Federal employment eligibility verification form i 9!

Why Understanding the Federal Employment Eligibility Verification Form I-9 Matters for Your Business

The federal employment eligibility verification form i 9 is a mandatory document that every U.S. employer must complete for each new hire to verify their identity and work authorization. Created under the Immigration Reform and Control Act of 1986, this form protects your business from penalties while ensuring you hire only authorized workers.

Quick Facts About Form I-9:

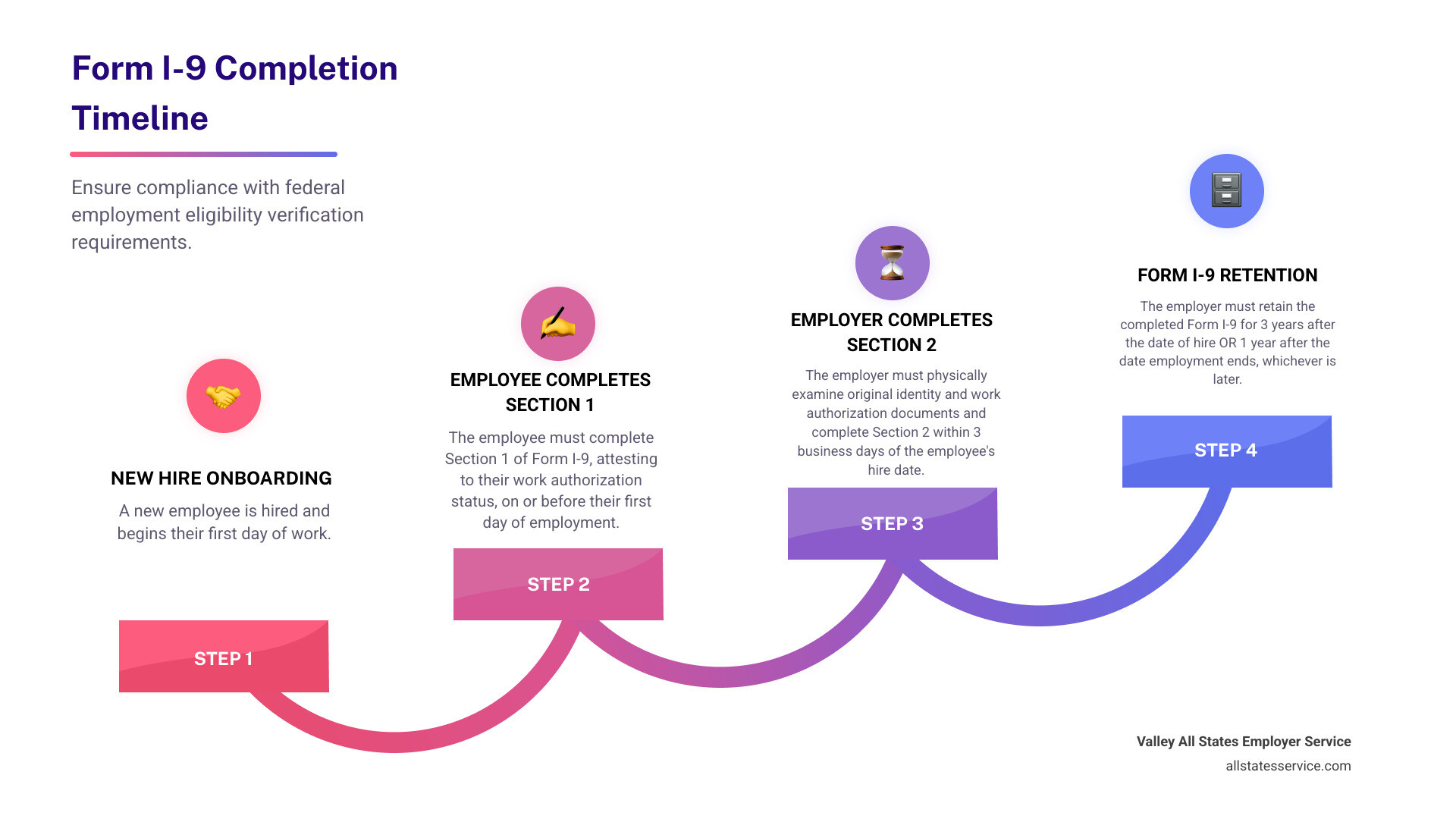

- Required for: All employees hired after November 6, 1986 (citizens and non-citizens)

