Why Employee Onboarding Compliance Sets Your Business Up for Success

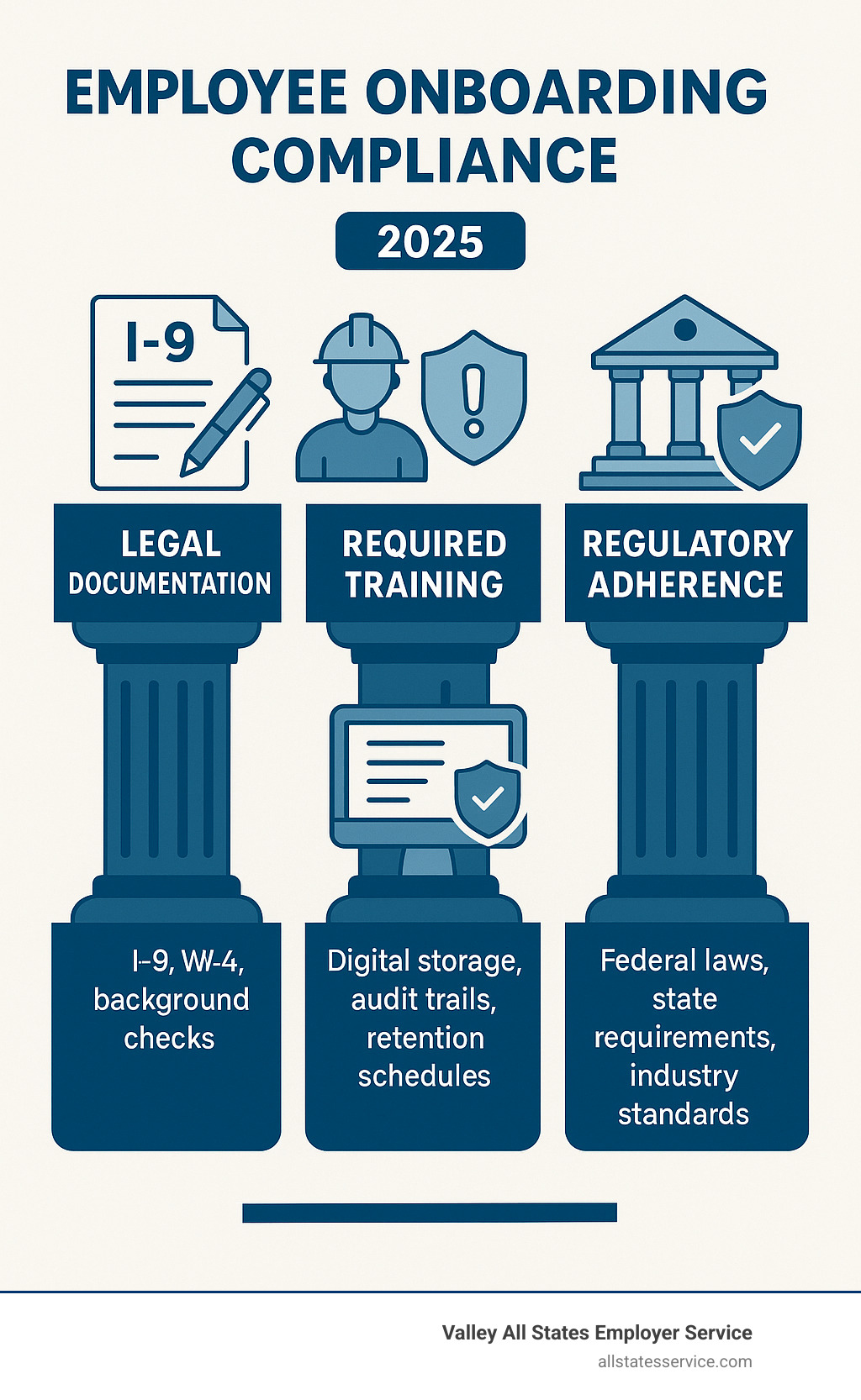

Employee onboarding compliance ensures new hires understand legal requirements, company policies, and regulatory obligations from day one. Here’s what it covers:

- Legal Documentation: I-9 verification, W-4 forms, and employment eligibility checks

- Required Training: Safety protocols, anti-harassment policies, and industry regulations

- Record Keeping: Proper storage and tracking of compliance documentation

- Regulatory Adherence: Meeting federal, state, and local employment laws

- Risk Mitigation: Protecting your business from fines and legal issues

Think about it: would you start a road trip without knowing the traffic rules? That’s exactly what happens when employees begin work without proper compliance training.

