Why Employment Income Verification is Essential for Modern Business

Employment income verification is the process of confirming an employee’s job status, salary, and work history through official documentation or third-party services. This verification serves as a crucial bridge between employees and the organizations that need to assess their financial stability and employment credentials.

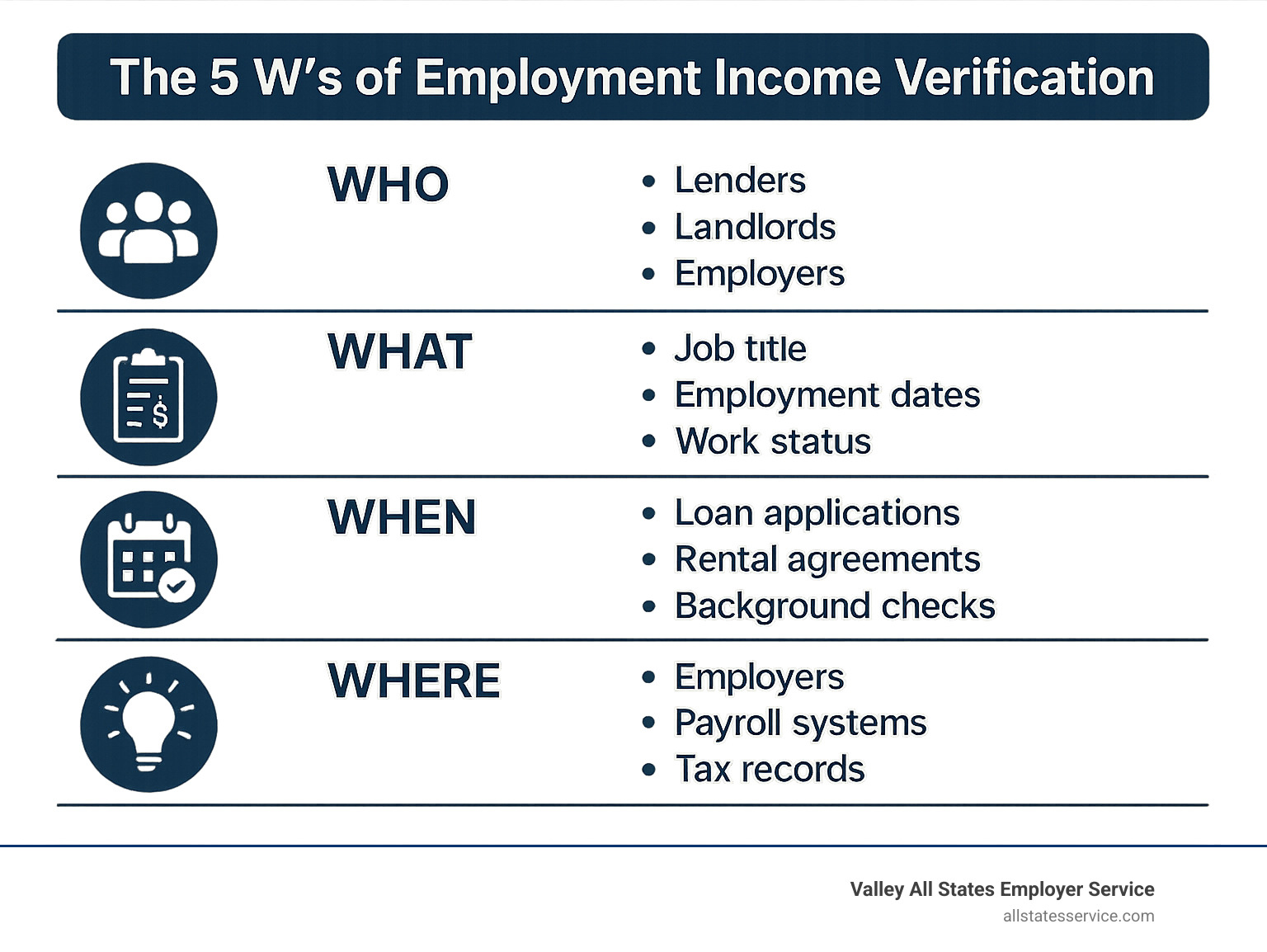

Key aspects of employment income verification:

- Who requests it: Mortgage lenders, landlords, government agencies, and employers

- What gets verified: Job title, employment dates, salary, work status, and income history

- When it’s needed: Loan applications, rental agreements, background checks, and benefit eligibility

- How it works: Through pay stubs, tax returns, direct employer contact, or automated third-party services

The numbers tell the story of how widespread this process has become. According to industry data, The Work Number now serves 3 million employers, while Equifax Workforce Solutions fulfilled 148 million verification requests in 2022 alone. These statistics highlight just how integral verification has become to everyday financial transactions.

