Your Guide to Flawless I-9 Compliance

I-9 form completion is a federal requirement that every U.S. employer must handle correctly for each new hire. This process verifies both identity and work authorization, but with 76% of paper Form I-9s containing at least one fineable error, getting it right is more challenging than it appears.

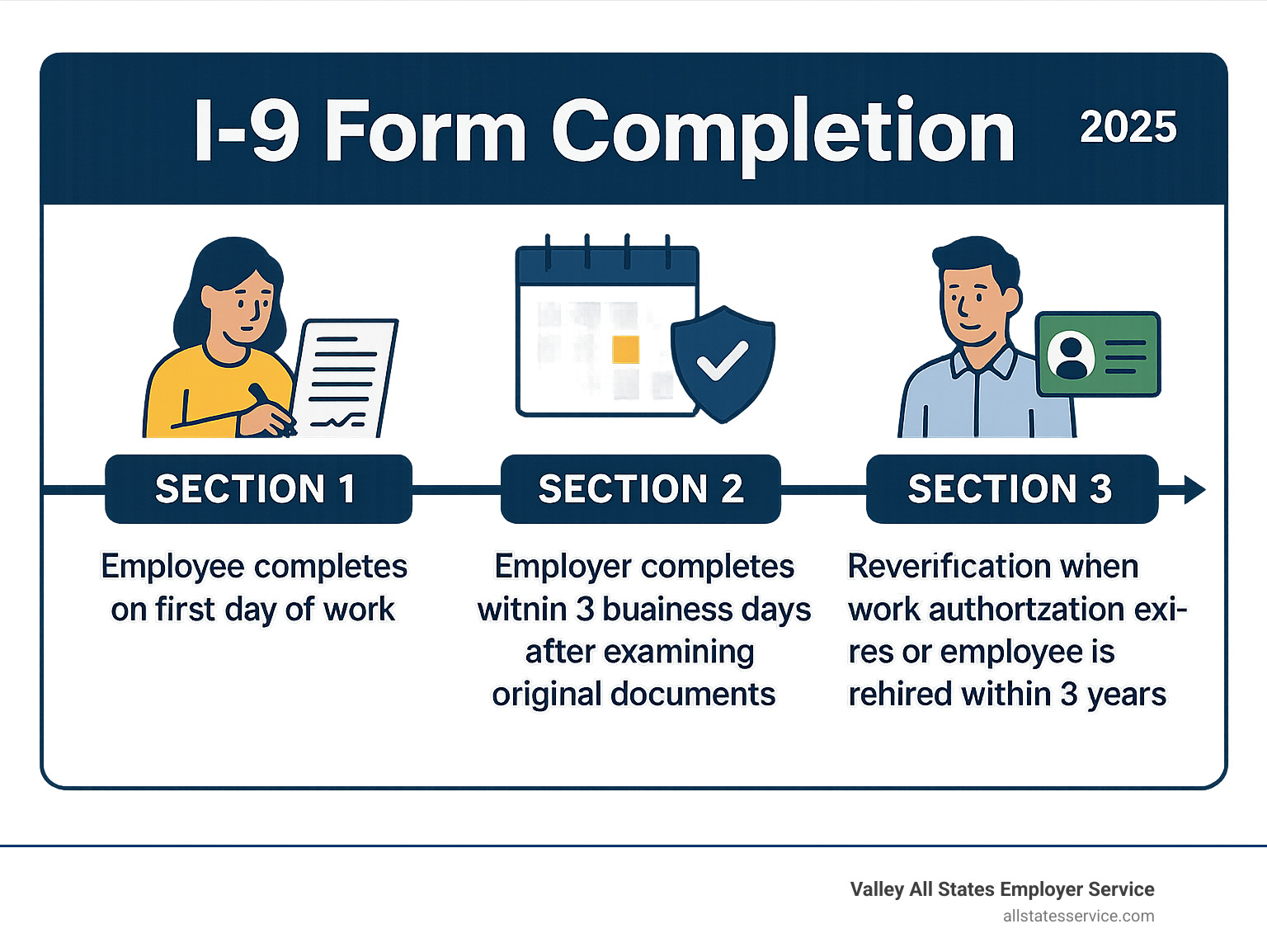

Quick I-9 Completion Overview:

- Employee responsibility: Complete Section 1 by the first day of work

- Employer responsibility: Complete Section 2 within 3 business days

- Documents required: Original, unexpired documents from List A OR combination of List B + List C

- Retention period: 3 years from hire date OR 1 year after termination (whichever is longer)

- Penalties: Up to $2,292 per substantive error

The Form I-9, mandated by the Immigration Reform and Control Act of 1986, serves as the backbone of employment eligibility verification. Every person hired after November 6, 1986, must complete this form, regardless of citizenship status.