The stakes are higher than many business owners realize. Only 29% of newly hired employees report feeling wholly prepared to tackle their role successfully after onboarding. Even worse, half of all hourly workers leave within the first 120 days when onboarding falls short.

But here’s the good news: companies that invest in comprehensive compliance training see a 45% higher return on their investment. For every dollar spent on compliance, businesses save $1.37 in damages, fines, and legal costs.

Getting compliance right from the start isn’t just about avoiding penalties. It’s about building trust, setting clear expectations, and creating a foundation where both your business and your employees can thrive.

What Is Employee Onboarding Compliance and Why It Matters

When you hire someone new, you’re not just adding a team member. You’re also taking on legal responsibilities that start the moment they walk through your door. Employee onboarding compliance is how you meet those responsibilities while setting your new hire up for success.

Think of compliance onboarding as the foundation of a house. You might not see it once the walls go up, but everything else depends on getting it right from the start. It’s where legal requirements, regulatory training, and policy acknowledgments come together in your new hire process.

Traditional onboarding focuses on company culture and job training. That’s important, but it’s only part of the picture. Compliance onboarding ensures every new employee understands the rules, regulations, and legal expectations before they need them.

The foundation rests on what experts call the “Four Cs” framework: Compliance, Clarification, Culture, and Connection. While all four matter, compliance serves as the cornerstone that protects both your business and your employees.

Here’s why employee onboarding compliance matters more than ever:

Legal Protection becomes your safety net. Every company operates under federal, state, and local employment laws. From anti-discrimination requirements to workplace safety standards, compliance onboarding ensures your team knows the rules before situations arise where they need them.

Risk Mitigation isn’t just about rule-following. It’s about preventing the real financial and reputational damage that follows compliance failures. A single harassment claim or safety violation can cost thousands in legal fees, not to mention the lasting damage to your company’s reputation.

Cultural Foundation gets established when you start with compliance. You’re showing new hires that your company takes its responsibilities seriously. This builds trust and respect from day one, creating a professional atmosphere where everyone understands expectations.

Operational Efficiency improves dramatically with proper compliance training. Companies with comprehensive onboarding programs help new hires become high-performing employees 34 times faster than those with shorter programs.

The Hidden Costs of Non-Compliance

The real price of skipping compliance steps goes far beyond obvious fines. Let’s look at what non-compliance actually costs your business:

Direct Financial Penalties hit first and hardest. Form I-9 violations alone can result in fines ranging from hundreds to thousands of dollars per defective form. OSHA violations carry even steeper prices, with serious violations bringing penalties of up to $15,625 per incident.

Legal Defense Costs pile up quickly, even when you win. Legal defense averages $75,000 to $125,000 per case. When you lose, settlements and judgments can reach six or seven figures.

Turnover Expenses multiply when poor onboarding leads to higher turnover rates. Replacing an employee costs 50% to 200% of their annual salary. When half of all senior external hires fail within 18 months, these financial impacts compound quickly.

Reputation Damage spreads faster than ever in our connected world. Compliance failures become public through social media, review sites, and news coverage. This damage can hurt your employer brand for years.

The $1.37 savings ratio we mentioned earlier captures all these costs, not just the fines. It’s the total financial impact when compliance falls through the cracks and problems compound over time.

Essential Legal Requirements for New Hire Onboarding

When you bring someone new onto your team, you’re taking on a whole set of legal responsibilities that come with specific deadlines and requirements. Miss these, and your business could face penalties that range from annoying to downright expensive.

Let’s start with the big one: employment eligibility verification. This isn’t just for certain industries or types of workers. Every single person you hire needs proper documentation proving they can legally work in the United States. No exceptions.

