What Every Employer Needs to Know About Pre-Employment Screening

Background check pre employment screening is a systematic process used by employers to verify candidate information and identify potential risks before making hiring decisions. With nearly 90% of employers conducting some form of screening, understanding this process is crucial for any business looking to build a safe, qualified workforce.

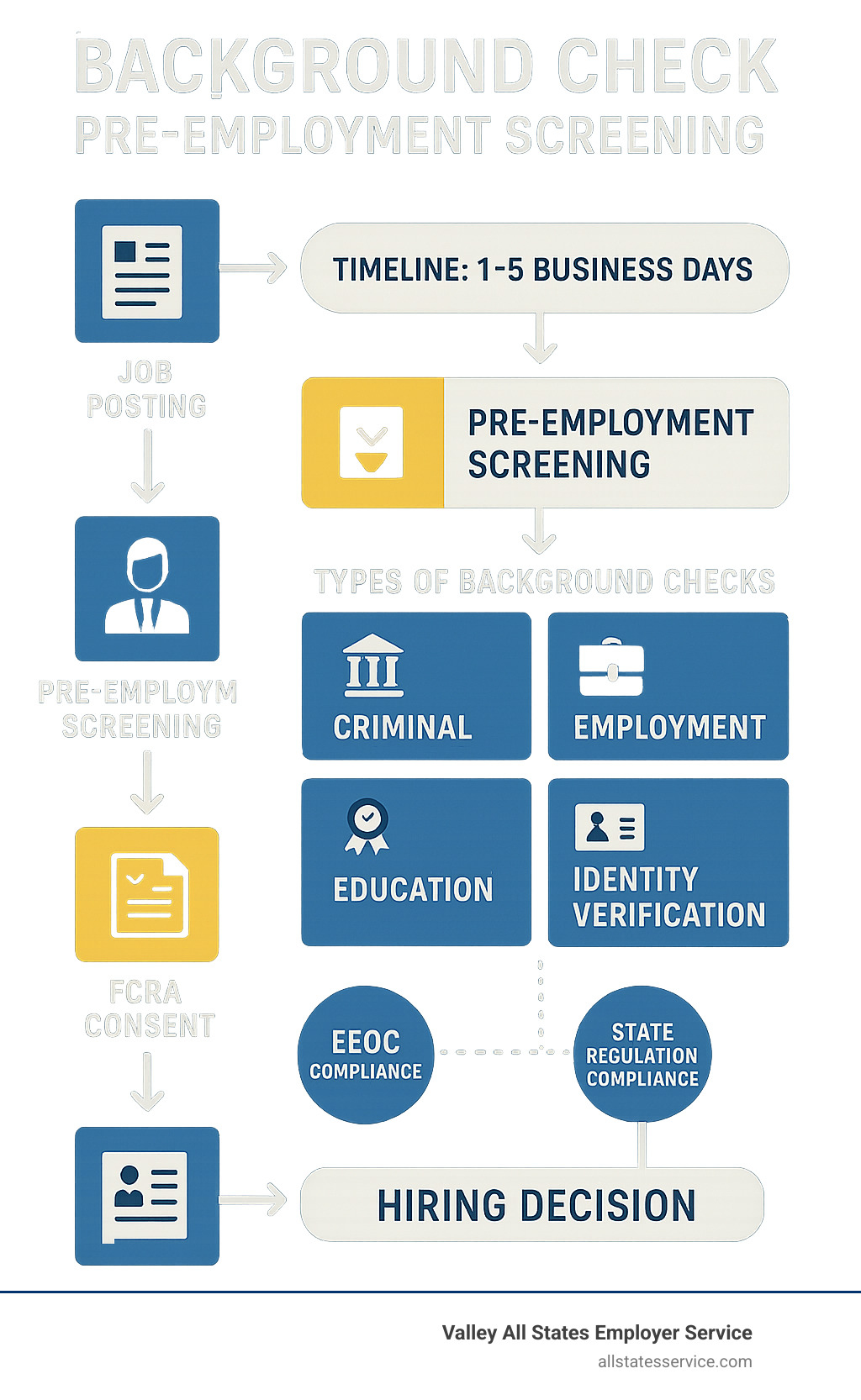

Here’s what you need to know about the background check process:

Key Components:

- Criminal history checks – Review court records and databases

- Employment verification – Confirm work history and job titles

- Education verification – Validate degrees and certifications

- Identity verification – Confirm the candidate is who they claim to be

- Credit checks – For financial or sensitive positions

- Drug testing – Ensure workplace safety and compliance

Legal Requirements:

- Must obtain written consent from candidates

- Follow Fair Credit Reporting Act (FCRA) guidelines

- Comply with Equal Employment Opportunity Commission (EEOC) standards

- Adhere to state-specific “Ban the Box” laws where applicable

Timeline and Process:

- Background checks typically take 1-5 business days

- Must provide adverse action notices if declining based on results

- Candidates have rights to dispute inaccurate information

In an ideal world, every resume would be 100% accurate and every candidate would be completely honest. But research shows that’s simply not the case. One study found that 54% of employers find discrepancies in employee background checks, while other studies indicate that 78% of job seekers are prepared to lie or misrepresent facts during the hiring process.

This reality makes background screening not just helpful, but essential. It protects your company from costly hiring mistakes, ensures workplace safety, and helps maintain legal compliance. The average cost of a bad hire can reach 30% of that person’s first-year earnings, making thorough screening a smart investment.

This guide breaks down everything you need to know about conducting effective, compliant background checks that protect your business while treating candidates fairly.

Background check pre employment screening vocab explained:

What is Pre-Employment Screening and Why is it Crucial?

A pre-employment background check is a comprehensive process that helps employers verify the information job candidates provide during the hiring process. Think of it as your business’s safety net, designed to uncover any potential red flags that could affect whether someone is truly suitable for a role.

This isn’t just about checking boxes or being overly cautious. It’s about making smart, informed hiring decisions that protect your company’s assets, reputation, and most importantly, your employees. When you invest in thorough screening, you’re creating a foundation of trust and safety that benefits everyone in your organization.

The numbers speak for themselves. Nearly 90% of employers now conduct some form of background check pre employment screening, and there’s a good reason for this widespread adoption. The process delivers tangible benefits that directly impact your bottom line and workplace culture.

Ensuring a safe work environment is perhaps the most critical benefit. Your existing team and customers deserve to feel secure, and proper screening helps identify potential risks before they become problems. Protecting your company’s reputation and customer trust is equally important, as a single problematic hire can undo years of hard work building your brand.

The screening process also reduces the risk of theft, fraud, and workplace violence by revealing patterns of behavior that might indicate future issues. It verifies candidate qualifications and experience, ensuring you’re hiring people who can actually do the job they’re applying for. Finally, it helps maintain legal and regulatory compliance, which is crucial in today’s complex regulatory environment.

The High Cost of a Bad Hire

Making the wrong hiring decision isn’t just disappointing, it’s expensive. The financial impact extends far beyond the obvious costs, affecting everything from team productivity to workplace morale. When you hire someone who isn’t a good fit, it creates a ripple effect that touches every part of your organization.

The numbers are sobering. According to the U.S. Department of Labor, the cost of a bad hire can be at least 30% of the individual’s first-year earnings. Imagine losing a third of a new employee’s annual salary simply because your vetting process wasn’t thorough enough.

But the real cost goes deeper. Decreased productivity affects not just the new hire but the entire team. Team morale suffers when colleagues have to pick up the slack or deal with problematic behavior. Legal risks multiply if the bad hire leads to issues like harassment, theft, or workplace violence. Background check pre employment screening helps you avoid this costly mistake by identifying potential problems before they walk through your door.

What Information is Included in a Background Check Pre Employment Screening?

When you conduct a thorough screening, you’re looking at multiple types of information to build a complete picture of each candidate. The specific checks you run depend heavily on the role and industry, but there are common elements that most employers find valuable.

Criminal records form the backbone of most screening processes, revealing felony and misdemeanor convictions, and sometimes pending charges. For certain industries like childcare or healthcare, federal law may require specific types of criminal background checks.