The stakes are high. With ICE fines reaching $2,292 per substantive error, a company with 1,000 annual hires faces a minimum error risk of $1,638,560 annually. These aren’t just numbers on paper, they represent real compliance challenges that busy HR managers face every day.

The process involves three main sections: employee attestation (Section 1), employer verification (Section 2), and reverification when needed (Section 3). While seemingly straightforward, the combination of strict deadlines, document requirements, and evolving regulations around remote verification creates complexity that trips up even experienced HR professionals.

Understanding the Basics of Form I-9

Every time you bring someone new onto your team, you’re stepping into a partnership that goes beyond just work responsibilities. I-9 form completion creates a foundation of trust and legal compliance that protects both you and your employee from the very first day.

At its heart, Form I-9 serves two essential purposes: verifying identity and confirming employment authorization. Think of it as your company’s way of saying, “We want to make sure you are who you say you are, and that you have the legal right to work here.” It’s not about creating barriers, it’s about following the law while welcoming new talent to your organization.

This process applies to everyone you hire for employment in the United States. Whether your new employee is a U.S. citizen, lawful permanent resident, or authorized noncitizen, the same verification requirements apply. No exceptions, no shortcuts.

The beauty of the I-9 process lies in its shared responsibility. Employees provide honest information and proper documentation, while employers examine those documents fairly and thoroughly. When both sides fulfill their roles correctly, everyone wins. For the most current guidance and official instructions, USCIS I-9 Central remains your go-to resource.

Section 1: Employee Information and Attestation

This is where your new hire takes center stage. Section 1 belongs entirely to the employee, and they must complete it no later than their first day of work. The timing matters here, they can’t fill it out before accepting your job offer, but they absolutely must finish it before they start earning their first paycheck.

Your employee will provide their full legal name, address, date of birth, and Social Security number if they have one and you’re using E-Verify. But here’s where things get important: they must attest under penalty of perjury to their work authorization status.

They’ll choose from four specific categories: U.S. Citizen, Noncitizen National of the United States, Lawful Permanent Resident, or Alien Authorized to Work. If they select that last option, they need to provide additional details like their employment authorization expiration date and either their Alien Registration Number, USCIS Number, or Form I-94 Admission Number.

Sometimes employees need help completing this section due to language barriers or other challenges. When that happens, the Preparer and/or Translator Certification section ensures accountability by requiring that helper to sign and take responsibility for their assistance.

Section 2: Employer Review and Verification

Now it’s your turn to step up. Section 2 is where you verify everything your employee provided in Section 1, and timing is crucial here too. You have exactly three business days from their first day of employment to complete this section. If the job lasts less than three days, you need to finish Section 2 on day one.

Your main job is examining original, unexpired documents that prove both identity and work authorization. Your employee gets to choose what to show you from the official Form I-9 Acceptable Documents list. They can present one List A document (which covers both identity and work authorization) or combine one List B document (identity) with one List C document (work authorization).

Here’s something that trips up many employers: you cannot tell employees which specific documents to bring. Your role is simply to examine whatever valid documents they choose and confirm they appear genuine and relate to the person presenting them.

Once you’ve reviewed the documents, you’ll record the document title, issuing authority, document number, and expiration date in Section 2. Finally, you’ll sign and date the certification, confirming you’ve done your due diligence and that this person is authorized to work.

Section 3: Reverification and Rehires

Most employers forget about Section 3 until they need it, but understanding when to use it can save you from compliance headaches down the road. This section handles two main situations: when work authorization expires and when you rehire former employees.

Reverification becomes necessary when an employee’s work authorization document has an expiration date that’s approaching or has passed. You’ll need to examine updated, unexpired documentation from List A or List C before their current authorization expires. It’s like renewing a subscription, you want to handle it before it lapses.

The rehire scenario applies when you bring back a former employee within three years of their original Form I-9 completion date. You can either reverify their previous employment authorization using Section 3 or complete an entirely new Form I-9, depending on what makes sense for your situation.

Name changes also find their home in Section 3. When an employee’s legal name changes due to marriage, divorce, or other reasons, you can update this information here rather than starting from scratch.