Whether someone is applying for a mortgage, renting an apartment, or starting a new job, employment income verification acts as the foundation for trust between parties. It helps lenders determine loan eligibility, assists landlords in evaluating potential tenants, and enables employers to make informed hiring decisions.

The process has evolved significantly from manual phone calls between HR departments to sophisticated automated systems that provide instant, secure access to employment data. This shift toward automation has made verification faster, more accurate, and less burdensome for all parties involved.

Employment income verification terms you need:

What is Employment and Income Verification and Why Does It Matter?

Picture this: you’re applying for your dream apartment, and the landlord asks for proof of income. Or maybe you’re finally ready to buy that house, and the mortgage lender wants to verify your employment. This is where employment income verification comes into play, and it’s become as routine as checking your credit score.

Employment income verification is essentially a trust-building exercise between you and whoever needs to know about your financial situation. It’s like having a reliable friend vouch for you, except this friend has access to official records and can prove you’re telling the truth about your job and earnings.

The process breaks down into two main parts. Employment verification focuses on the basics of your work life: what you do, where you work, how long you’ve been there, and whether you’re working full-time or part-time. Income verification digs deeper into your paycheck, examining your salary, any bonuses you might receive, overtime pay, and other forms of compensation.

For lenders, this verification process is absolutely crucial. It helps them determine whether you can actually afford that car loan or mortgage payment. Landlords use it to figure out if you’ll be able to cover rent month after month. Even employers conducting background checks rely on verification to make sure candidates haven’t stretched the truth about their work history.

The numbers behind this industry are staggering. The Work Number now serves over 3 million employers, while verification services handle 148 million requests annually. That’s a lot of people proving they can pay their bills, and it shows just how integral this process has become to modern financial life.

The Core Purpose of Verifying Employment

When someone requests employment verification, they’re looking for specific details that paint a clear picture of your work situation. Your job title matters because it gives context to your role and responsibilities. A senior manager likely has different income stability than a recent graduate in an entry-level position.

Employment dates tell the story of your job stability. Verifiers want to know when you started your current position and, if you’ve left previous jobs, when those employment periods ended. This information helps them understand your work patterns and career progression.

Your employment status makes a significant difference in how others view your financial stability. Full-time employees typically have more predictable income and benefits than part-time workers or contractors. This distinction can affect everything from loan approval to rental applications.

Work history confirmation serves as a reality check on your resume. It’s one thing to claim you worked somewhere for three years, but verification proves you actually did. This process helps prevent fraud and ensures that decisions are based on accurate information rather than wishful thinking.

For employers who need comprehensive background information, pre-employment work history verification provides detailed insights into a candidate’s employment background.

The Financial Side: Verifying Income

Income verification goes beyond confirming that you have a job. It examines the complete financial picture of your earnings, which can be more complex than it initially appears.

Your salary forms the foundation of most verification requests. This is your regular, predictable income that forms the backbone of your financial stability. Lenders and landlords love salary information because it’s consistent and reliable.

Bonuses and commissions add layers of complexity to the verification process. These variable income sources can significantly boost your total earnings, but they’re not guaranteed. Verifiers often average these payments over time to determine what portion of your variable income they can count on.

Overtime pay presents another interesting challenge. While it can substantially increase your take-home pay, verifiers need to determine whether this overtime is consistent and likely to continue. Someone who worked 60-hour weeks during a busy season might not maintain that schedule year-round.

The ultimate goal is proving your ability to pay for whatever you’re applying for. Whether you’re seeking a mortgage, auto loan, or trying to convince a landlord you’re a reliable tenant, income verification provides the financial evidence needed to support your application. Lenders use this information to calculate debt-to-income ratios and assess the risk of lending to you, while landlords want assurance that rent payments won’t be a struggle.

