Why Employment Verification Matters in Maryland

Employment verification Maryland is a cornerstone of smart hiring and regulatory compliance for businesses across the state. It’s how employers confirm a job candidate’s identity, work eligibility, and past work history. Doing it right protects your business and ensures a smooth onboarding process.

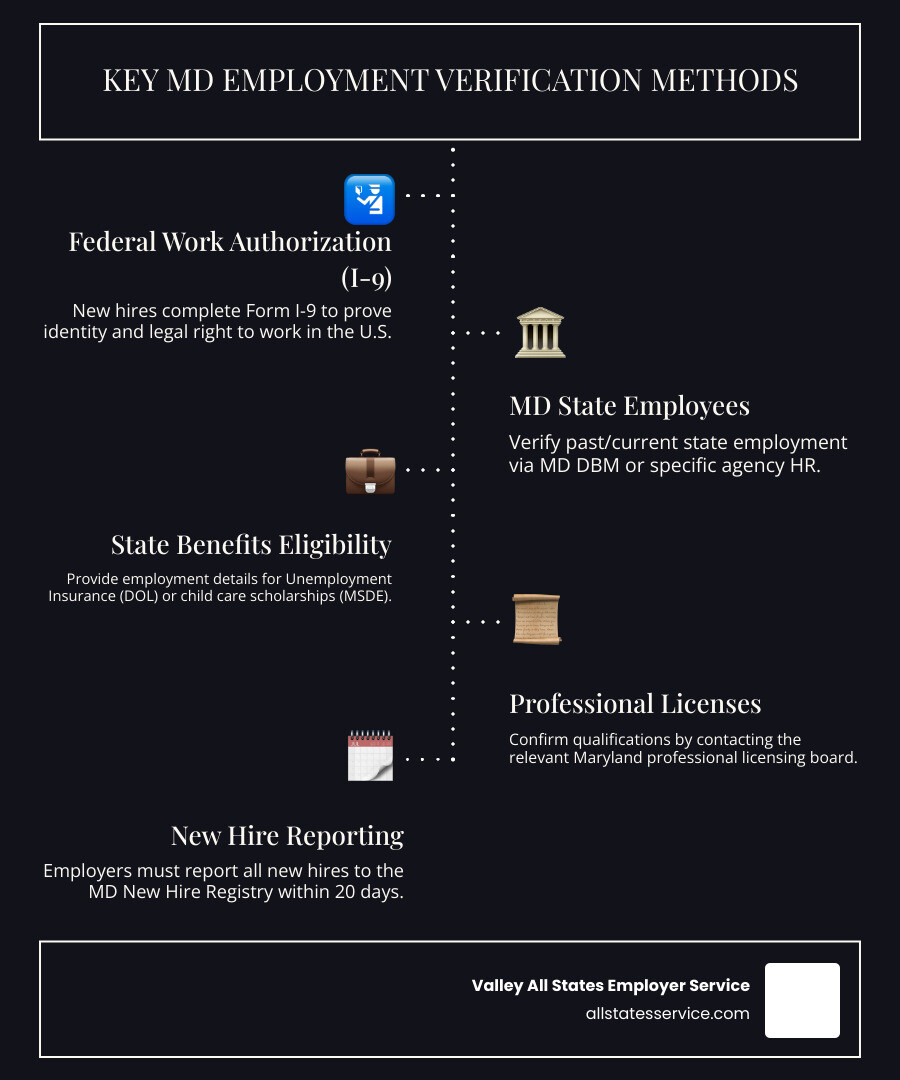

If you’re looking for a quick overview on how to verify employment in Maryland, here’s what you need to know:

- For Federal Work Authorization: All new hires must complete the I-9 Form to prove their identity and legal right to work in the U.S.

- For Maryland State Employees: To verify past or current employment with a state agency, contact the Maryland Department of Budget and Management (DBM) or the specific agency’s Human Resources department.

- For State Benefits Eligibility: Provide employment details to relevant state agencies, such as the Maryland Department of Labor for unemployment insurance or the Maryland State Department of Education for child care scholarship eligibility.

- For Professional Licenses: Confirm professional qualifications by contacting the relevant Maryland professional licensing board (e.g., for doctors or therapists).