- Employee deadline: Complete Section 1 on or before first day of work

- Employer deadline: Complete Section 2 within 3 business days of hire

- Retention period: 3 years after hire OR 1 year after termination (whichever is later)

- Penalties: $250 to $5,500 per unauthorized worker; up to $1,100 per form for record-keeping violations

If you’re an HR manager juggling complex compliance requirements, you’re not alone. The I-9 process might seem straightforward, but one small mistake can lead to hefty fines during an ICE audit. In fact, since 2009, ICE has conducted over 7,500 audits and imposed more than $80 million in fines.

The good news? Once you understand the basics, Form I-9 becomes much more manageable. This guide breaks down everything you need to know, from acceptable documents to avoiding common pitfalls that trip up even experienced HR professionals.

What is the Federal Employment Eligibility Verification Form I-9?

Picture this: you’ve just hired a fantastic new employee, and you’re excited to get them started. But before they can begin their first day, there’s one crucial piece of paperwork that stands between you and compliance with federal law. That’s the federal employment eligibility verification form i 9.

This isn’t just another form to shuffle through your onboarding stack. The Form I-9 serves two essential purposes that protect both you and your new hire. First, it verifies identity by ensuring the person sitting across from you is who they claim to be. Second, it verifies employment authorization by confirming they’re legally allowed to work in the United States.

The U.S. Citizenship and Immigration Services (USCIS) manages this process, and here’s the thing: it’s not optional. Every employer who hires someone for paid work must complete this form. Think of it as your legal shield against hiring unauthorized workers while maintaining fair employment practices for everyone.

Who Must Complete Form I-9?

Here’s where it gets interesting. The federal employment eligibility verification form i 9 applies to pretty much everyone you’d expect, plus a few situations that might surprise you.

New hires are the obvious candidates, whether they’re citizens or non-citizens. If you’re paying someone to work for you, they need a completed Form I-9. This includes U.S. citizens, non-citizen nationals, lawful permanent residents, and authorized workers from other countries.

But what about those gray areas? Contractors who are truly independent don’t need Form I-9, but be careful here. Misclassifying an employee as a contractor can create bigger headaches than just I-9 compliance issues. Volunteers performing unpaid services are also exempt, as are casual domestic employees who work sporadically for private households.

There’s also a grandfather clause for exempt individuals hired before November 7, 1986, unless they’re being rehired or their work authorization has expired.

When in doubt, it’s better to err on the side of caution and complete the form. You can find the official version and detailed instructions at Form I-9, Employment Eligibility Verification.

Employee Responsibilities for the federal employment eligibility verification form i 9

Let’s talk about what your new employee needs to do. Their job is actually pretty straightforward, but the timing is critical.

Completing Section 1 is entirely the employee’s responsibility. They must finish this section on or before their first day of employment. No exceptions, no extensions. This section asks for basic information like their legal name, address, and date of birth, but the most important part is attesting to their status.

Your employee will declare whether they’re a U.S. citizen, a noncitizen national, a lawful permanent resident, or an authorized alien worker. If they’re in that last category, they’ll need to provide their registration number and any expiration dates for their work authorization.

Here’s what makes this tricky: the information must be completely accurate. False statements can lead to serious legal trouble, including criminal charges. If your employee needs help with language barriers, they can use a preparer or translator, but they must personally sign Section 1.

After completing the paperwork, your employee’s next job is providing documentation. They get to choose which acceptable documents to present from the official lists, and here’s a key point: you cannot tell them which specific documents to bring. That choice is entirely theirs.

For employees who want to understand their role better, the USCIS offers a helpful Form I-9 Employee Information Sheet. If you need more guidance on ensuring Section 1 gets completed properly, check out our detailed resource on I-9 Form Completion.