Employment history verification confirms past employers, job titles, dates of employment, and sometimes reasons for leaving. This often includes pre-employment work history verification to ensure what’s on the resume matches reality.

Education verification confirms degrees, certifications, and attendance at educational institutions. You’d be surprised how often people embellish their educational credentials. Driving records are essential for any role involving company vehicles or transportation of goods or people.

Credit reports become relevant for positions with financial responsibilities or access to sensitive financial information. Professional licenses and certifications need verification for regulated professions like healthcare or law. Drug testing helps maintain a drug-free workplace and ensures safety, especially in roles involving heavy machinery or safety-sensitive environments.

The process also includes identity verification using Social Security Numbers and dates of birth, along with checks against sex offender registries and terror watch lists when appropriate for the role. The specific checks you choose should always align with the job’s requirements and industry regulations, ensuring both relevance and compliance.

How to Conduct a Compliant Background Check Pre Employment Screening

Running a background check pre employment screening the right way isn’t just about checking boxes. It’s about building a fair, legal process that protects everyone involved. Think of it like following a recipe – skip a step or change the order, and you might end up with a mess instead of the result you wanted.

A structured and consistent process is your best friend here. It helps you make smart hiring decisions while keeping you on the right side of the law. Let’s walk through the five essential steps that will set you up for success.

Step 1: Develop a Clear, Written Policy

Here’s the thing about consistency – it’s not just nice to have, it’s legally required. You need to spell out exactly which checks you’ll run for which positions. A cashier might need a criminal background check, while a delivery driver would also need their driving record reviewed. Someone handling finances? They’ll likely need a credit check too.

Your policy should be documented clearly and applied the same way to every candidate for that specific role. This isn’t just good practice – it’s your shield against discrimination claims. When you treat all candidates for a position the same way, you’re showing that your decisions are based on job requirements, not personal bias.

Don’t forget to consider all types of workers in your policy. Temporary employees, independent contractors, and interns should go through the same screening process as full-time hires. A consistent approach across all employment types keeps your workplace safe and your policies legally sound.

Step 2: Get Written Consent from the Candidate

This step is absolutely non-negotiable. The Fair Credit Reporting Act (FCRA) requires you to tell candidates in writing that you plan to run a background check, and you must get their written permission first. Think of it as asking permission before entering someone’s house – it’s basic respect and legal requirement rolled into one.

The disclosure needs to be clear and conspicuous, typically in a stand-alone document separate from the job application. You can’t bury it in fine print or combine it with other paperwork. Candidates need to understand exactly what information you’ll be checking and agree to the process before you begin.

Step 3: Gather Necessary Information

Getting accurate information from your candidate is like having the right address before sending a package – without it, you’re not going to get where you need to go. You’ll typically need their full name (including any previous names they’ve used), date of birth, Social Security Number, and current and past addresses.

For certain checks, like driving records, you might also need their driver’s license number. And of course, you’ll need that signed consent form from Step 2. The more accurate the information your candidate provides, the more reliable and timely your background check report will be.

Step 4: Choose a Screening Method

You have options here, but some are definitely better than others. While you could handle basic checks like reviewing public social media profiles in-house, partnering with a professional, FCRA-compliant Consumer Reporting Agency (CRA) is usually your best bet for accuracy, speed, and legal protection.

These agencies are like specialists who know all the ins and outs of record searches and compliance regulations. They can often deliver the information you need in less than 12 hours, and they have the expertise to conduct various types of checks efficiently and accurately. This keeps you compliant while giving you reliable information.

A word of caution: stay away from services promising “instant results.” These often rely only on easily accessible online data and might miss crucial offline records. Good screening takes a little time to do right.

Step 5: Review the Report and Make a Decision

Once you get your background check report, your real work begins. This is where you need to put on your detective hat and conduct an individualized assessment. If there are any concerning findings, like criminal history, you can’t just automatically disqualify the candidate.

You need to consider the nature of the offense, how much time has passed since the conviction, and most importantly, how relevant it is to the specific job duties. A minor offense from 20 years ago might have no bearing on someone’s ability to work in an office. But a recent theft conviction would be highly relevant for someone handling cash or inventory.

