Why I-9 Verification Assistance Can Save Your Business

I-9 verification assistance keeps your company out of trouble, plain and simple. Federal law says every new hire must have a properly completed Form I-9. Miss a line or a deadline and you could face fines from $272 to $27,018 per mistake—and ICE only gives you 72 hours’ notice before an audit.

Quick ways to get help, ranked from DIY to fully outsourced:

- Government Resources: USCIS I-9 Central (888-464-4218), M-274 Handbook, free E-Verify system

- Third-Party Reviewers: Impartial document checks ($95–$110 per form), five-minute virtual verifications

- Digital Platforms: Smart forms with error flags, cloud storage, automatic reverification alerts

- Live Support Channels: Dedicated phone lines, two-day email turnaround, anti-discrimination guidance

Roughly 60-80 % of I-9s contain at least one error. With penalties assessed per form, even small teams can rack up five-figure fines fast. Assistance turns that risk into a predictable, streamlined workflow so you can focus on hiring, not paperwork.

Why Form I-9 Compliance Is Non-Negotiable

Here’s the thing about I-9 verification assistance: it’s not just helpful advice, it’s your shield against federal penalties that can devastate your business overnight.

The Immigration Reform and Control Act of 1986 (IRCA) made employment eligibility verification mandatory for every single hire in America. No exceptions. Whether you’re hiring a CEO or a part-time cashier, whether they’re a U.S. citizen or work visa holder, Form I-9 must be completed correctly.

Think of I-9 compliance like your business license. You wouldn’t operate without one because the consequences are immediate and severe. The same logic applies here, except the penalties are often much steeper.

When ICE audits happen (and they do, with just 72 hours’ notice), the financial impact hits fast. Current penalty ranges tell the whole story: $272 to $2,701 for each paperwork violation, $676 to $5,503 for first-time unauthorized employment, and a crushing $5,404 to $27,018 per violation for repeat offenders.

We’ve watched businesses receive penalty notices that rival their annual rent payments, all because of missing signatures, incorrect dates, or expired document copies they forgot to update.

But here’s what keeps many employers up at night: I-9 compliance isn’t just about avoiding fines. The law also includes strict anti-discrimination provisions. You can’t tell employees which acceptable documents to provide, and you must follow consistent retention rules for all forms. Mess up either requirement, and you’re facing additional penalties from different federal agencies.

The Cost of Mistakes

Let’s get real about that 60-80% error rate we mentioned earlier. If you hire 25 people this year and 70% of your I-9s contain errors, you’ve got 17 problematic forms sitting in your files right now.

During an audit, each flawed form becomes a potential penalty. Even at the minimum $272 per document, those 17 forms could cost you $4,624 before ICE even looks at whether you employed anyone without proper authorization.

The mistakes that trigger these paperwork fines are surprisingly common. Missing employee signatures in Section 1, employers completing Section 2 after the three-day deadline, accepting photocopies instead of original documents, and failing to reverify expired work authorization top the list.

Civil penalties stack up quickly because most employers make the same errors repeatedly. Use an expired driver’s license for five different employees? That’s five separate violations, not one systematic mistake.

Here’s a self-audit tip that takes five minutes: grab 10 random I-9s from your files. Check if Section 1 is completely filled out, Section 2 was finished within three business days of each start date, and all required signatures are present. If 6 or more forms have problems, you need professional I-9 verification assistance immediately.

The math is simple. Professional verification assistance costs a fraction of what you’ll pay in penalties, and it transforms your hiring process from a compliance gamble into a predictable, manageable system.

Step-by-Step I-9 Verification Assistance for Every Hire

Getting I-9 verification assistance doesn’t mean you’re losing control of your hiring process. Think of it more like having a GPS for a complicated road trip. You’re still driving, but you’ve got expert guidance to keep you from taking expensive wrong turns.