The Verification Playbook: Who, What, and How

Picture this: you’re applying for a mortgage, and your lender asks for employment income verification. What exactly are they looking for, and how does this whole process work? Let’s break down the who, what, and how of verification so you know exactly what to expect.

The verification landscape involves three key players working together. You have the requester (like a lender or landlord), the employee whose information is being verified, and the source of that information (usually your employer or a third-party service). Think of it as a three-way handshake where everyone needs to be on the same page.

Who Typically Requests Verification?

You might be surprised by how many different organizations need to verify your employment and income. Mortgage lenders are probably the most familiar example, since buying a home involves such a significant financial commitment. They need to know you can handle those monthly payments for the next 15 to 30 years.

Property managers and landlords also rely heavily on verification. They want to make sure you can cover rent, utilities, and other housing costs without stretching your budget too thin. It’s really about protecting both you and them from financial stress down the road.

When you’re job hunting, pre-employment screening companies often verify your work history as part of their background checks. This helps employers confirm that everything on your resume is accurate and that you’ve been honest about your experience.

Government agencies use verification for all sorts of benefit programs. Whether you’re applying for housing assistance, student loans, or other government services, they need to know your true income level to determine eligibility.

Don’t forget about auto financing companies and credit unions either. Car loans might seem straightforward, but lenders want to ensure you can handle the monthly payments plus insurance and maintenance costs. Social service agencies also use verification to determine who qualifies for programs like SNAP benefits or Medicaid.

What Specific Information is Verified?

The details that get verified depend on why someone is asking, but there are some common elements that pop up again and again. Employee details like your full name, Social Security number, and current address help ensure the verification matches the right person. It sounds basic, but mix-ups can happen.

Employer information includes your company’s name, address, and contact details. This confirms that you actually work where you say you do and that the business is legitimate. Compensation breakdown gets into the nitty-gritty of your earnings, including base salary, hourly wages, overtime rates, bonuses, and commissions.

Your job history might include previous positions, how long you stayed in each role, and any gaps in employment. Employment dates specify exactly when you started and ended each position, while your job title and responsibilities help verify your level of experience and the compensation that typically comes with it.

Pay frequency tells verifiers whether you’re paid weekly, bi-weekly, monthly, or on some other schedule. This helps them understand your cash flow and budgeting situation.

Common Methods for Employment Income Verification

The verification world has come a long way from the days when HR departments spent hours on the phone with lenders. Manual verification still happens, but it’s becoming less common as automated systems take over.

Pay stubs remain popular because they show detailed information about your recent earnings, including gross pay, deductions, and what you actually take home. The downside? They only give a snapshot of recent activity, not the full picture.

Bank statements can reveal income patterns over time and are especially useful if you have multiple income sources. They show actual deposits, which can be more reliable than just looking at what you’re supposed to earn on paper.

Tax returns provide the most comprehensive view of your annual income. The IRS Form W-2 information is particularly valuable because it’s official documentation that’s hard to fake. This approach works especially well for self-employed individuals or anyone with variable income.

Third-party services like Equifax, Experian, and Truework have revolutionized the entire process. These companies maintain huge databases of employment and income information that can be accessed instantly with proper authorization. Services like Truework typically charge around $59.95 for verification, while Equifax runs about $66.45. That might sound expensive, but it’s actually cost-effective compared to the time and effort involved in manual verification.

The shift toward automation has been dramatic and beneficial for everyone involved. Instead of waiting days or weeks for verification, decisions can often be made within hours or even minutes.

Navigating the Modern Landscape of Automated Verification

Manual phone tag is out, automated employment income verification is in. Modern platforms tap into secure payroll and tax databases covering millions of workers, flag inconsistencies instantly, and return clean reports while you sip your coffee.

HR teams gain back hours they once spent on verification calls, and employees get quicker approvals on mortgages, rentals, and benefit programs.

For a deeper dive into related HR tech, see our guide on automated eligibility verification systems.

The Benefits of Using Third-Party Services

Independent verification platforms now power most requests. They deliver:

- Speed – results often appear in seconds.