Getting Section 3 right requires attention to detail and good timing. The USCIS Reverification and Rehires Guide provides step-by-step instructions for these situations. You can also explore More info about New Hire Eligibility to better understand the broader context of employment verification requirements.

A Step-by-Step Guide to I-9 Form Completion

The path to successful I-9 form completion doesn’t have to feel overwhelming. Think of it like following a recipe, each step builds on the last, and when you’re done, you have a perfectly compliant form. The secret ingredients? Timeliness and accuracy. Miss either one, and you could end up with a costly mistake.

The beauty of Form I-9 is its logical flow. Employees complete their part first, then employers verify and certify. Simple in theory, but the devil is in the details. One missed signature, one wrong date, or one expired document can turn a routine hire into a compliance headache.

Let’s walk through this process together, breaking down exactly what each party needs to do and when they need to do it.

Employee Guide to I-9 Form Completion (Section 1)

Your journey with I-9 form completion begins the moment you accept that job offer. Section 1 is your responsibility, and you have until your first day of paid work to get it right. No pressure, but this section sets the tone for your entire employment verification.

Start with the basics. Fill in your full legal name exactly as it appears on your identification documents. If you’ve ever gone by other names (maiden name, nickname used professionally, etc.), include those in the “Other Names Used” field. Your current address and date of birth come next, straightforward enough.

The Social Security number field trips up many people. Here’s the deal: it’s optional unless your employer uses E-Verify. When in doubt, provide it if you have one. It makes the process smoother for everyone.

Now comes the big decision – selecting your citizenship or immigration status. This isn’t a multiple-choice test where you can guess. You need to know which category fits your situation exactly. U.S. Citizens have it easy, just check the first box. Noncitizen Nationals (think American Samoa or certain other territories) select the second option.

Lawful Permanent Residents choose the third box and must provide their Alien Registration Number or USCIS Number. Everyone else authorized to work selects the fourth option, but here’s where it gets tricky. You need to provide the expiration date of your work authorization and either your A-Number or I-94 Admission Number.

Finding these numbers can feel like a treasure hunt. Your A-Number typically appears on your green card or Employment Authorization Document. Your I-94 number comes from your arrival/departure record. If you’re struggling to locate these, the USCIS guide on Finding your A-Number and DOS Case ID can point you in the right direction.

Special situations require extra attention. If you’re an F-1 student on Optional Practical Training, you’ll check “Alien Authorized to Work” and use the expiration date from your EAD card. H-1B visa holders also select this option, using the end date from their I-94 record. J-1 exchange visitors follow similar rules, referencing their DS-2019 form.

Don’t forget the finish line. Sign and date Section 1. If someone helped you complete it, they must sign the Preparer and/or Translator Certification section too.

Watch out for these common mistakes: leaving required fields blank, selecting the wrong status box, entering incorrect authorization dates, forgetting to sign, or not having your helper sign when required. These simple oversights can cost your employer thousands in fines.

Employer Guide to I-9 Form Completion (Section 2)

Once your employee hands you their completed Section 1, the clock starts ticking. You have exactly three business days from their first day of employment to complete Section 2. If the job lasts fewer than three days, you need to finish this on day one. No extensions, no excuses.

Document examination is your primary job. The employee will present original, unexpired documents from the official Lists of Acceptable Documents. Your role isn’t to be a forensics expert, but you do need to verify that the documents reasonably appear genuine and belong to the person standing in front of you.

Understanding the document lists makes this easier. List A documents are the gold standard because they prove both identity and work authorization. A U.S. passport, permanent resident card, or employment authorization document from this list means you’re done. One document, problem solved.

When employees don’t have List A documents, they need to present one from List B (proves identity, like a driver’s license) plus one from List C (proves work authorization, like an unrestricted Social Security card). Two documents instead of one, but equally valid.

Here’s what you cannot do: tell the employee which documents to bring. They choose from the acceptable options. You just examine what they present and determine if it passes the “reasonable appearance” test.

Recording information accurately is where many employers stumble. Write down the document title exactly as it appears, the issuing authority, document number, and expiration date if there is one. Double-check these details against the actual documents. A transposed number or missed expiration date can trigger penalties during an audit.

Your certification signature is the final step. Include the employee’s first day of employment, then sign and date the form. This signature confirms you’ve examined the documents and believe the employee is authorized to work.