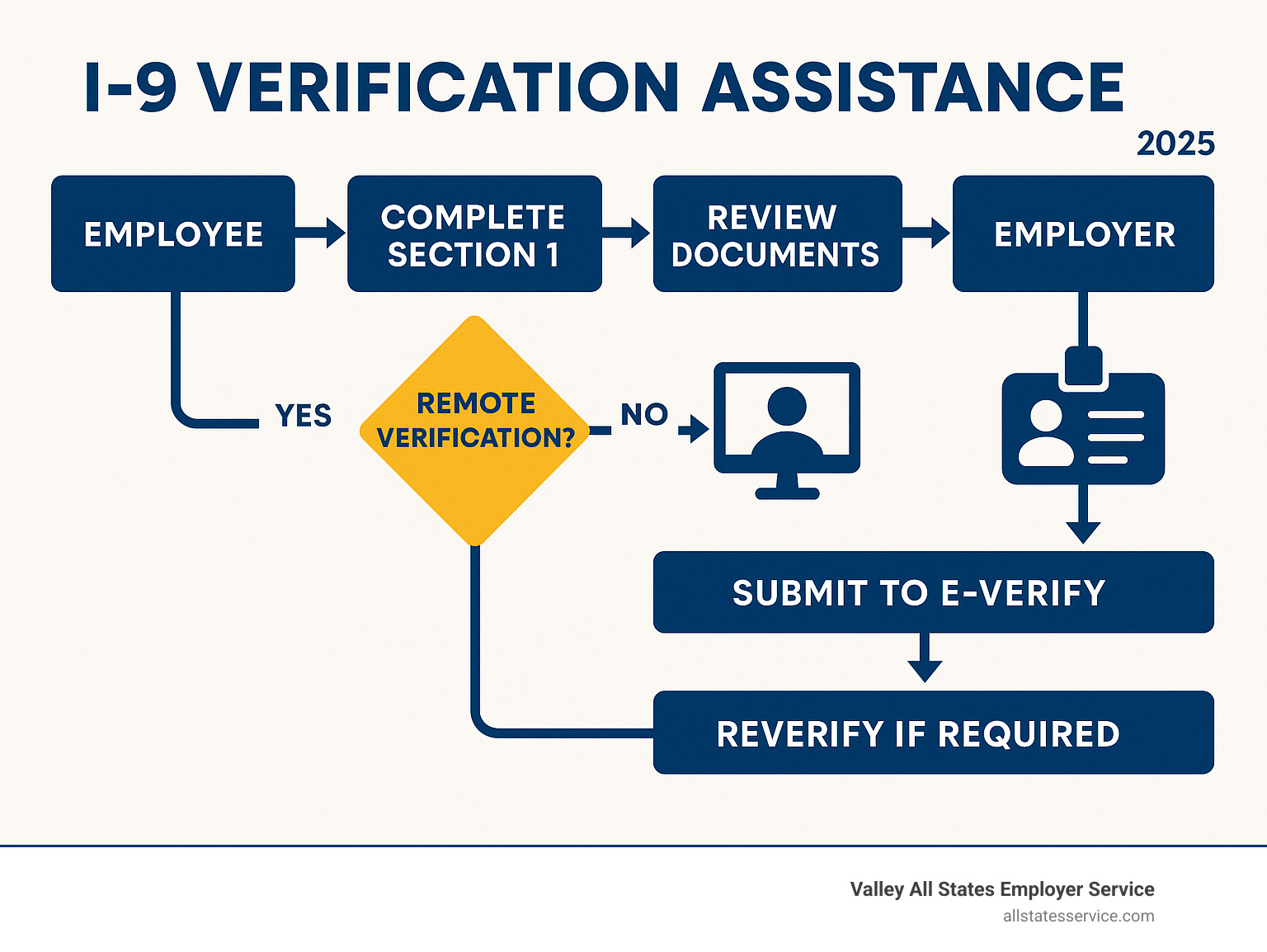

The I-9 process has three main sections, and each one has its own potential pitfalls. Let’s walk through where you’ll likely need the most help and how to get it.

