Only if the data in your system was lifted directly from the signed Form I-9. Double-check that every field matches the form exactly before you submit a case.

How do I know if an employee is “assigned to a contract”?

They must be doing hands-on work paid for by that award, not general overhead. When in doubt, either verify the person or adopt the entire-workforce option and eliminate the guesswork.

What if I’m a subcontractor? How do I prove I’m enrolled in E-Verify?

Log in, open Company → Company Profile, and print the Maintain Company page that lists your E-Verify ID and active status. Give a copy to the prime contractor for their files.

Master Your Compliance and Secure Your Contracts

Think of E-Verify for contractors as your key to the federal contracting kingdom. Get it right, and you open up billions in federal opportunities. Get it wrong, and you’re locked out entirely.

The numbers don’t lie. With approximately 95,000 federal contractors enrolled in E-Verify and hundreds of billions of dollars in federal contracts hanging in the balance, this isn’t just paperwork. It’s your business’s future.

Here’s what really gets our attention: between 2020 and 2023, USCIS terminated over 5,000 contractor accounts for non-use and nearly 300 more for misuse. That’s not just statistics. Those are real businesses that lost their ability to compete for federal work.

Your roadmap to E-Verify mastery starts with understanding that compliance isn’t a one-time event. It’s an ongoing partnership with the federal government that requires precision, consistency, and the right support system.

The 30-day enrollment deadline after contract award might seem generous, but it’s just the beginning. You’ll need to verify new hires within 3 business days and complete existing employee verification within 90 days. Miss any of these deadlines, and you’re not just risking a slap on the wrist. You’re risking your entire federal contracting future.

Subcontractor oversight adds another layer of complexity. You’re responsible for ensuring every covered subcontractor flows down the E-Verify requirements properly. One non-compliant subcontractor can jeopardize your entire contract.

Record-keeping and poster requirements might seem like small details, but they’re the foundation of ongoing compliance. The required E-Verify and Right to Work posters must be displayed prominently, and every E-Verify case number must be recorded on the corresponding Form I-9.

Here’s where Valley All States Employer Service makes the difference. We understand that federal contractors need more than just E-Verify processing. You need expert guidance, error-free verification, and administrative efficiency that lets you focus on delivering exceptional results on your contracts.

Our team has seen every E-Verify scenario imaginable. We know which employees are truly “assigned to a contract” and which aren’t. We understand the nuances of subcontractor requirements and the complexities of temporary worker verification. Most importantly, we know how to keep you compliant while minimizing the administrative burden on your team.

E-Verify compliance simplification isn’t just about avoiding penalties. It’s about positioning your business as a trusted federal partner. When contracting officers see that you’ve mastered workforce verification, they see a contractor who takes compliance seriously across all areas of federal contracting.

The federal government has made workforce verification non-negotiable. Your response should be equally decisive. Don’t let E-Verify requirements become a barrier to your federal contracting success.

Ready to streamline your E-Verify process? Explore our solutions. and find how we can help you master E-Verify requirements while reducing administrative burden and minimizing compliance risk.

Your federal contracts represent more than revenue. They’re proof that your business meets the highest standards of American enterprise. Let us help you protect that investment with bulletproof E-Verify compliance.