- For New Hire Reporting (Employer Duty): Employers are required to report all newly hired employees to the Maryland New Hire Registry within 20 days of their start date.

In today’s environment, navigating the rules for workforce eligibility can feel like a maze. But understanding these processes is vital. Proper verification helps prevent fraud, ensures you’re following federal and state laws, and builds a foundation of trust with your new team members. It also streamlines your operations, allowing you to focus on growth, not compliance headaches.

Understanding the Basics: Federal I-9 & E-Verify in Maryland

This section covers the mandatory federal requirements that all Maryland employers must follow, forming the foundation of your hiring compliance strategy. These are the bedrock of compliant hiring practices for any business operating in the United States, including those in Maryland.

The Mandatory Form I-9

Every employer in Maryland needs to understand one simple truth: Form I-9 is not optional. Federal law requires this form for every single new hire, whether they’re your first employee or your hundredth. It’s how you prove that each person on your team has the legal right to work in the United States.

Here’s how the process works in practice. Your new employee fills out Section 1 of the I-9 on their very first day of work. Then you have exactly three business days to complete Section 2 by examining their original documents. This 3-day rule is firm, so don’t let paperwork pile up.

The document requirements might seem confusing at first, but they’re actually straightforward. The government provides three lists: List A documents prove both identity and work authorization (like a U.S. passport), List B documents prove identity (like a driver’s license), and List C documents prove work authorization (like a Social Security card). Your employee needs to show you either one document from List A, or one from List B plus one from List C.

The key to staying compliant is consistency. You must follow the same process for every new hire to avoid discrimination claims. Don’t make assumptions about anyone’s eligibility based on their appearance or accent. Let the documents do the talking.

If you’re feeling overwhelmed by I-9 requirements, you’re not alone. Consider conducting an I-9 Self-Audit to make sure your records are spotless. You can also find the official forms and detailed instructions at I-9, Employment Eligibility Verification – USCIS.

What is E-Verify?

Think of E-Verify as your Form I-9’s tech-savvy partner. This electronic system takes the information from your completed I-9 and cross-references it with the USCIS database and Social Security Administration database. It’s like having a direct line to the federal government to double-check that everything matches up.

E-Verify complements Form I-9 rather than replacing it. You still need to complete the I-9 process first, then E-Verify helps you catch any red flags or mismatches that might have slipped through. The system is incredibly efficient at reducing errors and giving you confidence in your hiring decisions.

Here’s what many Maryland employers don’t realize: E-Verify is not federally mandated for all MD employers. You’re only required to use it if you’re a federal contractor or if you’re sponsoring employees for certain visa programs. However, smart businesses often choose E-Verify as a best practice anyway.

Why would you use E-Verify if it’s not required? Simple. It protects your business from accidentally hiring someone without work authorization, and it shows government agencies that you’re serious about compliance. Plus, the system catches honest mistakes before they become bigger problems.

Ready to explore how E-Verify can streamline your employment verification Maryland process? Check out the official E-Verify: Home website, or learn about our comprehensive E-Verify Employment Verification services that take the administrative burden off your shoulders.

Maryland-Specific Verification: From State Benefits to Agency Employment

Beyond federal rules, Maryland has unique processes for different situations, from verifying eligibility for state programs to confirming the work history of a former state employee. Understanding these nuances is key to comprehensive employment verification Maryland.

Verifying Employment for State Benefits

When Maryland residents apply for state benefits, the verification dance begins. The state needs to confirm employment details to ensure resources go to the right people and prevent fraud. It’s a careful balancing act that keeps the system fair for everyone.

The Maryland Department of Labor plays a central role in this process, especially for unemployment insurance claims. When someone files for benefits, the department verifies their work history and wages with past employers. This isn’t just paperwork shuffling either. The Child Care Scholarship Program also requires employment verification through detailed forms that ask for everything from job titles to gross pay and work schedules.

Here’s where it gets interesting for employers: you’re legally required to report all new hires to the Maryland New Hire Registry within 20 days of their start date. This requirement comes from both Maryland law and federal legislation from 1996. The registry serves two important purposes: helping the Maryland Child Support Program track down non-custodial parents and assisting the Division of Unemployment Insurance in catching benefit fraud.