Form I-9 sits at the heart of this process. Your new employee must complete Section 1 on their very first day of work. Then you have exactly three business days to complete Section 2, which involves reviewing their documents and verifying everything checks out.

E-Verify processing is required for federal contractors and employers in certain states. The process can be tricky, and mistakes are costly. At Valley All States Employer Service, we specialize in expert, impartial, and efficient E-Verify processing that minimizes errors and reduces your administrative burden.

The document requirements deserve special attention because they trip up many employers. Your new hire needs to provide documents that prove both their identity and work authorization. A U.S. passport works perfectly because it covers both requirements. So does a driver’s license paired with a Social Security card. But here’s the key: you cannot tell an employee which specific documents to bring.

Record retention is crucial. Those completed I-9 forms need to stay in your files for three years after the hire date or one year after the person leaves, whichever comes later.

Federal Compliance Mandates

Beyond proving someone can work legally, federal law requires several other pieces of documentation and training for virtually every new hire.

Tax documentation comes first. Every new employee must complete Form W-4 before you can run their first payroll. This determines how much federal income tax to withhold from their paychecks.

Equal Employment Opportunity requirements touch every aspect of hiring and employment. The EEOC expects you to maintain records showing you’re following anti-discrimination laws. Your employee onboarding compliance program should include training on major laws like Title VII of the Civil Rights Act, the Americans with Disabilities Act, and the Age Discrimination in Employment Act.

Workplace safety training varies by job but applies to everyone. OSHA requires employers to provide safety training relevant to each person’s specific duties. This might include general workplace safety, how to handle hazardous chemicals, emergency procedures, or proper use of protective equipment.

Anti-harassment policies have become essential even where they’re not legally required. Many states now mandate this training, and it’s considered best practice everywhere else.

State-Specific Employee Onboarding Compliance Requirements

State and local laws add layers of requirements that vary dramatically depending on where you operate. If you have employees in multiple states, you’re juggling different rules for each location.

Ban-the-box laws restrict when and how you can ask about criminal history. These laws have been popping up across the country, each with its own specific requirements.

Pay transparency requirements are spreading rapidly. More states now require employers to include salary ranges in job postings or provide them when candidates ask.

Drug testing regulations have become a moving target as marijuana laws change. Your policies need to stay current with these evolving laws.

State tax forms add another layer of paperwork. Thirty-one states require their own withholding forms in addition to the federal W-4.

Workers’ compensation notifications round out the state requirements. Most states require you to carry workers’ compensation insurance and provide specific notifications to new employees about their rights and benefits under these programs.

Building Your Compliance-First Onboarding Program

Building a solid employee onboarding compliance program isn’t about drowning new hires in paperwork on their first day. It’s about creating a smooth, well-organized process that protects your business while making employees feel welcomed and prepared.

The best programs follow what experts call the “5 Cs” framework: Compliance, Clarification, Connection, Culture, and Consistency. While all five matter, compliance comes first because it protects everyone involved.

