I-9 Audit Services: End I-9 Stress 2025!

The Alarming Reality of I-9 Non-Compliance

If you are worried about I-9 inspections or penalties, I-9 audit services can help your business catch problems early and stay compliant. You get expert support to review your Forms I-9, fix errors, and lower the risk of costly fines.

Here is what you need to know about I-9 compliance and I-9 audit services.

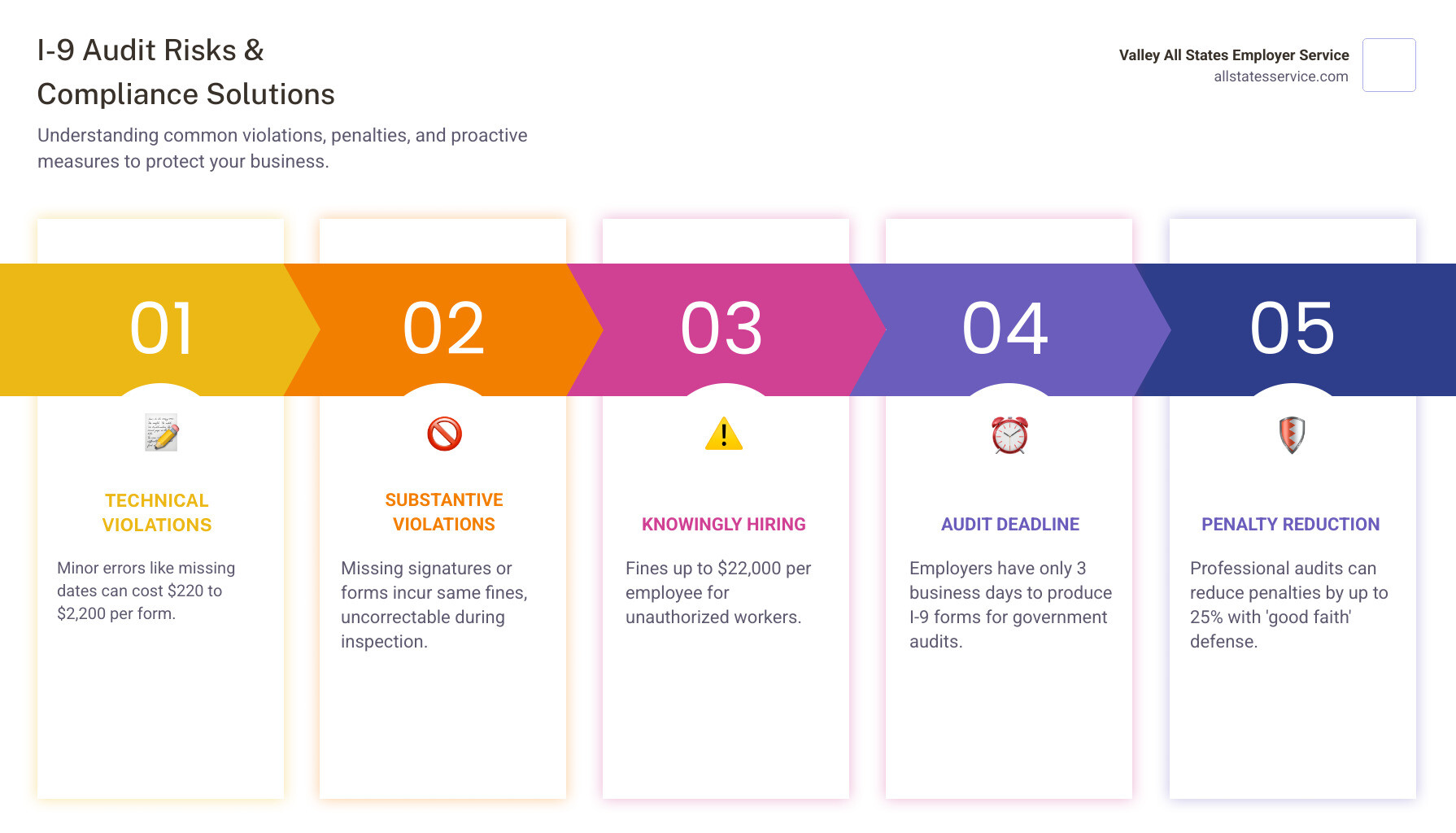

Key Facts About I-9 Audits:

- Technical violations (minor errors like missing dates) can cost $220 to $2,200 per form

- Substantive violations (missing signatures, no form at all) carry the same fines but cannot be corrected during inspection

- Knowingly hiring unauthorized workers triggers fines up to $22,000 per employee

- Government audits give you just 3 business days to produce all I-9 forms

- Professional audit services identify errors before ICE does, often reducing penalties by up to 25% through a “good faith” defense

Imagine this. Your company just received a Notice of Inspection from ICE. You have 72 hours to produce every I-9 form for current and terminated employees. As you pull files, you realize some forms are incomplete. Others are missing entirely. A few use outdated versions from years ago.