When the Division of Unemployment Insurance comes knocking with a DLLR/DUI 330 form for an audit, they want precise details. They need the actual first day someone worked (not just when you hired them), current employment status, and gross weekly earnings. The tricky part? Wages must be reported when earned, not when paid, and calculated for standard calendar weeks running Sunday through Saturday, regardless of your payroll schedule.

The Maryland New Hire Registry makes reporting straightforward, and if you need help navigating UI audits, the state provides detailed guidance for employers.

How to Verify Past Employment with Maryland State Agencies

Verifying employment for former Maryland state employees might seem like navigating a government maze, but the state has actually streamlined the process quite well. The key is knowing where to start and who to contact.

The Department of Budget and Management (DBM) and its Office of Personnel Services and Benefits (OPSB) serve as the central hub for state employee records. They oversee the State Personnel Management System (SPMS), which maintains employment records across various state agencies. Think of it as the master database for Maryland’s government workforce.

Your first step is identifying which specific agency employed the person you’re verifying. Many state agencies handle their own employment verification requests through dedicated HR contacts. For instance, if you need to verify someone who worked for the Maryland State Department of Education, you’d email humanresources.msde@maryland.gov directly.

The OPSB has designated Misty Caleb at (410) 767-4718 as the go-to contact for employment verification information. She’s your lifeline when you can’t figure out which agency to contact or need general guidance on the process.

Maryland makes things easier by providing a comprehensive directory of HR contacts specifically for employment verification. This directory includes names, titles, phone numbers, and email addresses for various departments. If you can’t find the agency you need in their official SPMS Employment Verification Contacts directory, you can always reach out to DBM.PSD@maryland.gov for assistance.

When making your request, come prepared with the employee’s full name, employment dates, and any other identifying information. This helps the agencies locate records quickly and saves everyone time.

Professional License and Credential Verification

Some jobs require more than just confirming someone showed up to work. In regulated professions like healthcare, education, and specialized services, you need to verify that professionals hold active, valid licenses. It’s not enough to know they worked somewhere; you need to know they’re legally qualified to practice.

The Maryland Department of Health oversees numerous professional boards, each managing licenses for specific fields. Whether you’re hiring doctors, nurses, therapists, or audiologists, each profession has its own board with specific verification procedures.

These boards typically offer online verification portals or provide clear instructions for requesting official documentation like a “Letter of Good Standing.” The process varies by profession, but most are straightforward. For example, the Board of Audiologists, Hearing Aid Dealers, and Speech-Language Pathologists requires a written request with the licensee’s name, profession, license number, and recipient details.

Some boards charge fees for verification, especially for non-active licensees, while others provide the service free for currently licensed professionals. The key is contacting the right board for the specific profession you’re verifying.

The Maryland Department of Health License Verification page serves as your starting point, providing links and guidance to individual professional boards. This verification step is crucial for compliance and maintaining workforce integrity, especially in highly regulated sectors where public safety is at stake.

Best Practices for a Compliant Employment Verification Maryland Process

A clear and consistent process is your best defense against compliance issues. Here’s how to build a solid strategy for your business, ensuring your employment verification Maryland practices are robust and legally sound.

Creating a Compliant Employment Verification Maryland Policy

Think of your employment verification policy as your business’s safety net. Without one, you’re essentially walking a tightrope without protection. A well-written, consistent policy protects you from discrimination claims and ensures everyone on your team handles verification requests the same way, every time.

Consistency is everything when it comes to legal compliance. Your policy should clearly outline how your organization handles both incoming verification requests and how you verify new hires. This isn’t just about efficiency, it’s about creating a legal shield that protects your business from potential lawsuits.

When someone calls asking about a former employee, stick to the facts. Confirm dates of employment and job titles without getting into personal opinions or subjective performance details. It’s tempting to share more, especially if you had a great relationship with the employee, but keeping it factual protects everyone involved.

Employee consent matters, particularly when it comes to salary information. While you can generally confirm employment dates and job titles, sharing salary details typically requires written permission from the former employee. Many smart employers today have their HR departments handle all verification requests to ensure consistency and reduce liability risk.

