E-Verify case status: Master Your 8 Results

Understanding Your E-Verify Case Status

When your employer creates an E-Verify case status check, you need to know what comes next. Most cases get resolved within seconds with an “Employment Authorized” response, but sometimes the system needs more time or additional information from you.

Quick Status Check Options:

- Case Tracker: Use your 15-digit case number at myE-Verify Case Tracker

- myE-Verify Account: Create a free account for full case history and identity protection

- Email Notifications: Get alerts only when action is required (if you provided your email on Form I-9)

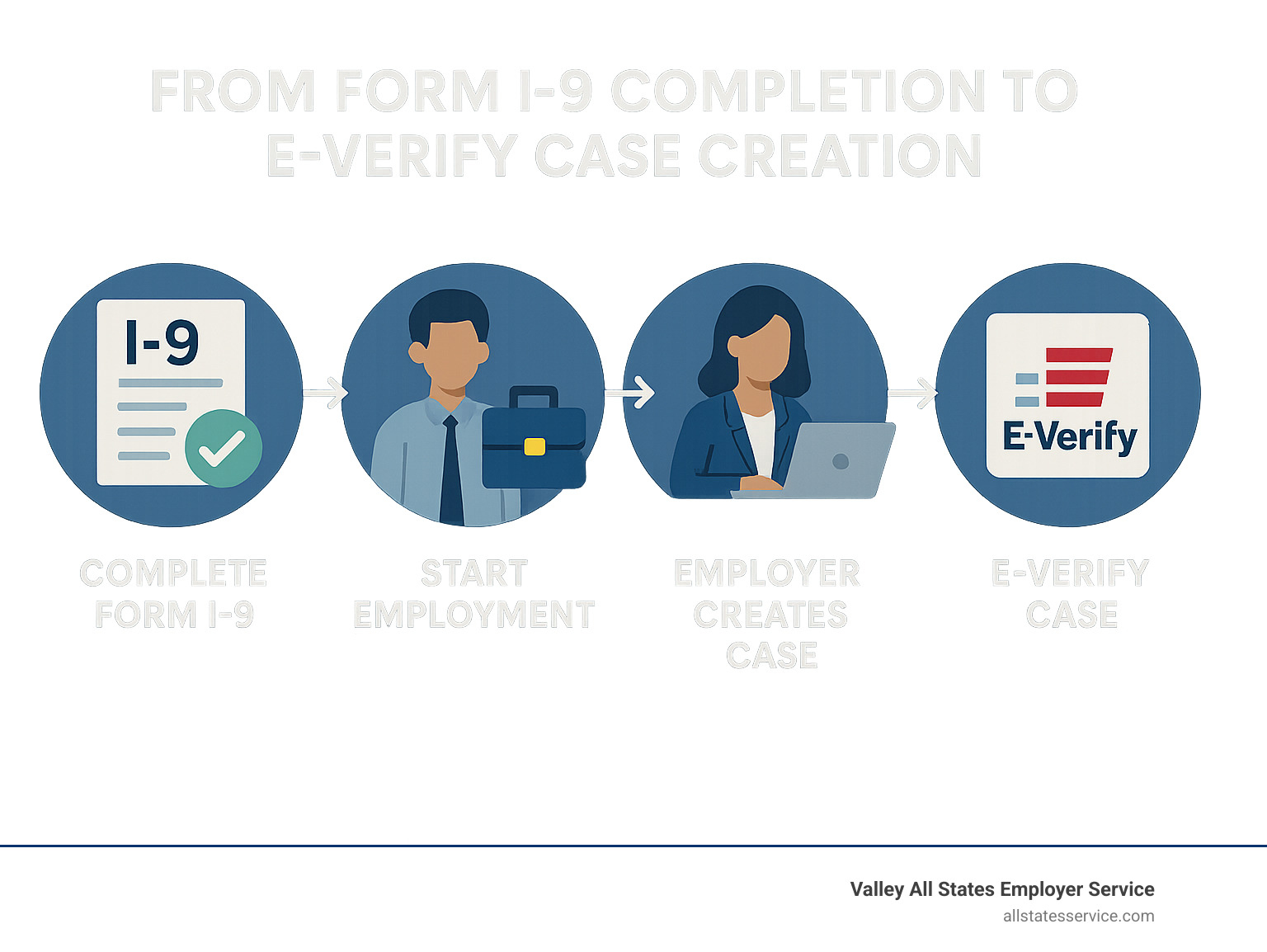

E-Verify is a web-based system run by U.S. Citizenship and Immigration Services that works with the Social Security Administration and Department of Homeland Security. It supplements Form I-9 by matching your employment eligibility information against government records.