- Accuracy – automated cross-checks slash typos and transcription errors.

- Lower HR workload – no more answering the same salary question 20 times a week.

- Security – enterprise-grade encryption and tight access controls.

- Better employee experience – fast answers mean less stress for borrowers and renters.

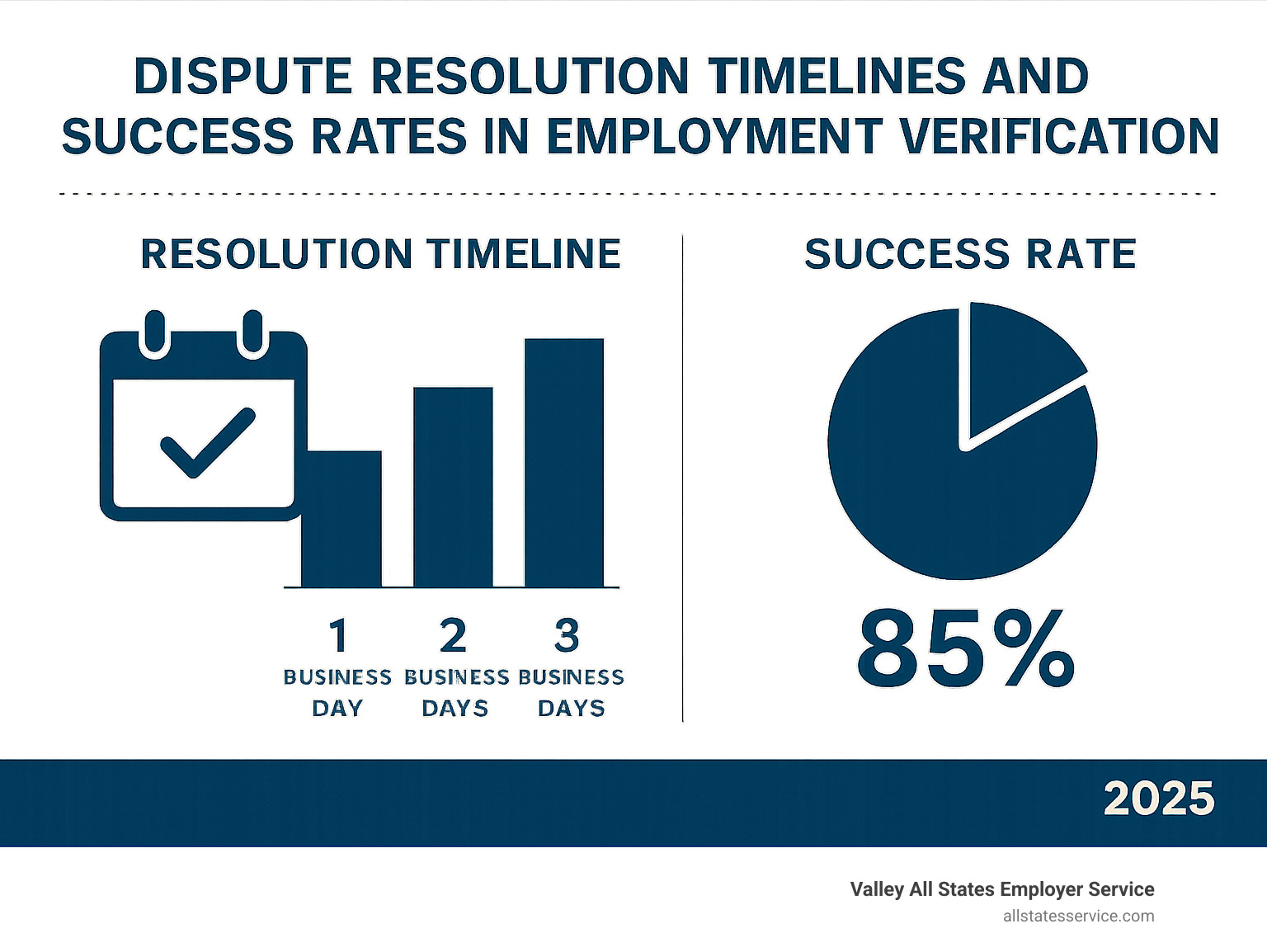

Industry leaders like Equifax complete many verifications in one to three business days versus up to two weeks manually.