Employer Responsibilities and Timelines

Now comes your part, and honestly, this is where most compliance issues happen. The good news? Once you understand the process, it becomes much more manageable.

Completing Section 2 is your main responsibility, and you have exactly three business days from your employee’s first day of work to get it done. If someone starts on Monday, you need Section 2 completed by Thursday. No weekends or holidays count toward this deadline.

Your primary job is physically examining documents that your employee presents. You’re looking for documents that “reasonably appear to be genuine and relate to the person presenting them.” You don’t need to be a document expert, but you should spot obvious problems like expired dates or documents that clearly don’t match the person.

You must examine original documents. Photocopies won’t cut it, except for certified copies of birth certificates. After examining everything, you’ll record the document details in Section 2 and add your signature and date.

Remote examination has become more common, and there are authorized alternatives for situations where physical document review isn’t practical. If you use these methods, you must indicate this on the form.

Reverification and rehires add another layer of complexity. Some employees will need their work authorization reverified before it expires. Others might be rehired within three years of their original Form I-9. In these cases, you’ll use Supplement B to update their information rather than starting from scratch.

The document verification process has its own set of nuances and potential pitfalls. For detailed guidance on getting this right, our Verifying I-9 Documents resource breaks down everything you need to know about examining and recording document information properly.

A Guide to Acceptable I-9 Documents

When it comes to document verification for the federal employment eligibility verification form i 9, there’s one golden rule you need to remember: it’s the employee’s choice, not yours. Your new hire gets to pick which documents they want to present from the official “Lists of Acceptable Documents,” and you cannot demand specific ones or reject documents that appear genuine and are on the approved list.

Your job is to examine whatever documents they bring and make sure they reasonably appear genuine and relate to the person standing in front of you. Think of yourself as a reasonable person, not a document expert. You’re looking for obvious signs that something might be off, but you’re not expected to be a forensics specialist.

Here’s something that trips up many employers: all documents must be unexpired. It sounds obvious, but you’d be surprised how often someone presents an expired driver’s license or passport. If it’s expired, it’s not acceptable for I-9 purposes, period.

The acceptable documents fall into three straightforward categories, and understanding them will make your life much easier. List A documents are the all-in-one option because they establish both identity and employment authorization. If your employee hands you a U.S. Passport or U.S. Passport Card, you’re done. Same goes for a Permanent Resident Card (Form I-551) or an Employment Authorization Document (EAD) Card (Form I-766). These documents do all the heavy lifting in one shot.

But not everyone has a List A document, and that’s where the combination approach comes in. List B documents prove identity only, so they need to be paired with a List C document that proves work authorization. A driver’s license or state ID card are common List B choices, along with school ID cards with photos, voter registration cards, or military cards. For employees under 18 who might not have a driver’s license yet, alternatives like school records or clinic records can work.

On the List C side, the U.S. Social Security Card is probably the most common choice, but it cannot be one of those cards marked “not valid for employment.” A birth certificate issued by the U.S. government also works, as does a Certification of Report of Birth Abroad for those born to U.S. citizens overseas.

Here’s where some employers get nervous: what if the document looks a little worn or the photo is old? You’re looking for documents that reasonably appear to be genuine. A driver’s license that’s been in someone’s wallet for three years might look worn, but that doesn’t make it invalid. Focus on whether the document appears to belong to the person presenting it and whether it looks authentic to a reasonable person.

The key is consistency in your approach. Treat every employee the same way, examine documents with the same level of scrutiny, and never ask for more documentation than what’s required. This protects both you and your employees from discrimination issues.

If you’re feeling overwhelmed by document verification or want to ensure you’re always making the right call, professional guidance can be invaluable. You can learn more about getting expert support at More info about I-9 Verification Assistance.

Form I-9 vs. E-Verify: What’s the Difference?

If you’ve ever wondered whether Form I-9 and E-Verify are the same thing, you’re not alone. Many HR professionals get confused by these two systems, but understanding their differences is crucial for staying compliant.