Your employer initiates an E-Verify case after you complete Form I-9 and accept a job offer. They must submit this information within the first three days of your employment. The system then cross-references your data to confirm you’re authorized to work in the United States.

Understanding your case status helps you take the right action quickly. Some statuses require immediate employee response within 8 federal working days, while others need no action at all.

How to Check Your E-Verify Case Status

Checking your E-Verify case status doesn’t have to be a guessing game. While your employer starts the E-Verify process after you complete Form I-9, you have the power to track your case every step of the way. Think of it like tracking a package, you want to know where things stand without having to call and ask.

The good news? You have two main options to stay in the loop. The Case Tracker tool gives you a quick peek at your current status, while a myE-Verify account offers a complete dashboard of benefits. Both are free, and both put you in control of your employment verification journey.

Your employer plays their part by submitting your information within three business days of your start date. But when it comes to monitoring progress and responding to any requests for additional information, that’s where your employee self-service tools become invaluable. For a complete picture of how employment verification works, check out our guide on E-Verify Employment Verification.

What You Need to Check Your E-Verify Case Status

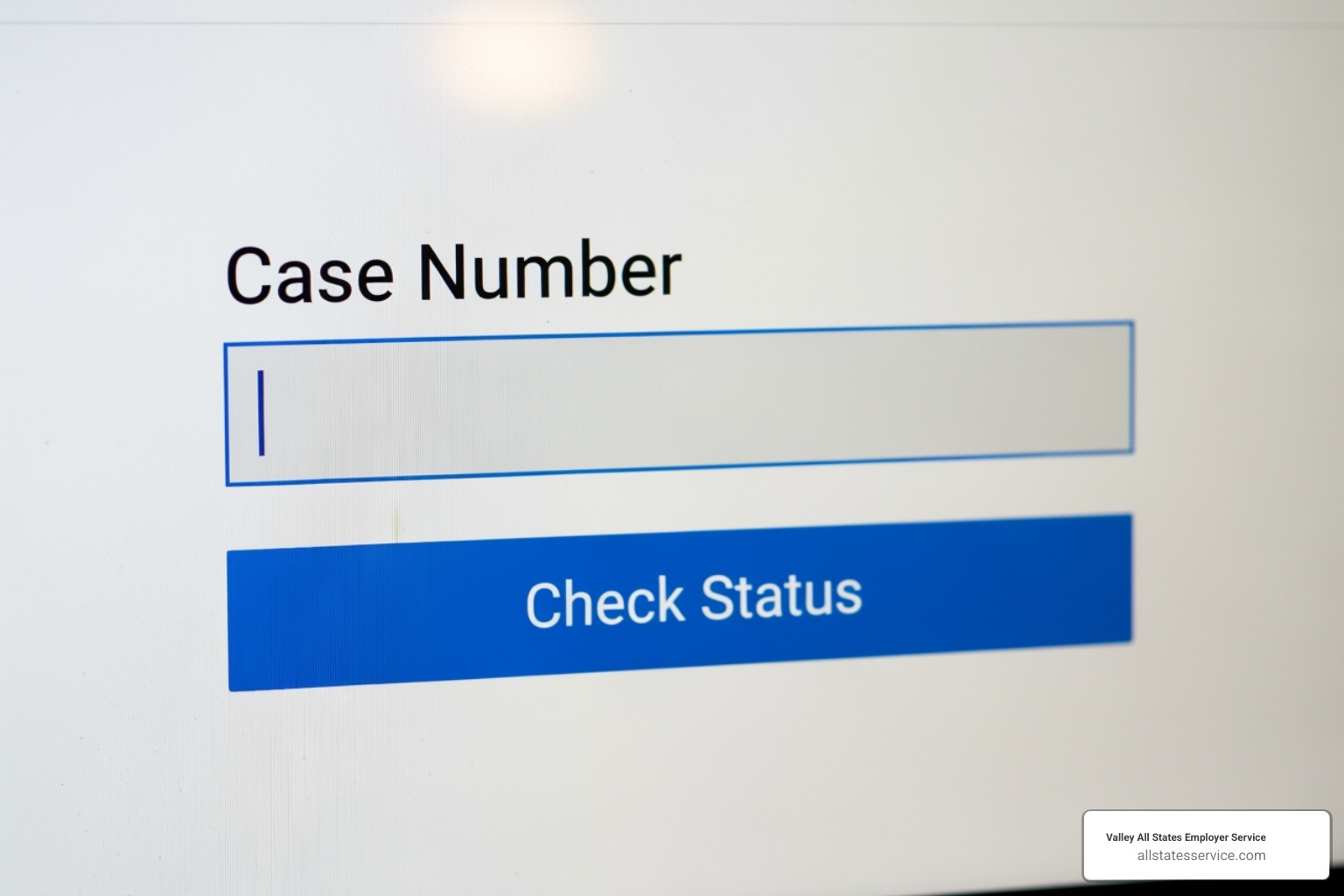

The key to checking your E-Verify case status is your E-Verify case number. This unique 15-digit number is like your case’s fingerprint, identifying your specific verification in the system.

Here’s where you’ll find this important number: if your case needs additional action beyond the initial check, your employer must give you a Further Action Notice. This notice contains your 15-digit case number and explains what steps you need to take next.

Got your number? Head over to the myE-Verify case tracker and enter those 15 digits into the search field. Hit enter, and you’ll see your current status right away. It’s that simple.