Your policy should also cover internal verification processes. Make sure you have clear procedures for collecting and storing I-9 Forms and related documentation. Always get signed releases from applicants before reaching out to former employers or educational institutions. This simple step can save you from serious legal headaches down the road.

For comprehensive guidance on building a rock-solid framework, explore our insights on Employer HR Compliance.

Handling Verification Requests: In-House vs. Outsourcing

Every business faces the same question: should we handle employment verification ourselves, or bring in the experts? Both approaches have their place, but the right choice depends on your company’s size, resources, and risk tolerance.

Handling verification in-house gives you complete control over the process and can feel more personal. Your team knows your employees and company culture, which can make responses feel more authentic. You also avoid the ongoing costs of outsourcing services.

However, in-house verification comes with significant challenges. Your HR team needs to stay current on constantly changing federal and state laws. One small mistake can lead to costly fines or legal issues. The administrative burden can also be overwhelming, especially during busy hiring periods or when you’re dealing with multiple verification requests.

Outsourcing to specialized services brings expertise and efficiency to your verification process. Professional services stay current on all compliance requirements and have systems in place to ensure accuracy. They can handle high volumes without overwhelming your internal team, and they typically carry liability insurance that protects your business.

The trade-off with outsourcing is less direct control over the process and ongoing service costs. However, many businesses find that the peace of mind and reduced administrative burden more than justify the investment.

Professional verification services like our Employment and Income Verification Services combine expertise with efficiency, helping you maintain compliance while freeing up your team to focus on core business activities.

Common Pitfalls to Avoid in Employment Verification Maryland

Even well-intentioned businesses can stumble when it comes to employment verification Maryland. We’ve seen these mistakes countless times, and they’re almost always preventable with the right knowledge and systems in place.

I-9 errors are surprisingly common and can be incredibly expensive. Something as simple as missing a signature or entering an incorrect date can result in hefty fines during a government audit. The federal three-day rule for completing Section 2 of the I-9 Form isn’t flexible, so having a solid system in place is crucial.

Inconsistent responses to verification requests can create serious legal vulnerabilities. If you tell one employer that John worked from 2020 to 2023, but tell another that he worked from 2019 to 2022, you’ve created a problem that could come back to haunt you. Standardized processes prevent these kinds of damaging inconsistencies.

Delays in responding might seem minor, but they can seriously impact someone’s job search or loan application. Internally, slow verification of new hires can bottleneck your onboarding process and hurt productivity. Quick, efficient responses benefit everyone involved.

Privacy violations happen when businesses share more information than legally permissible or fail to get proper consent. Sharing salary history without permission or discussing an employee’s performance issues can lead to serious legal consequences.

ADA compliance issues often arise during background checks that accompany employment verification. While not directly part of verification, these processes must follow Americans with Disabilities Act guidelines, particularly regarding medical inquiries.

Maryland has some unique local requirements that can trip up even experienced employers. Montgomery County, for example, has specific procedures for certain verification requests, including HB486 requirements that mandate specific submission procedures and direct email protocols. They explicitly warn against sending requests to former supervisors or managers, emphasizing the need to follow official channels to avoid delays and confusion.

These local nuances highlight why understanding your specific jurisdiction’s requirements is so important for employment verification Maryland compliance. Our Background Check Pre-Employment Screening services help minimize these risks by ensuring all processes meet both federal and local requirements.

Your Top Maryland Verification Questions Answered

Let’s tackle some of the most common questions Maryland employers have about the verification process. These are the questions we hear all the time, and getting clear answers helps you steer this complex landscape with confidence.

What’s the difference between an I-9 verification and a background check?

This question comes up constantly, and for good reason. While both processes help ensure you’re building a quality workforce, they serve completely different purposes and follow different rules.

I-9 verification is laser-focused on one thing: proving your new hire’s identity and their legal right to work in the United States. It’s a federal requirement for every single new employee, no exceptions. Think of it as answering two basic questions: “Who are you?” and “Are you legally allowed to work here?” The employee presents specific documents from the government’s approved list, you review them, and you’re done. It’s strictly about work eligibility, nothing more.