This nightmare plays out for thousands of U.S. employers every year. Government inspections of employment paperwork have increased dramatically, and the consequences are severe. Companies face fines that can reach into the millions, criminal prosecution for owners and managers, and even debarment from federal contracts.

The stakes are higher than most business owners realize. According to one Equifax analysis, each I-9 form could have more than 300 potential issues. Employers are accountable for more than 900 pages of guidance regarding Form I-9. If more than half your forms contain errors, you could face fines of $2,191 per incorrect form.

The good news is that you do not have to face this alone. Professional I-9 audit services exist specifically to help employers work through these complex requirements, spot problems before the government does, and build a strong, defensible compliance program.

Ready to find out how I-9 audit services can protect your business and give you peace of mind? Let’s explore what these services include and how they support real, day to day compliance.

I-9 audit services terms explained:

Want deeper insight into the basics first?

- Learn more about the form itself in What is an I-9?

- See why it matters in What is I-9 Form Needed For?

Ready to simplify compliance? Contact our team today to learn how our I-9 audit services can support your business.

Why Form I-9 is More Than Just Paperwork

Form I-9, the Employment Eligibility Verification form, is a seemingly simple document. However, it carries immense legal weight and is a cornerstone of U.S. immigration law. Mandated by the Immigration Reform and Control Act (IRCA) of 1986, this form serves a critical purpose: to verify the identity and employment authorization of all individuals hired in the United States after November 6, 1986.

Every new hire, regardless of their citizenship status, must complete Section 1 of Form I-9 by their first day of employment. Then, as the employer, you must complete Section 2 within three business days of the employee’s first day, examining original documents that establish identity and work authorization. It’s not just about collecting paperwork; it’s about upholding federal law and ensuring a legal workforce. Understanding What is an I-9? is the first step toward compliance. For a deeper dive into its necessity, explore What is I-9 Form Needed For?.

The Crushing Weight of Non-Compliance Penalties

The consequences of I-9 non-compliance are far-reaching and can be financially devastating for businesses. The U.S. Department of Homeland Security (DHS) and U.S. Immigration and Customs Enforcement (ICE) take these violations seriously, imposing escalating penalties for various infractions.

We’re talking about two main categories of penalties:

- Paperwork Violations: These are penalties for errors or omissions on the Form I-9 itself, or for failing to produce a Form I-9. Fines for substantive violations, which include failing to produce a Form I-9, range from $220 to $2,200 per violation. These fines are per error, not per form. A single form could have multiple violations, each carrying its own penalty. If more than half of your forms contain errors, the fine can be as high as $2,191 per incorrect form. Imagine finding 300+ potential issues per I-9, as one analysis suggests, and the costs can quickly escalate into tens or even hundreds of thousands of dollars for a mid-sized business. You can learn more about these risks in our I-9 Compliance Penalties Complete Guide and I-9 Audit Penalties Complete Guide.

- Knowingly Hiring or Continuing to Employ Unauthorized Workers: This is the most severe violation. Penalties can range from $548 for a first offense to $19,242 for repeat offenders, especially when a majority of the workforce is unauthorized. Companies found to employ unauthorized workers can be fined up to $22,000 per employee. Beyond fines, employers may face debarment from federal contracts and even criminal prosecution for owners, managers, and supervisors.

These figures are adjusted annually for inflation, so they are always a moving target. The sheer volume of guidance – over 900 pages – makes navigating these regulations a monumental task for any employer.

Understanding Government Inspections and Your 3-Day Window

The threat of a government inspection is not theoretical; it’s a very real and increasing possibility. Government inspections of employment paperwork, including Form I-9, have increased dramatically in recent years. Agencies like ICE, the Department of Homeland Security (DHS), and the Department of Labor (DOL) are actively scrutinizing businesses across all industries and sizes.

How does this usually begin? Typically, you will receive a Notice of Inspection (NOI) from ICE. This formal document informs you that an inspection of your I-9 forms is imminent. The most critical detail here is the timeline: employers typically have only three business days to produce all requested Forms I-9 and supporting documentation. This includes forms for all current employees and those who have been terminated but whose forms are still within the required retention period. In some cases, officials may ask that you bring your I-9 forms to a U.S. Immigration and Customs Enforcement field office for review.

Refusing or delaying an inspection can lead to further legal complications and may be interpreted as an attempt to conceal non-compliance. While a written notice is standard, it’s also possible for authorities to use subpoenas and warrants to obtain forms without prior notice, especially in cases of suspected criminal activity. This tight turnaround highlights why proactive compliance and audit readiness are not just good practice, but absolutely essential for any business. For more information on what to expect, refer to Government inspections and our guide on ICE I-9 Audit.