The whole process takes less than a minute. You type in your number, and the system shows you exactly where your case stands. No phone calls, no waiting on hold, just instant results.

The Benefits of a myE-Verify Account

While the Case Tracker works great for quick status checks, creating a myE-Verify account open ups a whole toolkit of features that go way beyond just viewing your current E-Verify case status.

The SSN lock feature alone makes the account worth it. You can lock your Social Security Number in the E-Verify system, which prevents anyone from using your SSN without your permission. It’s like putting a security system on your identity.

Your account also gives you access to your complete case history, so you can see every E-Verify case that’s ever been run on you. Need to upload documents to resolve a case? You can do that directly through your account. Want to track multiple cases if you’ve had several jobs? Your dashboard shows everything in one place.

The identity protection features help you spot any unauthorized use of your information quickly. Plus, you can manage document uploads and communicate directly with the system when needed. For the full rundown of everything your account can do, visit More on myE-Verify benefits.

Decoding Your Results: A Guide to Each Status

When you check your E-Verify case status, you’ll encounter one of eight possible responses. Each status tells a different story about your employment eligibility verification process and often dictates what, if any, action is required from you or your employer. Understanding these statuses is key to navigating the system effectively.

Here are the eight different responses you may receive when you use the Case Tracker:

- Employment Authorized: Confirmed eligibility.

- E-Verify Needs More Time: DHS requires additional time to verify.

- SSA Tentative Nonconfirmation (mismatch): Information does not match SSA records.

- DHS Tentative Nonconfirmation (mismatch): Information does not match DHS records.

- Employer Action Required: Employer needs to take a specific step.

- Employment Authorization Not Confirmed: Final determination of ineligibility.

- Case Referred to SSA: Employee needs to contact SSA.

- Case Referred to DHS: Employee needs to contact DHS.

Let’s explore what some of these common statuses mean for you.