The key is reviewing findings in the context of the specific job responsibilities. Your decision should always be job-related and consistent with business necessity. This approach keeps you legally compliant while helping you make fair, informed hiring decisions.

Navigating the Legal Maze of Screening

Let’s be honest: the legal side of background check pre employment screening can feel overwhelming. Between federal laws, state regulations, and anti-discrimination requirements, it’s easy to feel like you’re walking through a minefield. But here’s the thing: compliance isn’t optional. It’s a legal requirement that protects both your business and the people you’re considering hiring.

The good news? Once you understand the key laws and follow the right steps, staying compliant becomes much more manageable. Think of it as building a solid foundation for your hiring process, one that keeps you out of legal trouble while treating candidates fairly.

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is your primary guide for employment background checks. This federal law doesn’t just tell you what you can do; it outlines exactly what you must do to stay on the right side of the law.

Under the FCRA, candidates have important rights that we need to respect. They have the right to know if information in their report influenced your hiring decision. They can request a copy of their background check report. If they find mistakes, they have the right to dispute inaccurate or incomplete information and require corrections.

What does this mean for you? Before running any background check through a third-party provider, you must give candidates proper disclosure and get their written permission. No shortcuts here. The law is clear about following strict procedures, especially if you decide not to hire someone based on what you find.

EEOC Guidance and Anti-Discrimination Laws

The U.S. Equal Employment Opportunity Commission (EEOC) enforces federal laws that prevent workplace discrimination. Your screening policy can’t unfairly target people based on race, color, religion, sex, or national origin. This means applying your background check policy consistently across all candidates for similar roles.

The EEOC is particularly focused on how employers use criminal history information. They want you to consider the nature and gravity of the offense, how much time has passed since the incident, and how relevant it is to the specific job. This approach helps you avoid what’s called “disparate impact,” where a policy that seems neutral actually discriminates against certain protected groups.

Here’s a practical example: a 10-year-old shoplifting conviction might not be relevant for someone applying to be a software developer, but it could be significant for a retail cashier position. Context matters.

The ‘Adverse Action’ Process Explained

If you’re planning to reject a candidate or withdraw a job offer based on their background check results, you can’t just send a quick “thanks, but no thanks” email. The FCRA requires a specific two-step process called “adverse action.”

First, send a pre-adverse action notice. This isn’t your final decision yet. You need to give the candidate a copy of their background check report, a summary of their FCRA rights, and reasonable time (usually 5-10 business days) to review everything. Maybe there’s an error in the report, or perhaps they can provide important context you didn’t have before.

Then, if you still decide not to hire them, you send a final adverse action notice. This confirms your decision and provides contact information for the screening company, along with another copy of their FCRA rights.

This process might seem like extra work, but it’s actually protecting you from potential lawsuits while giving candidates a fair chance to address any issues.

E-Verify and I-9 Compliance

While we’re talking about legal requirements, let’s not forget about work eligibility verification. E-Verify is separate from traditional background screening, but it’s equally important. This system confirms that your new hires are legally authorized to work in the United States.

E-Verify compares information from the employee’s Form I-9 with government databases. It’s mandatory for federal contractors and a smart practice for many other employers who want to ensure they’re building a legal workforce.

At Valley All States Employer Service, we specialize in making this process smooth and error-free. Our expert team handles E-Verify background checks with the efficiency and accuracy you need. We also provide comprehensive I-9 Verification Assistance to keep your hiring process fully compliant with federal regulations.

The beauty of working with specialists? We handle the complex compliance details so you can focus on finding great employees without worrying about administrative mistakes.

Common Questions About the Screening Process

When you’re setting up a background check pre employment screening process, questions naturally arise. Whether you’re an employer trying to steer compliance or a job seeker wondering what to expect, these are the most common concerns we hear every day.

What are Common ‘Red Flags’ on a Background Check?

Think of a “red flag” as any information that’s job-relevant and suggests a potential risk or lack of qualification for the position. What raises concerns really depends on the specific role you’re filling, but some findings consistently grab attention.