Decoding the I-9 Audit, Proactive Defense vs. Reactive Panic

An I-9 audit can be either a proactive internal review or a reactive response to a government inspection. The difference between these two situations can be huge for your business. A proactive audit, done on your own schedule, lets you find and fix errors quietly, which lowers risk and shows good faith. A reactive audit, triggered by an ICE Notice of Inspection, puts you under intense time pressure with serious penalties on the line.

The goal is to keep your Forms I-9 in a constant state of readiness, so a potential crisis turns into a routine administrative task. That is where professional I-9 audit services can guide you, your HR team, and your managers.

Why should you conduct an audit? In simple terms, to stay compliant and avoid fines. An audit helps you:

- Keep employee verification accurate and consistent with USCIS rules

- Confirm that document retention and storage are correct

- Reduce the risk of penalties in a government I-9 inspection

If you want a deeper process overview, take a look at our guide on Auditing I-9 Forms.

The Internal Audit, Your First Line of Defense

Regular internal audits, sometimes called self audits, are one of the most effective steps you can take for I-9 compliance. While not legally required, they are a smart way to make sure you are always ready for an inspection.

DHS and the Department of Justice Immigrant and Employee Rights Section publish guidance that encourages employers to perform their own internal Form I-9 audits. That guidance supports a structured, non discriminatory review, which is exactly what strong I-9 audit services will help you design.

An internal audit allows you to:

- Identify errors early. You can correct mistakes without the pressure of a government deadline.

- Plan for remediation. You can use a clear, step by step approach to fix issues following the legal rules.

- Demonstrate good faith. If ICE visits your business, a history of documented internal I-9 audits and corrections is one of your best defenses. It shows that you take compliance seriously and often helps reduce fines, sometimes by as much as 25 percent.

- Train and educate staff. An internal audit highlights common mistakes, so you can give focused I-9 compliance training to your HR team.

Your internal audit process can review all I-9 forms, or you can use a sound sampling method, as long as your selection criteria are consistent and non discriminatory. This proactive approach can save you money, time, and stress.

If you are planning a self review, you may find our I-9 Self Audit and Internal I-9 Audit Complete Guide especially helpful.

Technical vs. Substantive Errors, A Critical Distinction

When you look at I-9 errors, it is important to understand the difference between technical and substantive violations. This difference affects how you correct issues and how serious the fines may be.

During an official audit, you typically have 10 business days to correct technical errors. Substantive errors usually cannot be fixed for that inspection and often result in fines.

| Error Type | Description & Examples | Correction |

|---|---|---|

| Technical/Procedural | Minor mistakes that do not undermine the core purpose of the form. Examples include a missing address, incorrect date format, or a missing date of birth in Section 1. | Correctable. During an audit, you are usually given 10 business days to fix these. Corrections should be made by drawing a single line through the error, writing the correct information, and then initialing and dating the change. |

| Substantive/Verification | Serious errors that are treated as a failure to complete the form. Examples include missing signatures, no attestation, or failing to complete Section 2 or 3 entirely. | Not Correctable for that inspection. These violations almost always result in a fine. You can complete a new Form I-9 going forward, but that will not erase the original violation. |

A proactive internal audit, supported by I-9 audit services, gives you a chance to find and correct both types of issues before they are reviewed by ICE. That preparation can protect your business from thousands or even hundreds of thousands of dollars in exposure.

The Right Way to Correct I-9 Errors

Once you find errors in your I-9 forms, you need to correct them the right way. Poor corrections can be just as risky as the original mistake.

Here is a simple checklist to follow:

- Do not use correction fluid or tape. All changes must be easy to see.

- Draw a single line through the incorrect information.

- Write the correct information nearby. If there is not enough space, you can use the margin.

- Initial and date the correction, so it is clear who made the change and when.

Who should make the corrections?

- For errors in Section 1, the employee must correct and initial the form.

- For errors in Section 2 or 3, the employer or an authorized representative must correct and initial the form.

Never backdate changes. If you correct a form long after the original hire date, it can help to attach a short, signed, and dated note explaining what you corrected and why. This shows a good faith effort to follow the rules.

Also, make sure you are using the most current version of Form I-9, which you can find on the USCIS website. Using an outdated form is a common issue that professional I-9 audit services watch for and help you fix.

To stay on top of future changes, you can review our I-9 Form Updates page and explore related support like HR compliance consulting and workforce verification solutions.

Ready to simplify compliance and get your I-9 records in order? Contact our team today to learn more about our I-9 audit services and how we can support your business.