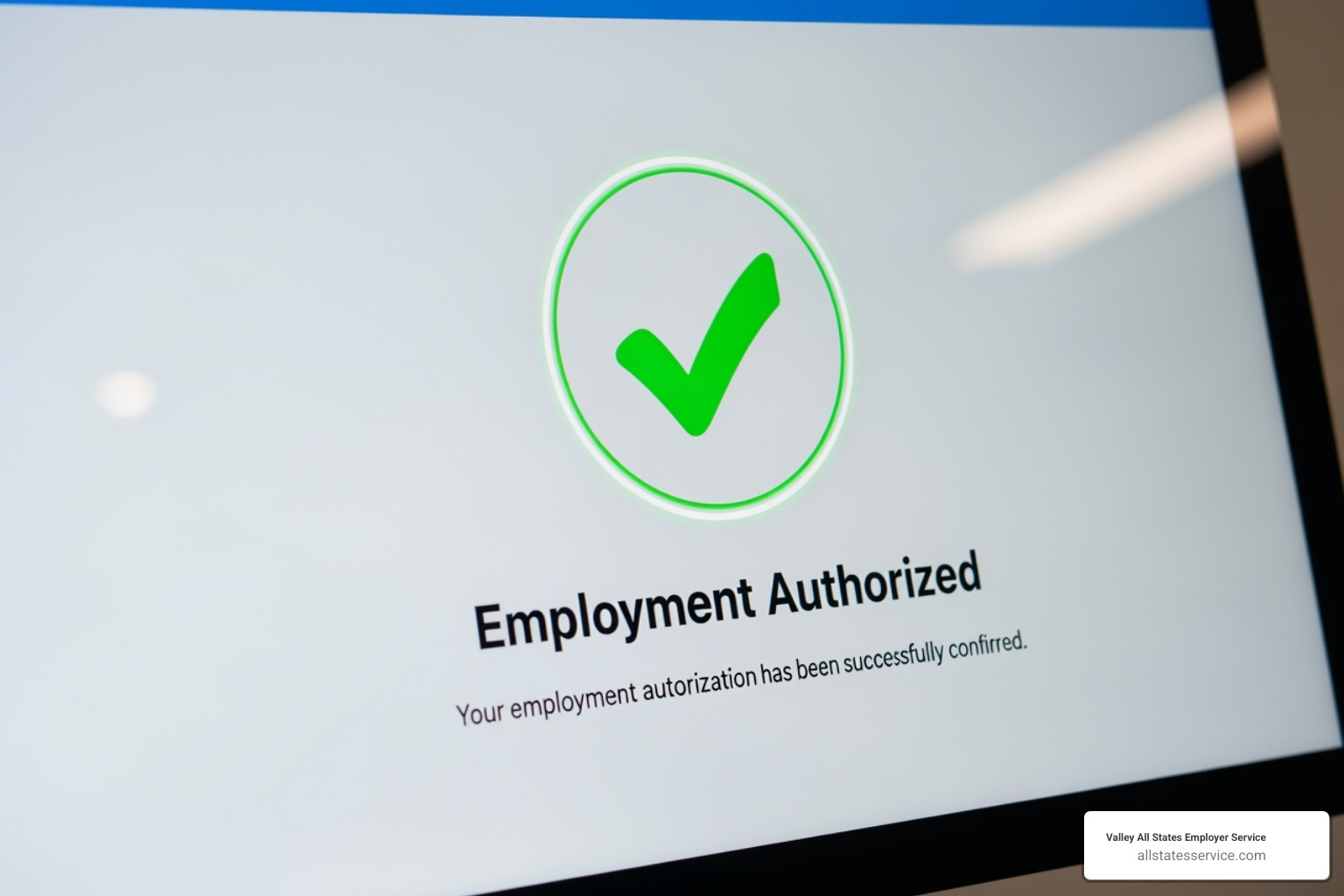

Employment Authorized

This is the golden ticket! When your E-Verify case status shows “Employment Authorized,” it means that E-Verify has successfully confirmed your authorization to work in the United States. This is the most common outcome, with E-Verify responding with “Employment Authorized” within seconds in most cases.

For you, the employee, this is fantastic news because it means your employment eligibility has been verified. For your employer, it signifies that they have met their E-Verify obligations for your hiring. No further action is needed from either party regarding this specific E-Verify case. The case is considered closed and confirmed. You’re all set to focus on your new role!

E-Verify Needs More Time

Sometimes, the system isn’t as quick as we’d like. If your E-Verify case status displays “E-Verify Needs More Time,” it indicates that the Department of Homeland Security (DHS) cannot immediately verify the data and requires additional time for review. This doesn’t mean there’s necessarily an issue; it simply means the case has been automatically referred for further verification.

The good news for you is that no action is required on your part at this time. Your employer should check E-Verify daily for updates, as DHS typically responds within 24 hours, though some cases may take up to three federal government working days. It’s crucial to remember that federal law prohibits your employer from taking any adverse action against you, such as terminating employment or delaying your start date, solely because your case has this status. Patience is key here. For more specific details, you can refer to the official guidance on E-Verify Needs More Time details.