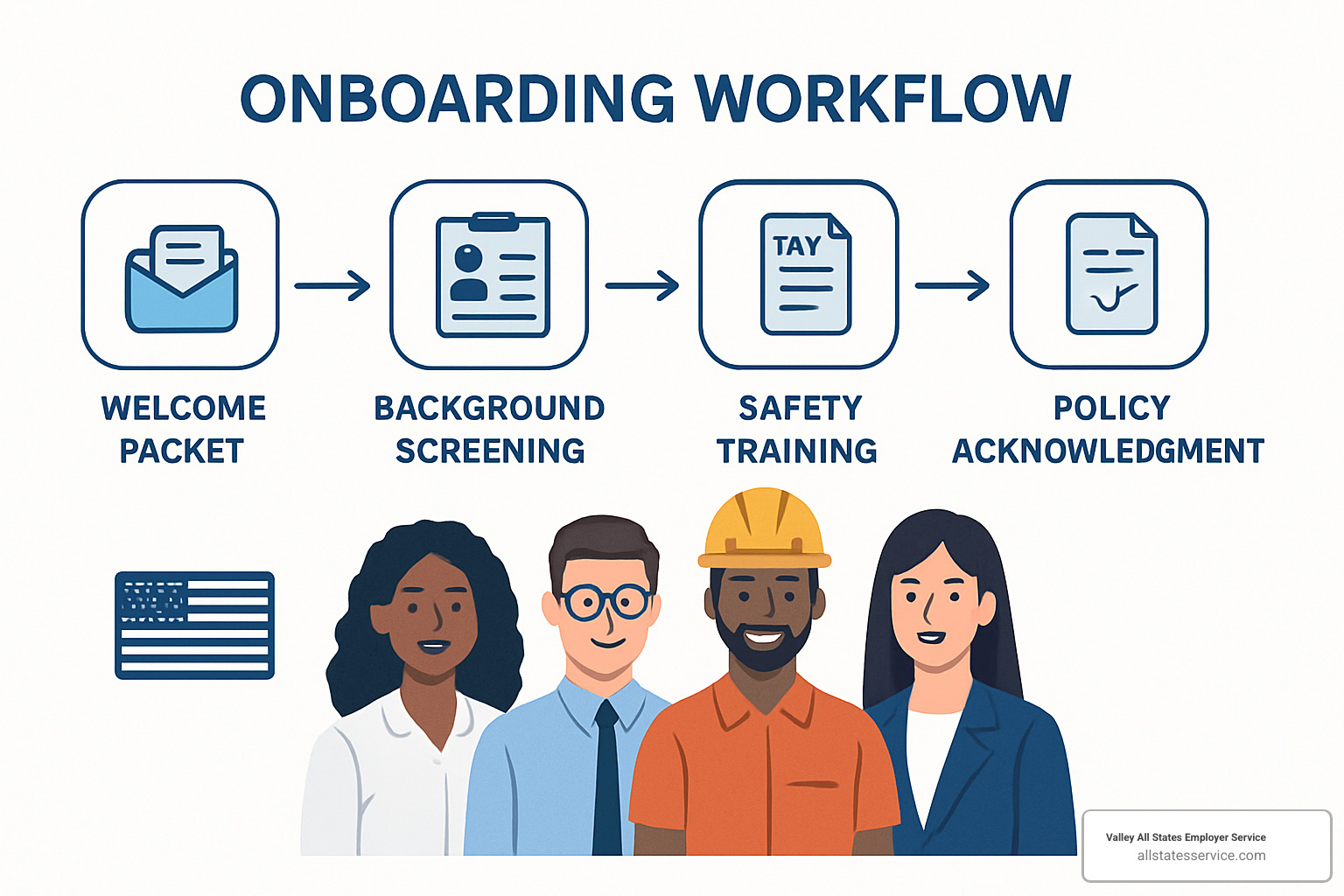

Your welcome packets should be ready before the new hire walks through the door. Digital packets work especially well because they ensure every employee gets the same information in the same format. No missing pages, no outdated forms, and no wondering if someone got the latest version of your handbook.

Background screening needs careful coordination. You can’t just run a check whenever you feel like it. There are specific rules about when to get consent, how to handle adverse findings, and what you can and can’t ask about.

Compliance training shouldn’t feel like detention. Design your training modules to be interactive and relevant to each role. A warehouse worker needs different safety information than an office administrator.

Record keeping might sound boring, but it’s your best friend during an audit. Digital systems make it easy to track who completed what training, when forms were signed, and whether all requirements were met.

Pre-boarding Compliance Setup

The smartest companies start their compliance work before the employee’s first day. Pre-boarding can boost new hire retention by 82% while reducing the stress and information overload that often overwhelm people on day one.

Your offer letters aren’t just friendly welcomes. They’re legal documents that should include job title, salary, employment status, start date, and any conditions of employment.

Consent and disclosure forms for background checks must be handled carefully. You need written consent after extending the job offer but before running the check.

Document collection works much better when it happens before day one. Secure digital platforms let new hires upload tax forms, emergency contacts, direct deposit information, and benefits paperwork from home.