Curious how long other hiring checks take? Read our post on pre-employment background check time.

How Employees Provide Consent

Verification only starts with permission. Under the Fair Credit Reporting Act, employees sign–or e-sign–a release that spells out which data may be shared and why.

Most systems collect this consent through a secure portal, store the digital signature for audits, and alert the employee each time their records are accessed.

This approach delivers two key benefits:

- Employee control – workers always know who views their data.

- Privacy protection – end-to-end encryption and role-based access keep sensitive information safe.

With a single click, the right people get the right data, and everyone stays compliant.

Ensuring Accuracy and Compliance in Verification

When dealing with employment income verification, getting the details right isn’t just important—it’s legally required. Think of it like handling someone’s financial DNA. One small mistake can ripple through their entire financial life, affecting everything from loan approvals to rental applications.

The verification process walks a careful line between providing necessary information and protecting employee privacy. Companies must steer complex privacy laws while maintaining the security that keeps sensitive financial data safe from prying eyes.

Privacy considerations go far beyond basic data protection. Employees have the right to know when their information is being accessed and by whom. Many verification services now send notifications when someone requests their employment data, giving people visibility into how their information is being used.

Data security involves multiple layers of protection, from encrypted transmission to secure storage and controlled access. The stakes couldn’t be higher—a single breach can expose sensitive financial information for thousands of employees. That’s why reputable verification services invest heavily in cybersecurity measures that most individual companies couldn’t afford on their own.

Dispute resolution provides a crucial safety net when things go wrong. Even the best systems can have errors, and employees need a clear path to correct inaccurate information that could derail their financial plans.

Legal compliance requirements vary by jurisdiction but generally include following the Fair Credit Reporting Act (FCRA) in the United States and similar privacy legislation like PIPEDA in Canada. These laws create specific requirements for how verification data can be collected, stored, and shared.

Handling Discrepancies: The Dispute Process

Nobody’s perfect, and that includes verification systems. When employment income verification reveals inaccurate information, employees need a straightforward way to set the record straight. The dispute process serves as both a safety valve and a quality control mechanism.

Inaccurate information can pop up for various reasons. Maybe someone in payroll made a typo when entering salary data, or perhaps the system is showing an old job title from before a recent promotion. Sometimes outdated records linger in databases longer than they should, creating confusion months or even years later.

Employee rights in the dispute process are well-established. You have the right to review your verification records, challenge information that’s wrong, and get corrections made within a reasonable timeframe. These aren’t just nice-to-have features—they’re legally protected rights under privacy legislation.

The steps to dispute typically start with contacting the verification provider directly. Most services have dedicated dispute resolution teams who understand that quick resolution benefits everyone involved. You’ll explain what’s wrong and provide supporting documentation to back up your claim.

Contacting the verification provider should be your first move when you spot an error. Most services offer multiple ways to reach them—phone numbers, email addresses, or online portals designed specifically for dispute submissions. Don’t wait and hope the problem fixes itself.

Providing documentation speeds up the resolution process significantly. Pay stubs, tax returns, employment contracts, or official letters from HR can quickly prove your case. The clearer your evidence, the faster the correction can be made.

Investigation timelines are usually regulated by law. Industry standards typically require resolution within 30 days, though many services can handle straightforward disputes much faster when you provide clear documentation. Some simple corrections, like updating a job title, can be resolved within days.

The Role of Government Agencies

Government agencies wear two hats in the verification world—sometimes they’re requesting verification, and sometimes they’re providing it. This dual role gives them unique insight into how the system works and what improvements are needed.

The Social Security Administration maintains one of the most comprehensive databases of earnings history in the country. These records stretch back years and can verify long-term income patterns that other sources might miss. They’re particularly valuable for people with gaps in their employment records or those who’ve worked for multiple employers.

Housing assistance programs rely heavily on income verification to determine who qualifies for various forms of support. Accurate verification ensures that assistance reaches the families who need it most while maintaining program integrity. The stakes are high—incorrect information can mean the difference between someone getting housing assistance or remaining homeless.