Case in Continuance

A “Case in Continuance” E-Verify case status is an important one, particularly if you’ve already received a Tentative Nonconfirmation (TNC) and taken action to resolve it. This status means that you, the employee, have contacted DHS and/or visited an SSA field office as instructed, but the relevant agency needs more time to determine a final case result. It’s a waiting period where the agencies are working behind the scenes to verify your information.

As the employee, you generally have no specific action to take during this period; you’ve done your part. For employers, the responsibility is to periodically check E-Verify for case result updates. It is absolutely critical that employers do not terminate or take any adverse action against an employee while their case is in continuance. If a case remains in continuance for more than 60 federal government working days, your employer should contact the E-Verify Contact Center for assistance. Understanding this status is vital for both parties, and you can find more information on Understanding Case in Continuance.

Case Incomplete

A “Case Incomplete” E-Verify case status often points to an employer-side issue or a technical hiccup during the initial case creation. This status can occur if the employer fails to take action on a “Review Case – Are You Sure?” alert screen, or if there’s an issue during the photo matching process that prevents the case from being finalized.

If your E-Verify case has an “Incomplete” status, it usually means the employer needs to go back into the system and complete the pending steps. For you, the employee, this typically means there’s nothing you need to do directly, but it’s a good idea to communicate with your employer to ensure they are aware of the status and are working to resolve it. The good news is that this status is fixable by the employer accessing the case and continuing the process. For official guidance on how to resolve this, see Resolving a Case Incomplete status.

What to Do for a Tentative Nonconfirmation (TNC)

Getting a Tentative Nonconfirmation (TNC) when you check your E-Verify case status might make your heart skip a beat, but take a deep breath. This isn’t the end of the world, and it definitely doesn’t mean you’re not authorized to work. Think of a TNC as E-Verify’s way of saying “hold on, something doesn’t quite match up here, and we need you to help us figure it out.”

A TNC happens when the information your employer entered from your Form I-9 doesn’t immediately match what’s on file with either the Social Security Administration or the Department of Homeland Security. It’s like when your bank card gets declined at the store, but you know you have money in your account. There’s probably just a simple explanation that needs clearing up.

Here’s what matters most: you have rights, and you have choices. Your employer must give you a Further Action Notice that explains exactly what’s happening and what you can do about it. You’re not required to take action, but if you don’t, your case will likely result in a Final Nonconfirmation. Most of the time, resolving a TNC is straightforward once you know what to do.

Understanding Your TNC: SSA vs. DHS Mismatch

When you see a TNC on your E-Verify case status, the first thing to figure out is whether it’s coming from the Social Security Administration or the Department of Homeland Security. This makes a big difference in where you’ll need to go for help.

An SSA Tentative Nonconfirmation means something doesn’t match up in Social Security’s records. This happens more often than you might think. Maybe you got married and changed your name but haven’t updated it with Social Security yet. Or perhaps there was a typo when someone entered your Social Security number or birth date. Sometimes it’s because you became a U.S. citizen but Social Security still shows your old immigration status.

A DHS Tentative Nonconfirmation points to a mismatch in Department of Homeland Security records. This could be because of an incorrect alien registration number, variations in how your name is recorded, or outdated information about your immigration status. Maybe you have a new Employment Authorization Document, but the old information is still in the system.

The type of mismatch tells you exactly which government office can help you sort things out. It’s like having a roadmap to the solution.

Your Next Steps After a TNC E-Verify Case Status

Time is absolutely critical when you’re dealing with a TNC. You have exactly 8 federal government working days from the date your employer gives you that Further Action Notice to take action. These aren’t regular business days, they’re federal government working days, which means weekends and federal holidays don’t count.

If your E-Verify case status shows you need to contact SSA, you’ll need to visit a Social Security Administration field office in person. Bring your Further Action Notice and your Referral Date Confirmation with you. The SSA staff can look at your records, spot the discrepancy, and usually fix it right there on the spot.

For a DHS referral, you’ll need to contact the Department of Homeland Security within that same 8-day window. Your employer will give you the specific contact information you need. Have your DHS Further Action Notice and Referral Date Confirmation ready when you call or visit.

The key is acting quickly and bringing the right paperwork. Most TNCs get resolved without much hassle once you connect with the right agency. They see these situations all the time and know exactly how to help. You can always double-check your current status and find additional resources at E-Verify Case Status responses to make sure you’re on the right track.