Background checks, on the other hand, cast a much wider net. They’re designed to assess whether someone is a good fit for a specific role based on their history. Depending on the position, this might include criminal history checks, credit reports for financial roles, driving records for delivery drivers, education verification, or professional license checks. The scope varies dramatically based on what the job requires and what your industry mandates.

Here’s the key difference: the I-9 is mandatory for everyone, while background checks are optional tools (though often highly recommended or required by specific industries). They operate under separate legal frameworks and serve distinct purposes in your hiring process.

Are Maryland employers required to use E-Verify?

For most private employers in Maryland, E-Verify is not mandatory. Unlike the I-9 Form, which every employer must use for every new hire, E-Verify requirements depend on your specific situation.

However, there are important exceptions where E-Verify becomes required. Federal contractors and subcontractors must generally use E-Verify for all new hires and sometimes for existing employees working on federal contracts. If you’re participating in the STEM OPT extension program for foreign students, you’ll also need to use E-Verify for those specific employees.

Even when it’s not required, many Maryland businesses choose E-Verify as a smart business practice. It dramatically improves the accuracy of work authorization verification, helping prevent the hiring of unauthorized workers and reducing compliance headaches down the road. Think of it as an insurance policy for your workforce eligibility process.

The system cross-references your employee’s I-9 information with federal databases, catching potential issues that might slip through manual verification. For businesses serious about maintaining a legal workforce, it’s often worth the investment.

If you’re considering E-Verify or need help implementing it smoothly, our specialized E-Verify Services can guide you through the entire process, ensuring seamless integration and ongoing compliance.

What information can I legally share about a former employee?

This is where many employers get nervous, and rightfully so. When someone calls asking about a former employee for a new job, apartment, or loan application, you want to be helpful without exposing your business to legal risk.

The safest approach is sticking to factual, objective information that you can easily verify. You can typically share dates of employment (exact start and end dates) and the position or job title they held during their time with your company. These are straightforward facts that rarely cause problems.

Salary information gets trickier. While some states have specific rules about salary history, the general best practice is to only provide this information if you have the former employee’s explicit written consent. Many companies have policies of confirming only dates and titles for all external inquiries, regardless of consent, to maintain consistency and minimize risk.

What should you avoid? Steer clear of subjective opinions about performance, reasons for termination (unless legally required for safety-sensitive positions), or personal details about the employee. Sharing negative opinions or performance evaluations can expose your company to defamation lawsuits if the information harms their ability to secure new employment or housing.

The key is having a clear, written policy for handling these requests and training your HR team or designated staff to follow it consistently. When everyone knows exactly what information to share and what to avoid, you protect both your former employees and your business from potential legal complications.

Consistency and sticking to verifiable facts are your strongest defenses in employment verification Maryland situations.

Streamline Your Workforce Eligibility and Stay Compliant

Managing employment verification Maryland doesn’t have to feel like walking through a legal minefield. Yes, you need to follow both federal I-9 requirements and steer Maryland’s unique state processes. But here’s the thing: when you get it right, everything flows smoothly. Your new hires get onboarded quickly, you stay compliant, and you can focus on what really matters—growing your business.

The reality is that a single misstep in verification can cost you big. Fines from federal audits can reach thousands of dollars per violation. State compliance issues can create headaches that drag on for months. And delayed hiring processes mean you might lose great candidates to competitors who move faster.

But there’s good news. You don’t have to handle all this complexity alone.

Expert verification services take the guesswork out of compliance. Instead of wondering if you filled out that I-9 form correctly or whether you’re following the latest Maryland reporting requirements, you get automated systems that handle the details. Your team spends less time on paperwork and more time on what they do best.

Accuracy improves dramatically when you have specialists managing your verification process. They know the ins and outs of federal databases, understand Maryland’s specific requirements, and catch errors before they become expensive problems. Plus, you get consistent responses to verification requests, which protects you from legal risks.

Think about it this way: you wouldn’t do your own corporate taxes when the stakes are high. The same logic applies to workforce eligibility verification. When compliance is this critical to your business, partnering with experts makes sense.

Ready to simplify your compliance and focus on what you do best? Our Automated Eligibility Verification System handles the complexity so you don’t have to. Let’s make employment verification Maryland the least of your worries.