Student loan programs use income verification for multiple purposes, from calculating need-based aid to setting up income-driven repayment plans. This helps ensure that educational resources are distributed fairly and that loan payments remain manageable for borrowers.

Tax agencies have developed some of the most sophisticated income verification systems available. The Canada Revenue Agency’s program, for example, serves over 100 partner programs and demonstrates how government agencies can streamline verification while maintaining accuracy and security.

Benefit eligibility determinations often hinge on precise income verification. Whether it’s food assistance, healthcare subsidies, or unemployment benefits, getting the income numbers right ensures that government resources are used effectively and reach the people who truly qualify.

Distinguishing Employment Income Verification from Eligibility Verification

Here’s where things get interesting—and where many people get confused. Employment income verification and work eligibility verification might sound similar, but they serve completely different purposes and follow different rules.

Two types of compliance exist in the employment world. Financial verification focuses on confirming income levels, employment status, and ability to pay. This information helps lenders, landlords, and others make financial decisions. Legal work authorization involves confirming that employees have the right to work in the United States, which is governed by immigration law rather than financial regulations.

Form I-9 serves as the foundation of work eligibility verification. This form requires employees to provide documentation proving both their identity and work authorization. Every employer must complete Form I-9 for every employee—no exceptions. It’s about legal compliance, not financial capacity.

E-Verify takes Form I-9 information and cross-references it against government databases to confirm work eligibility. While not required for all employers, E-Verify is mandatory for federal contractors and increasingly popular among other employers who want extra assurance about their workforce.

Confirming identity involves verifying that employees are who they claim to be through acceptable identification documents like driver’s licenses or passports. Confirming right to work requires checking that employees are legally authorized to work in the United States, whether as citizens, permanent residents, or holders of work-authorized visas.

The distinction matters because these processes require different expertise. While third-party services can handle financial verification efficiently, ensuring legal work authorization requires specialized knowledge of immigration law and government requirements.

At Valley All States Employer Service, we understand this distinction intimately. We specialize in E-Verify processing and know that work eligibility verification requires a different approach than financial verification. For more information about how E-Verify relates to background checks, you can learn about E-Verify background checks and I-9 verification assistance.

The key takeaway? While third-party services excel at handling financial data for employment income verification, ensuring a new hire is legally eligible to work through services like E-Verify represents a critical, separate step in the onboarding process. Both are essential, but they serve different masters and follow different rules.

Conclusion

The world of employment income verification has transformed dramatically, and the numbers speak for themselves. With 148 million verification requests processed by Equifax in 2022 and 3 million employers now served by The Work Number, this process has become the backbone of financial decision-making across America.

What started as time-consuming phone calls between HR departments has evolved into sophisticated automated systems that deliver results in minutes rather than days. This shift benefits everyone involved. Employees get faster approvals for loans and rentals, employers spend less time on administrative tasks, and lenders make more informed decisions with reliable data.

Compliance isn’t optional in this landscape. The 30-day dispute resolution timeline, privacy protections, and security requirements exist to protect employee rights while enabling legitimate verification needs. These safeguards ensure that the system works fairly for everyone.

Here’s something crucial that many people don’t realize: employment income verification and work eligibility verification are completely different processes. While automated services excel at confirming someone’s salary and job history, proving that a new hire can legally work in the United States requires specialized knowledge and different compliance frameworks entirely.

The verification industry will keep evolving as technology advances and regulations change. However, the fundamental need for accurate, secure confirmation of employment and income information isn’t going anywhere. If anything, it’s becoming more important as financial transactions become more complex and regulations more stringent.

Whether you’re applying for a mortgage, hiring new employees, or managing compliance requirements, understanding these systems helps everything run smoother. While third-party services handle financial data verification effectively, ensuring that new hires are legally eligible to work through services like E-Verify represents a critical, separate step in the onboarding process.

At Valley All States Employer Service, we’ve seen how complex employment compliance can be. That’s why we focus specifically on E-Verify processing and work eligibility verification, helping employers steer these requirements without the headaches and potential errors that come with handling it in-house.

Ready to streamline your employee onboarding compliance? Our team specializes in taking the burden of E-Verify processing off your shoulders, so you can focus on what you do best. Contact us today to learn how we can make your compliance process simpler and more reliable.