Think of the federal employment eligibility verification form i 9 as your foundation. Every U.S. employer must complete this form for every new hire, no exceptions. It’s the basic paperwork where employees attest to their work eligibility and present documents that you physically examine and record.

E-Verify is like adding a digital security layer on top of that foundation. This internet-based system takes the information from your completed Form I-9 and cross-references it against government databases from the Department of Homeland Security and Social Security Administration. The best part? You get confirmation results in just three to five seconds.

Here’s where it gets interesting: E-Verify is voluntary for most employers, but mandatory for federal contractors and employers in certain states. It’s also completely free, which explains why many businesses choose to use it even when they’re not required to.

The key differences become clearer when you look at specific requirements. For regular I-9 processing, employees don’t always need to provide their Social Security Number in Section 1. But if you’re using E-Verify, that SSN becomes mandatory because the system needs it to verify against government records.

Similarly, E-Verify requires photo identification for List B documents and includes a photo matching tool for certain documents like passports and permanent resident cards. Regular I-9 processing doesn’t have this photo requirement, which means a non-photo school ID can work just fine for identity verification.

There’s one important limitation to remember: you cannot use E-Verify for reverification when an employee’s work authorization expires. That process still requires the traditional I-9 reverification method.

Many employers find that using both systems together gives them the most confidence in their hiring process. The I-9 ensures you’ve met your basic legal obligations, while E-Verify provides that extra electronic confirmation against millions of government records.

For a complete breakdown of how these systems work together and what it means for your specific situation, check out our comprehensive resource: More info about our I-9 E-Verify Compliance Guide.

How E-Verify Works with the federal employment eligibility verification form i 9

Once you’ve completed the I-9 process with your new employee, E-Verify becomes your digital verification partner. The process is surprisingly straightforward, but there are some important steps to follow.

After your employee finishes Section 1 and you complete Section 2 of the federal employment eligibility verification form i 9, you’ll take that information and enter it into the E-Verify system. This includes basic details like the employee’s name, date of birth, citizenship status, and the document information you recorded.

The magic happens next. E-Verify instantly compares this data against millions of records held by government agencies. Most of the time, you’ll get an “Employment Authorized” result within seconds, and you’re done.

But sometimes you’ll encounter a Tentative Nonconfirmation (TNC). Don’t panic if this happens. A TNC doesn’t mean your employee is unauthorized to work; it just means there’s a mismatch between the information provided and what’s in government databases. This could be as simple as a name change that hasn’t been updated in the system.

When you receive a TNC, you must notify the employee and give them a chance to resolve the discrepancy with the appropriate government agency. Here’s the critical part: you cannot take any adverse action against the employee based solely on a TNC. They deserve the opportunity to clear up any database errors.

One of E-Verify’s coolest features is the photo matching tool. When employees present certain documents like U.S. passports, permanent resident cards, or employment authorization documents, you can compare the photo on their document with photos from government databases. It’s like having an extra security check built right into the system.

The entire process typically takes just a few minutes, but it can save you significant headaches down the road. Our team at Valley All States Employer Service handles E-Verify processing for busy employers, ensuring accurate data entry and helping resolve any TNCs that come up.

If you want to learn more about the nuts and bolts of E-Verify, USCIS offers helpful training sessions: Enroll in an E-Verify Webinar.

Staying Compliant: Penalties, Audits, and Anti-Discrimination Rules

When it comes to the federal employment eligibility verification form i 9, staying compliant isn’t just about checking boxes. It’s about protecting your business from serious financial consequences and legal troubles that can arise faster than you might expect.

Immigration and Customs Enforcement (ICE) doesn’t mess around when it comes to I-9 compliance. Since 2009, they’ve conducted over 7,500 audits and handed out more than $80 million in fines. That’s not pocket change for any business, and these numbers show just how seriously the government takes employment verification.

The Real Cost of Getting It Wrong

Let’s talk numbers because they tell the story better than anything else. Paperwork violations might sound minor, but they can cost you between $110 and $1,100 per form. Think about that for a moment. If you have 50 employees and each I-9 has just one small error, you could be looking at fines ranging from $5,500 to $55,000.