Avoid these costly mistakes: accepting expired documents (unless specific receipt rules apply), missing document numbers or dates, completing Section 2 late, forgetting to sign, demanding specific documents, or accepting documents that clearly don’t look genuine.

The complexity of I-9 form completion multiplies when you’re processing dozens or hundreds of new hires. That’s where expert assistance becomes invaluable. For comprehensive support with your workforce verification needs, explore our Workforce Eligibility Verification services.

Handling Special Situations: Remote Hires and E-Verify

The workplace has transformed dramatically, and I-9 form completion has had to evolve right alongside it. What used to be a straightforward face-to-face document check now involves video calls, authorized representatives, and digital verification systems. It’s like trying to shake hands through a computer screen, but thankfully, the government has caught up with creative solutions.

The COVID-19 pandemic didn’t just change how we work, it revolutionized how we verify employment eligibility. Before 2020, physical document inspection was practically non-negotiable. The pandemic forced everyone to get creative, and while those emergency flexibilities have ended, the Department of Homeland Security recognized that remote work isn’t going anywhere. They’ve introduced new procedures that make compliance possible without requiring your new hire in Montana to fly to your headquarters in Florida.

I-9 Verification for Remote Employees

When your newest team member lives three states away, traditional I-9 form completion becomes a logistical puzzle. Fortunately, we have two solid solutions that keep everyone compliant and sane.

The authorized representative method has been around for years and remains reliable. Think of it as deputizing someone to be your eyes and hands. You can designate anyone (a notary public, a trusted friend, even a family member) to physically examine your employee’s documents and complete Section 2 on your behalf. The representative does the heavy lifting, examining documents, filling out the form, and sending it back to you. Just remember, you’re still responsible for any mistakes they make, so choose wisely.

Here’s where things get exciting: if your company uses E-Verify, you now have access to virtual inspection through live video interaction. As of August 2023, E-Verify employers can conduct document examination remotely using video technology. It’s like having a virtual office visit where you can see the employee, examine their documents in real-time, and complete the verification process without anyone leaving their home office.

For virtual inspection to work, you need to meet specific requirements. The live video interaction must allow you to see both the employee and their documents clearly. You’ll need to retain copies of the documents and check a special box in Section 2 indicating you conducted a remote examination. It’s remarkably straightforward once you get the hang of it.

Document retention for remote verification follows the same rules as traditional I-9s, but with virtual inspections, you’ll also need to keep copies of the documents you examined. This creates a paper trail that proves you actually saw legitimate documents during your video call.

For more details on how E-Verify integrates with your I-9 process, check out our comprehensive guide on E-Verify and I-9.

The Role of E-Verify in the I-9 Process

E-Verify is like having a direct line to the government’s employment eligibility database. This internet-based system, run by USCIS in partnership with the Social Security Administration, takes the information from your completed Form I-9 and cross-references it with federal records. It’s essentially a digital double-check on your I-9 form completion process.

How E-Verify works with Form I-9 is beautifully simple. After you complete the traditional I-9 process, you enter the employee’s information into the E-Verify system. Within seconds (usually), you’ll receive a response confirming the employee is authorized to work. It’s like getting a green light from the government saying “yes, this person can work for you.”

Most employers can choose whether to use E-Verify, but federal contractor requirements make it mandatory for certain businesses. If you’re a federal contractor with specific contract clauses, you’ll need E-Verify for all new hires and sometimes for existing employees working on federal contracts. The requirements can get complex, so it’s worth understanding your obligations upfront.

Sometimes E-Verify throws you a curveball called a Tentative Nonconfirmation (TNC). Don’t panic when this happens. A TNC simply means the information doesn’t match government records perfectly. Maybe there’s a typo, or the employee recently changed their name. The employee gets a chance to resolve the discrepancy with the appropriate agency. It’s more of a “hold on, let’s double-check this” than a “no, absolutely not.”

For official guidance straight from the source, visit E-Verify I-9 Central. We also provide specialized support to help you steer E-Verify Employer Requirements without the headaches.

The High Cost of Non-Compliance & Record-Keeping Rules

Let’s be honest: when it comes to I-9 form completion, the stakes couldn’t be higher. Every form sitting in your filing cabinet represents a potential financial landmine if it’s not handled correctly. The U.S. Immigration and Customs Enforcement (ICE) doesn’t just send friendly reminders when they find problems, they send hefty fines that can seriously impact your bottom line.