System access preparation shows professionalism and helps new employees feel valued. When their computer account, email address, and necessary system permissions are ready on day one, it sends a message that you were expecting them and prepared for their arrival.

Day One Through Week One Essentials

The first week sets the tone for the entire working relationship. A well-planned timeline ensures you meet all legal requirements while creating a positive experience.

Policy acknowledgments need to happen early, but they don’t have to be painful. When employees review and sign acknowledgments for your handbook, code of conduct, and confidentiality agreements, research shows that 87% follow the policies they’ve formally acknowledged.

Safety training must be completed before employees start work in potentially hazardous areas. This isn’t just about obvious dangers like machinery or chemicals. Even office workers need to know emergency procedures, ergonomic practices, and how to report safety concerns.

Harassment prevention education works best when it’s interactive and includes real-world scenarios. Role-playing exercises, case studies, and group discussions help employees understand not just what the rules are, but why they matter.

Benefits enrollment can be overwhelming for new employees. Guide them through health insurance options, retirement plans, and other benefits with clear explanations of costs, coverage, and deadlines.

Timing matters. Federal requirements like I-9 verification have strict deadlines, while state requirements vary by location. A good compliance program builds in buffer time so you’re never scrambling to meet a deadline at the last minute.

Technology Solutions for Streamlined Compliance

Modern technology transforms employee onboarding compliance from a paper-heavy burden into a streamlined, efficient process. The right tools don’t just reduce administrative overhead, they actually improve accuracy and provide better audit trails that protect your business.

Think about it: how many hours does your team spend chasing down incomplete forms or searching for missing signatures? Digital form management through cloud-based platforms eliminates these headaches entirely. These systems use required field validation and digital signatures to ensure forms are completed correctly the first time.

Automated workflow systems act like your personal compliance assistant, sending alerts and reminders for critical deadlines. When an I-9 Section 2 is due in two days, the system automatically notifies the right manager.

The real game-changer is learning management systems (LMS) that make compliance training engaging rather than painful. Modern platforms use gamification, progress tracking, and mobile accessibility so employees can complete training anytime, anywhere.

Compliance tracking dashboards give you real-time visibility into your entire program. You can see completion rates, pending tasks, and compliance status across all departments at a glance.

Integration capabilities matter more than most people realize. When your compliance system talks to your payroll platform and HR information system, data flows seamlessly without manual entry.

Mobile accessibility isn’t optional anymore. Most people browse the web on their phones, and your compliance systems need to work just as well on a smartphone as on a desktop computer.

Measuring Compliance Success

You can’t manage what you don’t measure, and effective compliance programs include robust metrics that show exactly where you stand.

Completion rate metrics tell you the percentage of employees finishing required training and documentation within your specified timeframes. Aim for 100% completion on mandatory compliance items.

Assessment score analysis reveals whether your training actually works. When employees consistently score below 90% on compliance assessments, it’s time to redesign your training materials or delivery methods.

Audit results tracking helps you spot patterns and improvements over time. Document findings from both internal and external audits, then track how your program evolves.

Incident rate monitoring shows the real-world impact of your compliance efforts. Track workplace incidents, complaints, and violations to identify trends.

Employee feedback collection provides insights you can’t get from numbers alone. Surveys reveal whether training is effective, policies are clear, and the overall onboarding experience meets expectations.

Retention rate analysis during the critical first 120 days shows whether your program creates lasting employee relationships. Well-designed compliance programs contribute to 82% retention rates for new hires over their first year.

Ready to streamline your compliance process? Valley All States Employer Service specializes in expert E-Verify processing that minimizes errors and reduces your administrative burden, letting you focus on what matters most: growing your business.

Frequently Asked Questions about Employee Onboarding Compliance

Let’s address the most common questions we hear from employers about employee onboarding compliance. These are the real-world concerns that keep HR professionals up at night and the practical details that can make or break your compliance efforts.

What documents are legally required for new employee onboarding?

The paperwork side of hiring can feel overwhelming, but breaking it down makes it manageable. Every single new employee needs to complete Form I-9 for employment eligibility verification and Form W-4 for tax withholding. These aren’t suggestions or best practices, they’re federal requirements that apply to every employer.