Criminal convictions top the list, especially when they’re relevant to job duties. A theft conviction for someone handling cash registers or a history of violence for a customer-facing position would naturally raise eyebrows. But remember, context matters enormously.

Resume discrepancies are surprisingly common and often more damaging than people realize. When what a candidate claims doesn’t match what we verify, it creates trust issues. We’re talking about false degrees, exaggerated job titles, or incorrect employment dates. Studies show that 54% of employers find these kinds of inconsistencies, and 78% of job seekers admit to lying or misrepresenting facts on their applications.

Failed drug tests become significant red flags for roles requiring sobriety or in drug-free workplaces. Poor credit history can be concerning for positions with financial responsibilities or access to sensitive financial data. Negative driving records matter tremendously for jobs involving company vehicles, where multiple moving violations or DUIs would be major concerns.

Here’s what’s crucial to understand: a red flag doesn’t automatically disqualify someone. We always use an individualized assessment to determine the relevance and severity of any findings. A minor offense from 20 years ago might be completely irrelevant for most positions today.

How Far Back Do Background Checks Go and How Long Do They Take?

The lookback period for a background check pre employment screening follows what’s commonly called the “seven-year rule.” Most checks for criminal and court records look back seven years, though this varies significantly by state and position type.

Some states have specific restrictions, while others allow longer lookback periods for certain types of records or positions with specific legal requirements. For instance, roles involving vulnerable populations might have no time limit on criminal history checks. It’s one of those areas where state laws can get pretty complex.

Turnaround times can range from a few hours to several days, depending on what you’re checking. Simple database screenings might come back in minutes, while more comprehensive checks involving manual court record searches or international verification take longer. Factors like court backlogs, holidays, or difficulty reaching past employers can extend the timeline.

When working with a Consumer Reporting Agency, the average turnaround time is typically three to five business days. For more specific details about timing, you can check our page on Pre-Employment Background Check Time.

What Should Job Applicants Know?

If you’re a job applicant, understanding the screening process can really help reduce anxiety. Honesty is absolutely the best policy. While it might be tempting to embellish a resume or omit details, discrepancies are often found. It’s always better to be upfront about any issues or gaps in your history.

You have important rights under the FCRA. You’re entitled to receive a copy of your background check report if it’s used to make an adverse hiring decision. You can also dispute any inaccuracies with the screening company. If you believe there’s an error, contact the Consumer Reporting Agency directly to initiate a dispute.

Being prepared helps the process go smoothly. Have documents like past pay stubs, W-2s, or transcripts ready. These can speed up employment and education verifications, especially when a former employer or institution is slow to respond.

Conclusion: Making Smart, Safe, and Compliant Hiring Decisions

When you think about it, a well-structured background check pre employment screening process is really the foundation of smart hiring. It’s not just another box to check or a hurdle to jump through. It’s actually one of the smartest investments you can make in your business’s future.

Think of screening as your safety net. It helps you build a team you can trust while keeping you protected legally. Throughout this guide, we’ve walked through everything from understanding what these checks involve to navigating the sometimes tricky legal requirements of FCRA and EEOC compliance.

We’ve also tackled those common questions that keep employers up at night. What exactly counts as a “red flag”? How long will this process take? What rights do candidates have? Having clear answers to these questions makes the whole process feel much more manageable.

The reality is that hiring with confidence comes from having good information. When you know you’ve done your due diligence, you can focus on what really matters: finding the right person for the job. You’re not just protecting your business from potential risks, you’re creating a safer, more productive workplace for everyone.

Screening is about fairness as much as safety. When you follow consistent, compliant processes, you’re treating all candidates equally while making informed decisions. That’s a win for everyone involved.

The legal landscape might seem overwhelming at first, but it doesn’t have to be. With the right approach and proper guidance, you can steer these requirements smoothly. Whether it’s following FCRA procedures, understanding EEOC guidelines, or ensuring your E-Verify processes are solid, having a clear system in place makes everything easier.

Ready to streamline your hiring compliance and make the screening process work better for your business? Our team at Valley All States Employer Service specializes in making employment verification simple and stress-free. Explore how our expert services can help you hire with confidence while staying fully compliant.