Section 1 is the employee’s responsibility. They fill out their personal information and confirm their work authorization status on or before their first day. If your new hire speaks limited English or needs help understanding the form, they can use a preparer or translator. Just remember that person must complete Supplement A to document their assistance.

Section 2 is where most employers stumble, and honestly, it’s where I-9 verification assistance becomes invaluable. You’ve got exactly three business days from the employee’s start date to examine their documents and complete this section. The employee shows you documents from the acceptable lists, and you verify they look genuine and belong to the person standing in front of you.

Here’s the tricky part: you can’t tell employees which specific documents to bring. You can explain the list categories, but the choice is theirs. It’s like being a referee who has to know all the rules but can’t coach the players.

Section 3 handles reverifications and rehires. If someone’s work authorization expires or you’re rehiring someone within three years, this section keeps you compliant without starting from scratch.

The big question many employers face today is whether to handle document review in person or remotely. In-person review gives you that direct, hands-on examination that feels most natural. You can hold the documents, check security features, and there’s no question about following proper procedures.

Remote video review has become a game-changer for distributed teams. It’s faster and more convenient, but you’ll need to be enrolled in E-Verify and follow specific procedures. The trade-off is worth it when your workforce spans multiple states or you’re hiring remote employees regularly.

Outsourced services take the pressure off entirely. Expert reviewers handle the verification, reduce your error rates, and provide audit support. Yes, there’s an additional cost, but many businesses find the peace of mind and reduced liability worth every penny.