ICE audits can happen to any employer, at any time. They might target your industry specifically, follow up on a tip from a disgruntled employee, or simply select your business through their random audit process. When those agents walk through your door, they’ll want to see every single Form I-9, and they’ll examine them with a fine-tooth comb.

The reality is sobering. These audits aren’t just paperwork reviews, they’re comprehensive examinations that can uncover years of accumulated errors. Beyond the immediate financial pain, compliance failures can damage your company’s reputation in ways that affect your ability to attract top talent and maintain customer trust.

Penalties for I-9 Errors and Violations

Understanding the difference between types of violations can help you grasp just how serious this gets. Substantive errors are the bread and butter of ICE fines. These include missing signatures, incorrect dates, or incomplete document information. Each substantive error can cost you up to $2,292 per form. 76% error rate we mentioned earlier? That means most companies are sitting on a pile of potential fines without even knowing it.

The math gets scary quickly. If you hire 100 people per year and maintain that average error rate, you’re looking at roughly 76 forms with at least one fineable error. Even if ICE only finds half of those during an audit, you could face fines exceeding $87,000.

But substantive errors pale in comparison to knowingly hiring violations. This is the nuclear option of I-9 penalties. When ICE determines that you knowingly hired or continued to employ someone without work authorization, fines can range from $573 to $20,130 per violation. In the most severe cases, you might face criminal charges and lose the ability to bid on government contracts.

The good faith defense offers some protection, but only if you can prove you made genuine efforts to comply and corrected errors promptly once finded. This defense works best when you have documentation showing regular training, internal audits, and swift corrective action. For a comprehensive breakdown of what these penalties really mean for your business, check out our detailed guide on I-9 Compliance Penalties.

Form I-9 Retention and Storage Rules

Completing the form correctly is only half the battle. How you store and maintain those forms can make or break your audit experience. The “3-1 Rule” is your North Star here: keep each completed Form I-9 for three years from the hire date OR one year after employment ends, whichever comes later.

Let’s walk through some real examples. Sarah was hired on March 1, 2022, and quit on June 15, 2023. You’d keep her I-9 until March 1, 2025 (three years from hire). But if Tom was hired on January 1, 2020, and finally retired on December 31, 2024, you’d keep his form until December 31, 2025 (one year after termination).

Storage security is just as crucial as timing. These forms contain sensitive personal information, so they must be kept separate from regular personnel files. Whether you choose paper or electronic storage, you need systems that protect employee privacy while ensuring quick access during an audit.

Electronic storage has become increasingly popular, and for good reason. Digital systems can automatically calculate retention periods, send alerts for upcoming deadlines, and organize forms for easy retrieval. However, any electronic system must meet specific DHS requirements for integrity, accuracy, and accessibility.

The smartest employers don’t wait for ICE to find their errors. Regular internal audits help you identify and fix problems before they become expensive penalties. Think of it as preventive medicine for your compliance program. When you find errors during your own review, you can correct them and document your good faith efforts to maintain compliance. Our I-9 Self Audit resource can guide you through this proactive approach, turning potential liabilities into demonstrations of your commitment to following the rules.

Simplify Your I-9 and E-Verify Process

Let’s be honest: I-9 form completion doesn’t have to consume your HR team’s entire day, but it often does. Between tracking those tight deadlines, double-checking every document detail, and navigating the maze of remote verification rules, it’s easy to see why so many businesses struggle with compliance. When you’re juggling payroll, benefits, hiring, and a dozen other priorities, the last thing you need is the constant worry of ICE penalties lurking in the background.

The reality is that I-9 compliance has become increasingly complex. Remote work has changed the game, E-Verify requirements vary by employer type, and those 76% error rates we mentioned earlier? They’re not going anywhere without expert help. Every missed deadline, every incomplete section, and every improperly verified document represents potential fines that can quickly add up to thousands of dollars.

This is where partnering with specialists makes perfect sense. Valley All States Employer Service takes the entire I-9 and E-Verify burden off your shoulders. We handle the intricate details of workforce eligibility verification so your team can focus on what they do best: building your business and supporting your employees.

Our approach is straightforward. We provide expert, impartial, and efficient E-Verify processing that minimizes errors and eliminates the administrative headaches that come with managing compliance in-house. Whether you’re dealing with remote hires, complex immigration statuses, or simply want the peace of mind that comes from knowing your I-9s are handled correctly, we’ve got you covered.

Ready to transform your hiring compliance from a source of stress into a seamless process? Your HR team deserves to spend their time on strategic initiatives, not worrying about form completion deadlines.