Your state might add its own requirements to the mix. Thirty-one states require their own tax withholding forms on top of the federal W-4. Some states have additional documentation requirements for workers’ compensation notifications or state-specific employment policies.

Beyond the government forms, you’ll need signed acknowledgments showing your new hire received and understood your employee handbook, anti-harassment policies, and safety training materials. These acknowledgments become crucial evidence if compliance issues arise later.

For background checks, the paperwork gets more detailed. You must obtain written consent before running any checks and provide all required Fair Credit Reporting Act disclosures.

How long do employers have to complete I-9 verification?

The I-9 timeline is one area where there’s absolutely no wiggle room. Miss these deadlines, and you’re looking at potential fines that can add up quickly across multiple employees.

Section 1 of Form I-9 must be completed by the employee on their first day of work. Not their second day, not when they get around to it, their actual first day.

Section 2 is where you examine the employee’s documents to verify their identity and work authorization. You have exactly three business days from the employee’s start date to complete this section.

If you’re required to use E-Verify, that adds another layer with the same tight timeline. You must create the E-Verify case within three business days of the employee’s start date.

These deadlines don’t shift based on your schedule, vacation time, or other business priorities. At Valley All States Employer Service, we help employers meet these critical deadlines with expert, impartial, and efficient E-Verify processing. Our specialized approach minimizes errors and reduces the administrative burden that often leads to missed deadlines.

What compliance training must all new hires receive?

Training requirements vary based on your industry, location, and specific job roles, but certain topics appear on almost every employer’s must-do list.

Workplace safety training tops the list for virtually every employer. OSHA requires training that’s relevant to each employee’s specific job duties. The training must happen before employees are exposed to the hazards, not after their first week on the job.

Anti-harassment and anti-discrimination training has become essential everywhere, even though it’s not federally mandated. Many states now require this training, and it’s considered a best practice for legal protection.

Industry-specific regulations add another layer. Healthcare employees need HIPAA training for patient privacy. Financial services workers might need SOX compliance training. Food service employees need food safety certification.

Data privacy and security policies have become increasingly important as more work involves handling sensitive information. This includes password policies, email security, and proper handling of customer or employee data.

The most effective approach is creating role-specific training programs rather than one-size-fits-all sessions. A customer service representative needs different compliance knowledge than an accountant or a delivery driver.

Conclusion

Getting employee onboarding compliance right from day one creates ripple effects that extend far beyond avoiding penalties. Yes, protecting your business from fines and lawsuits matters, but the real value lies in building something stronger: a workplace where trust and professionalism flourish from the very beginning.

When new employees see that you’ve thoughtfully prepared their onboarding experience, when every form has a purpose and every training session adds value, you’re sending a powerful message. You’re saying, “We take our responsibilities seriously, and we’ll help you succeed here.”

This foundation of compliance and care pays dividends in ways that might surprise you. Employees who feel properly prepared and supported don’t just stay longer, they contribute more. They become productive faster because they understand the rules of the road.

The numbers back this up beautifully. That $1.37 return for every dollar spent on compliance training isn’t just about avoiding legal trouble. It represents engaged employees who know what’s expected of them, managers who spend less time putting out fires, and a workplace culture built on solid ground.

Compliance isn’t a destination, it’s a journey. Laws evolve, your business grows, and new challenges emerge. The companies that thrive are the ones that treat compliance as an ongoing commitment, not a one-time checkbox exercise.

We understand that managing all these moving pieces can feel overwhelming, especially when you’re focused on growing your business. That’s exactly why Valley All States Employer Service exists. Our expert E-Verify processing takes one of the most critical compliance requirements off your plate, handling it with the precision and efficiency you need.

When you partner with us, you’re not just getting accurate E-Verify processing. You’re getting peace of mind that comes from knowing this essential piece of your compliance puzzle is handled by professionals who specialize in getting it right.

Ready to strengthen your onboarding program while reducing your administrative burden? Contact our team today to find how our E-Verify services can support your broader compliance goals. Because building a compliant, successful business shouldn’t mean doing everything alone.