Getting I-9 Verification Assistance on Day One

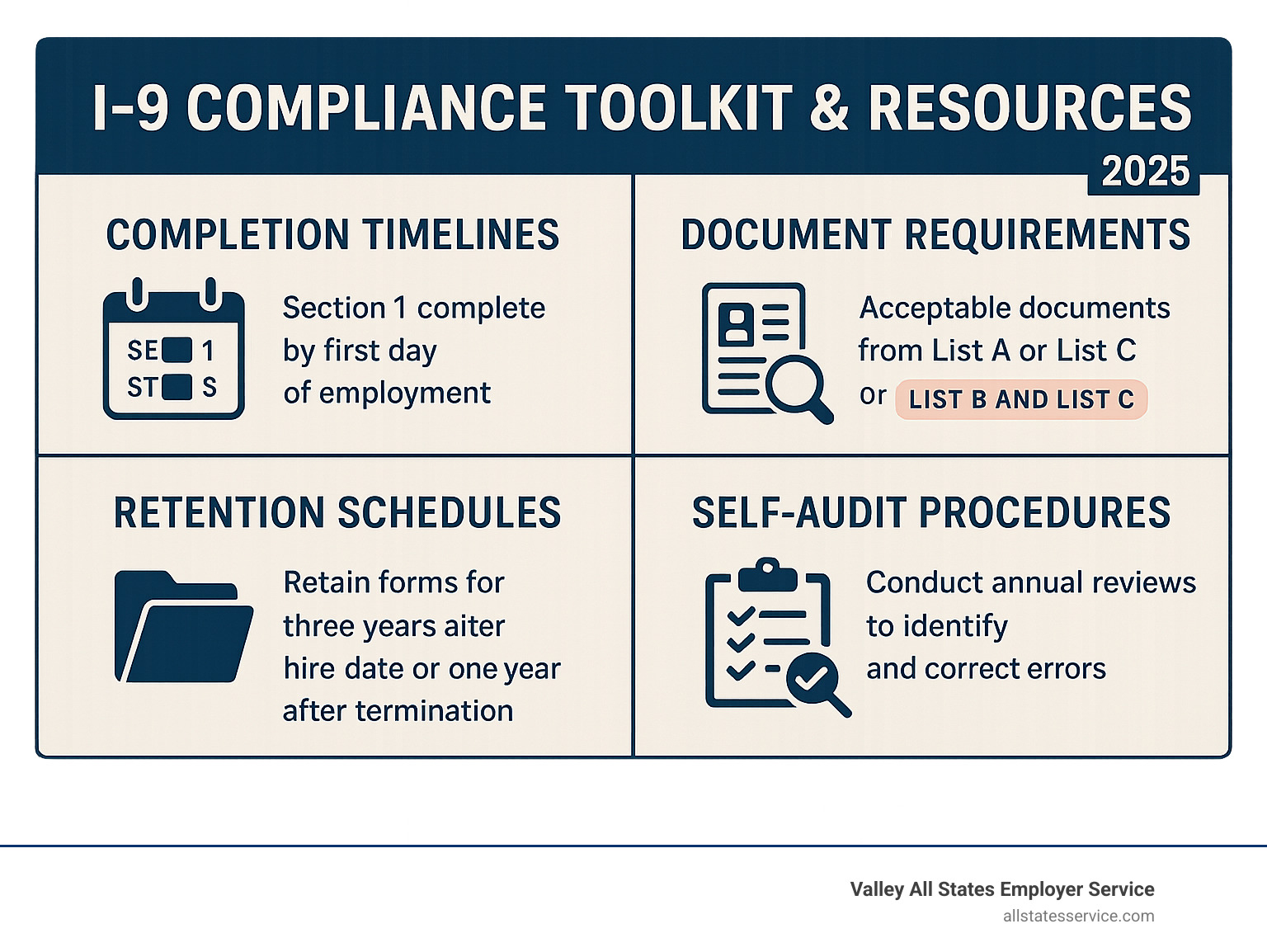

The moment your new employee clocks in for their first paid hour, the compliance clock starts ticking. Section 1 must be complete by the end of that first day, and you have until the close of business on the third business day to finish Section 2.

This is where I-9 verification assistance becomes your best friend. The document requirements might seem straightforward, but the devil is in the details.

List A documents are the simplest option because they prove both identity and work authorization in one shot. A U.S. passport is the gold standard, a permanent resident card (green card) works perfectly, and an employment authorization document (EAD) covers many work-authorized non-citizens.

When employees bring List B and C combinations, things get more complex. Their driver’s license or state ID card from List B proves who they are, while their Social Security card or birth certificate from List C confirms work authorization. Both documents must be acceptable, and both must clearly belong to your new hire.

The 90-day receipt rule offers some breathing room when life happens. If someone’s documents were lost, stolen, or damaged, they can present a receipt for the replacement. You accept the receipt as temporary proof, but mark your calendar because they must bring the actual document within 90 days.

I-9 Verification Assistance for Rehires & Reverifications

Bringing back former employees doesn’t always mean starting the I-9 process over. If you’re rehiring someone within three years of their original form, you can use Section 3 instead of completing an entirely new I-9. But here’s the catch: if their work authorization expired since they left, you’ll need to reverify their eligibility.

Supplement B comes into play when you’re rehiring someone after more than three years or when their name has changed. It’s essentially an update mechanism that keeps everything current without duplicating work.

The three-month notification rule is your early warning system. Reach out to employees at least three months before their work authorization expires. This gives them time to renew their documents and prevents those awkward situations where someone can’t work because their EAD expired over the weekend.

Here’s something that trips up many employers: the automatic EAD 540-day extension. Certain categories of workers who file timely renewal applications get automatic extensions while their cases are processed. This prevents work interruptions and keeps your workforce stable during immigration processing delays. The key word is “timely,” so that three-month heads-up becomes even more critical.

Getting I-9 verification assistance for these situations can save you from making costly assumptions about who needs what and when. The rules vary by document type and employee category, and one wrong guess can lead to unauthorized employment violations.

Remote & Digital Solutions: E-Verify, E-Verify+, and Beyond

Remote hiring is here to stay, and modern I-9 verification assistance tools make it painless.

E-Verify remains the backbone. Submit data online, and in 3–5 seconds DHS and SSA databases confirm work eligibility.