Knowingly hiring unauthorized workers carries even steeper penalties. First-time offenders face fines between $250 and $5,500 per unauthorized worker. Repeat offenders? The fines jump significantly higher, and in extreme cases, you might face criminal charges or even lose the ability to bid on federal contracts.

Document fraud penalties add another layer of risk, with fines ranging from $375 to $3,200 per fraudulent document for first-time violations. These penalties stack up quickly, especially for larger employers or those with multiple violations.

Record Retention: The Three-Year, One-Year Rule

Here’s where many employers trip up without realizing it. You must keep completed I-9 forms for three years after the date of hire OR one year after employment ends, whichever is later. This is often called the “3-year/1-year rule.”

But keeping the forms isn’t enough. They need to be organized, secure, and ready for inspection. When ICE shows up for an audit (and they will give you just three business days’ notice), you need to produce these records immediately. Scrambling to find missing paperwork during an audit is a surefire way to rack up additional penalties.

For detailed guidance on avoiding these costly mistakes, check out our resource: More info about I-9 Compliance Penalties.

I-9 Anti-Discrimination Provisions

Here’s where compliance gets tricky. While you need to verify work authorization, you also need to avoid discriminating against employees. The Immigration and Nationality Act includes specific anti-discrimination provisions that many employers accidentally violate.

National origin discrimination means you can’t treat someone differently because of their accent, country of origin, or ethnicity. Citizenship status discrimination prohibits favoring U.S. citizens over other work-authorized individuals like lawful permanent residents when both are equally qualified.

The biggest trap for employers? Unfair documentary practices. This happens when you reject valid documents that appear genuine and are on the acceptable documents list, even if something seems “off” to you. Unless you have concrete evidence of fraud, you must accept documents that meet the requirements.

You also can’t request specific documents from employees. If someone presents a valid driver’s license and Social Security card, you cannot demand to see their passport instead. Similarly, you can’t ask for more documents than necessary or treat employees differently during the I-9 process based on their perceived citizenship status.

The Office of Special Counsel (OSC), now part of the Department of Justice’s Immigrant and Employee Rights Section, enforces these anti-discrimination rules. They investigate complaints and can impose additional penalties for discriminatory practices. The official M-274, Handbook for Employers provides comprehensive guidance on avoiding these pitfalls.

The bottom line? Consistent processes and proper training are your best defense against both compliance violations and discrimination claims. When every employee goes through the exact same I-9 process, you protect both your business and your workers’ rights.

Conclusion

Getting the federal employment eligibility verification form i 9 right isn’t just about checking boxes. It’s about protecting your business while building a workforce you can trust. Every step matters, from that first day when your new employee fills out Section 1 to the careful document verification you complete within three business days.

Think of Form I-9 compliance like maintaining your car. Regular attention prevents major breakdowns. Consistency is your best friend here. When you create a solid process and stick to it for every single hire, you’re not just following the law. You’re building a foundation that keeps ICE audits from becoming your worst nightmare.

The truth is, even experienced HR professionals sometimes feel overwhelmed by the intricacies. Between keeping up with document lists, remembering retention rules, and avoiding discrimination pitfalls, it’s a lot to juggle. But here’s the thing: you don’t have to master every detail on your own.

Training your team thoroughly makes a huge difference. Make sure everyone who handles I-9 forms understands the timelines, knows which documents are acceptable, and recognizes the warning signs of discrimination. Stay current with USCIS updates, because the rules do change.

Most importantly, behind every form is a real person starting their journey with your company. When you handle the I-9 process professionally and fairly, you’re setting the tone for a positive employment relationship from day one.

Ready to simplify your employment eligibility verification process? Valley All States Employer Service takes the complexity out of E-Verify and I-9 compliance. We handle the detailed verification work so you can focus on what really matters: growing your business and supporting your team.

Find how our expert processing can give you peace of mind: More info about our Workforce Eligibility Verification services.