Employer Compliance and Advanced E-Verify Topics

While we’ve focused on helping you understand your E-Verify case status as an employee, it’s worth understanding the bigger picture of how employers steer this complex system. Your employer carries significant responsibilities when using E-Verify, and their compliance directly affects your experience as an employee.

Employers must follow strict rules about when they can and cannot take action against employees during the verification process. They’re required to maintain detailed records, provide proper notices, and stay current with system updates. The stakes are high because non-compliance can result in substantial penalties and even disbarment from federal contracts. For employers looking to understand their full obligations, reviewing E-Verify Employer Requirements is essential.

The Status Change Report for Revoked EADs

Here’s something that might affect you if you’re working with an Employment Authorization Document (EAD). The Department of Homeland Security recently began revoking EADs for certain individuals whose parole has been terminated. This created a challenge for employers who needed to know when their current employees’ work authorization documents were no longer valid.

E-Verify introduced the Status Change Report to address this issue. This report helps employers identify current employees whose EADs have been revoked, even if the physical document appears unexpired. If your EAD appears on this report, your employer must begin the reverification process immediately using Form I-9, Supplement B.

The key point for you as an employee is that your employer cannot accept a revoked EAD, even if it looks valid. You’ll need to provide new, unexpired documentation from the acceptable document lists. Your employer should not create a new E-Verify case status check during this process, but instead follow the specific reverification procedures. This can be confusing territory, so both you and your employer can find detailed guidance at More on EAD reverification.

Following the Rules: Adverse Action and Compliance

Your rights as an employee are protected throughout the E-Verify process, and understanding these protections is crucial. The most important rule is that employers cannot take adverse action against you based on certain E-Verify statuses. This means they cannot fire you, suspend you, delay your training, or reduce your pay simply because your case shows “E-Verify Needs More Time” or you received a Tentative Nonconfirmation.

The only time an employer can take adverse action is after your case reaches a Final Nonconfirmation. This happens only when you choose not to contest a TNC, or when you do contest it but the government agencies cannot resolve the discrepancy. Even then, the employer must follow specific procedures and provide you with proper notice.

These rules exist to protect employees from discrimination and ensure fair treatment during the verification process. Employers who violate these regulations face serious consequences, including hefty fines and potential loss of federal contracting opportunities. That’s why many smart employers turn to compliance experts to ensure they’re following all the rules correctly. For comprehensive guidance on maintaining compliance, employers should review E-Verify Best Practices to avoid costly mistakes and protect both their business and their employees’ rights.

Simplifying Your E-Verify Process

Navigating the E-Verify case status system doesn’t have to be overwhelming. Think of it like learning to drive – once you understand the rules of the road, everything becomes second nature. For employees, the key is staying proactive. Check your status regularly and respond to any TNCs within those crucial 8 federal working days. This simple step can save you from unnecessary headaches down the road.

For employers, the stakes are even higher. Creating cases on time, keeping detailed records, and following adverse action rules aren’t just good ideas – they’re the law. One misstep can lead to costly penalties or compliance issues that nobody wants to deal with.

Here’s where things get interesting. Many businesses, especially smaller ones, find themselves drowning in E-Verify paperwork and regulations. It’s like trying to juggle while riding a unicycle – technically possible, but why make life that hard?

That’s exactly why Valley All States Employer Service exists. We take the complexity of E-Verify off your plate entirely. Our team handles the nitty-gritty details of workforce eligibility verification, so you can focus on what you do best – running your business. We’ve seen every type of case status imaginable, and we know exactly how to handle each one efficiently and correctly.

Whether you’re a small business just starting to hire your first employees or an established company looking to streamline operations, getting E-Verify right is non-negotiable. The good news? You don’t have to become an expert overnight. Our expert, impartial, and efficient processing minimizes errors and cuts through the administrative burden that keeps so many business owners up at night.

For smaller operations especially, outsourcing E-Verify makes perfect sense. Why invest time learning complex regulations when you could be growing your business instead? Check out our specialized guidance on E-Verify for Small Businesses to see how we make compliance simple and stress-free.

Ready to simplify your E-Verify process and ensure seamless compliance? Contact our team today to learn how our expert services can benefit your business.