The new E-Verify+ pilot folds Form I-9 and E-Verify into one digital step. Employees store their info in a secure account they can take to the next job—think of it as a portable work-authorization passport.

Already use E-Verify? The Optional Alternative procedure lets you examine documents over a live video call, perfect for fully remote teams.

At Valley All States Employer Service, our E-Verify services handle submissions, deadlines, and audit prep so you don’t have to juggle multiple logins or spreadsheets. For official details, see the USCIS E-Verify overview.

Tech That Makes I-9 Help Effortless

- Automated alerts so Section 2 and reverification dates never sneak up on you

- Smart-form validation that catches errors in real time, before ICE does

- Secure cloud storage with full audit trails, ready if inspectors show up

- Integrations that pull data from your HR or onboarding system, eliminating double entry

Avoiding Discrimination, Errors, and Audits

The easiest way to steer clear of discrimination claims is simple: treat every employee the same. Accept any valid document listed on the form, never ask for extras, and never steer someone toward a specific choice.

Common safeguards:

- Use trained authorized representatives or a trusted third party for every verification.

- Provide annual refresher training and keep attendance records.

- Run self-audits at least once a year to spot and fix patterns early.

Need more detail? The Department of Justice IER page breaks down anti-discrimination rules in plain language.

Good-Faith Compliance Checklist

- Written procedures that walk staff through each section of the form

- Clear lists of acceptable documents and how to handle receipts

- Reverification timelines with automated reminders

- A purge schedule—destroy I-9s three years after hire or one year after termination, whichever is later

I-9 Compliance Toolkit & Resources

When it comes to I-9 verification assistance, you don’t have to reinvent the wheel. The federal government has created a comprehensive toolkit that’s completely free and surprisingly user-friendly.

The M-274 Handbook for Employers is your bible for I-9 compliance. Think of it as the instruction manual that actually makes sense. This handbook gets updated regularly to reflect new policies, document changes, and procedural updates. The current version includes detailed guidance on remote verification procedures and clarifies which documents are acceptable in different situations.

I-9 Central serves as your digital command center for everything I-9 related. This is where you’ll find the current Form I-9 PDF, updated acceptable documents lists, and those crucial notifications about temporary extensions or policy changes that seem to pop up when you least expect them.

Here’s something many employers miss: state E-Verify mandates can completely change your compliance requirements. Seventeen states currently have some form of E-Verify requirement, but the rules vary dramatically. Some states require all employers to use E-Verify, others limit it to government contractors, and some focus on specific industries. Arizona’s requirements look nothing like Florida’s, so you’ll need to check your specific state obligations.

The USCIS support lines are staffed by actual humans who understand I-9 complexities. These aren’t outsourced call centers reading from scripts. When you call with a question about whether a specific document combination is acceptable, you’re talking to someone who deals with these issues daily.

For employers looking at the bigger picture of HR compliance, our Human Resources category covers additional employment law topics that often intersect with I-9 requirements.

Quick-Access Help Channels

When you need immediate I-9 verification assistance, speed matters. Here are your fastest routes to expert help:

The USCIS I-9 Contact Center operates two separate lines, and knowing which one to call saves time. The employer line at 888-464-4218 handles verification questions, document acceptability issues, and procedural guidance. The employee line at 888-897-7781 focuses on worker rights and discrimination concerns. Both operate Monday through Friday from 8 a.m. to 8 p.m. Eastern Time, with TTY support available at 877-875-6028.

I-9Central email support at I-9Central@uscis.dhs.gov works best for complex questions that need detailed explanations. You’ll typically get responses within two business days, and the written format gives you documentation of official guidance.

The IER Anti-Discrimination Support line at 800-255-8155 becomes crucial when you’re dealing with challenging situations. Whether you’re unsure if a request might be discriminatory or need to report a problem, this specialized support prevents small issues from becoming major legal headaches.

The ICE IMAGE program offers proactive education through their email support at image@dhs.gov. This program focuses on workforce security best practices and can provide guidance on preparing for potential audits before they happen.

Frequently Asked Questions about I-9 Verification Assistance

What documents can employees show?

Here’s where many employers get confused, but the rules are actually pretty straightforward. Your new hire can choose from any document on the Lists of Acceptable Documents. They have two options: show you one List A document that proves both identity and work authorization (like a U.S. passport), or present one List B document for identity plus one List C document for work authorization.

The key word here is “choose.” You cannot tell an employee which specific documents to bring. If they walk in with a valid driver’s license and Social Security card, you must accept that combination, even if you’d secretly prefer to see a passport because it’s simpler.

Receipts for replacement documents add another layer of flexibility. When someone’s documents are lost, stolen, or damaged, they can present a receipt for the replacement. This receipt is valid for 90 days, giving them time to get the actual document. Just remember to follow up before that 90-day window closes.

Can I-9s be completed entirely online?

We’re getting closer to fully digital I-9 completion, but we’re not quite there yet. Here’s what you can do online right now: employees can complete Section 1 electronically, and you can use digital platforms for data entry, storage, and tracking.

The sticking point is Section 2 document examination. You still need to physically inspect documents or conduct a live video review if you’re enrolled in E-Verify. The video option has been a game-changer for remote workers, but it requires specific procedures and E-Verify enrollment.

E-Verify+ is piloting a fully digital process that could revolutionize how we handle I-9s, but it’s not widely available yet. For now, remote video examination through E-Verify is your best option for getting as close to fully online completion as possible.

How long must employers keep I-9 forms?

The retention rule is simple once you understand it: keep I-9 forms for three years after the hire date or one year after employment ends, whichever comes later. Let’s say you hire someone on March 1, 2024, and they leave on August 15, 2025. You’d keep their I-9 until March 1, 2027 (three years from hire), not August 15, 2026.

Here’s something that surprises many employers: don’t keep I-9s longer than required. Holding onto forms beyond the legal retention period can actually increase your liability during ICE audits. Every I-9 in your files during an inspection gets scrutinized, including those old ones you thought you were being careful by keeping.

Set up a purge schedule and stick to it. Mark your calendar to review and destroy I-9s that have reached their retention limit. This isn’t just good housekeeping, it’s smart compliance strategy that protects your business from unnecessary exposure to penalties.

Conclusion

Think about where you were when you started reading this article. Maybe you were staring at a stack of I-9 forms, wondering if you’d filled them out correctly. Or perhaps you just got word that ICE might be coming for an audit, and your stomach dropped.

Here’s the thing about I-9 verification assistance: it’s not about admitting you can’t handle compliance on your own. It’s about being smart enough to know when professional help can save you time, money, and a whole lot of stress.

You’ve seen the numbers. With error rates sitting at 60-80% and penalties ranging from $272 to $27,018 per violation, even small mistakes add up fast. But you’ve also seen the solutions. Government resources, digital platforms, and professional services all exist to make your life easier.

The best part? You get to choose how much help you need. Maybe you just want someone to answer questions when you’re stuck. Maybe you need a complete digital overhaul of your verification process. Or maybe you want to hand the whole thing over to experts who eat, sleep, and breathe employment verification.

At Valley All States Employer Service, we’ve helped countless employers transform their I-9 compliance from a source of anxiety into a smooth, reliable system. Our team handles the complexity while you focus on growing your business. We catch the errors before they become penalties, track the deadlines before they become problems, and provide the documentation you need when audits happen.

Your business deserves better than crossing your fingers and hoping your I-9s are correct. Our I-9 verification assistance through comprehensive E-Verify services gives you the confidence that comes from knowing your employment verification process is handled by people who understand both the rules and the real-world challenges you face.

Ready to stop worrying about I-9 compliance and start focusing on what you do best? Let’s talk about how we can make employment verification work for your business, not against it.