Why E-Verify Employer Requirements Are Critical for Your Business

Understanding e-verify employer requirements is essential for any business hiring employees in the United States. E-Verify is a free, web-based system operated by U.S. Citizenship and Immigration Services (USCIS) that helps employers confirm their employees’ eligibility to work legally in the U.S.

Key E-Verify Requirements at a Glance:

- Federal contractors must enroll within 30 days of contract award

- 23 states require E-Verify for some public or private employers

- All new hires must be verified within 3 business days of starting work

- Form I-9 completion is still required before creating E-Verify cases

- Required posters must be displayed in English and Spanish

- Social Security Numbers are mandatory for case creation

- Photo matching is required for certain documents like passports and green cards

More than 1 million employers across the country currently use E-Verify, with over 1,500 new companies joining each week. The system works by comparing information from your employee’s Form I-9 against records from the Department of Homeland Security and Social Security Administration.

Why does this matter for your business? Non-compliance can result in losing federal contracts, hefty fines, or even business license revocation. But beyond avoiding penalties, E-Verify helps you maintain a legal workforce and protects your company from unknowingly hiring unauthorized workers.

Whether you’re required to use E-Verify or considering voluntary participation, understanding these requirements will save you time, money, and legal headaches down the road.

Basic e-verify employer requirements glossary:

Who Must Use E-Verify? Federal and State Mandates Explained

Here’s the truth about E-Verify: most employers think it’s optional, but you might be legally required to use it without even knowing. The answer depends on your contracts, your location, and sometimes even the size of your business.

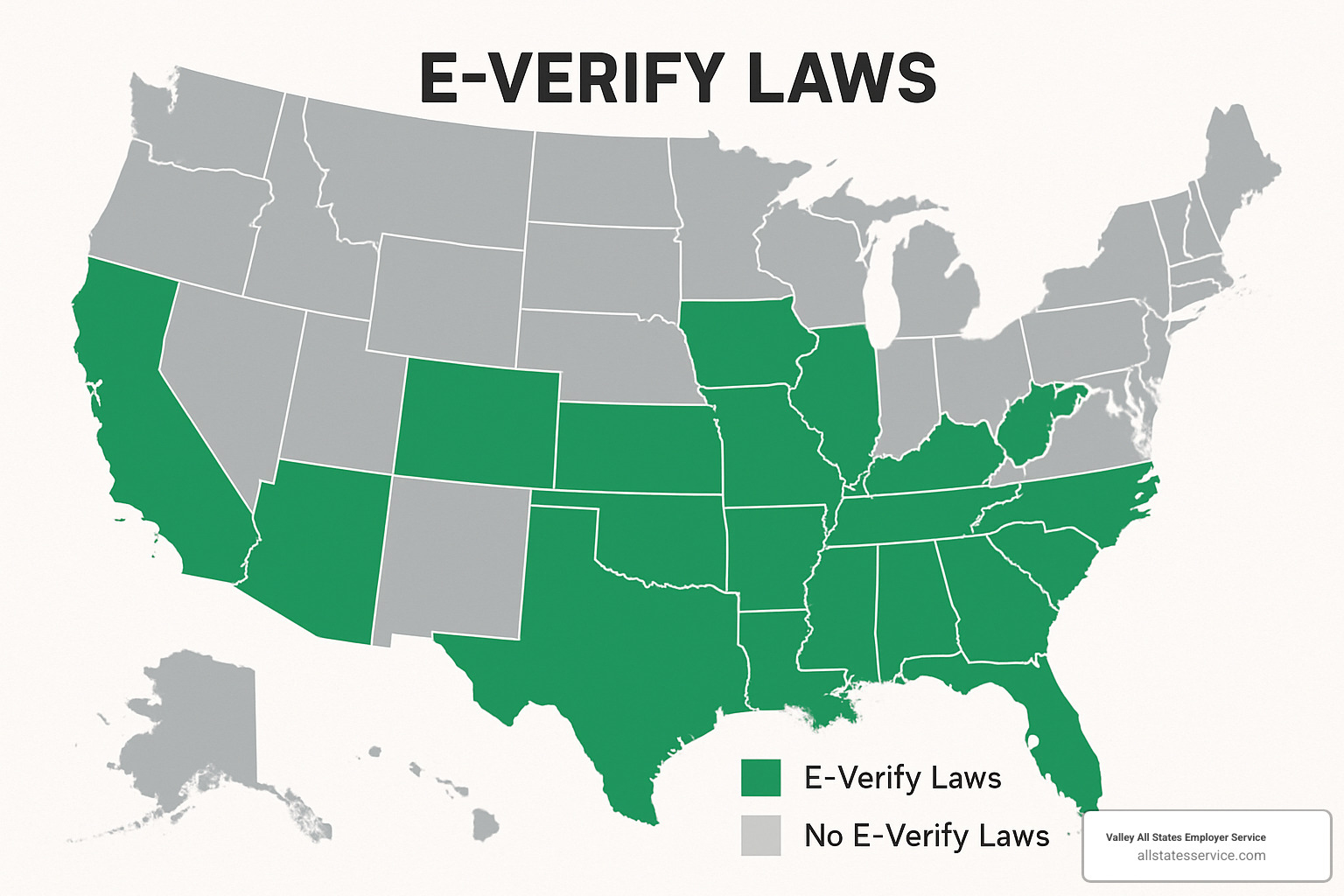

While E-Verify participation is voluntary for many employers, e-verify employer requirements are mandatory for federal contractors and businesses in 23 states. This patchwork of federal and state rules creates a compliance maze that catches many employers off guard.

Even if you’re not legally required to participate, nearly 3 million proactive worksites use E-Verify voluntarily. Why? Because it provides peace of mind and helps avoid the legal risks that come with unknowingly hiring unauthorized workers.

Understanding your obligations isn’t just about avoiding penalties. It’s about protecting your business from costly mistakes and maintaining a legal workforce. Let’s break down who must use E-Verify and when.

Federal Contractor Rules

If your business holds federal contracts, you’re almost certainly subject to the Federal Acquisition Regulation (FAR) E-Verify clause. This requirement applies to most federal contracts and subcontracts awarded after September 8, 2009.

The timeline is strict and non-negotiable. You must enroll in E-Verify within 30 days of the federal contract being awarded. Miss this deadline, and you risk contract termination.

For new hires, the standard three-day verification rule applies. You must verify all new employees within 3 business days of their first day of work. But here’s where it gets tricky: federal contractors also have additional obligations for existing employees.

You must verify existing employees assigned to the federal contract within 90 days of contract award or within 30 days of assignment to the contract, whichever comes later. This means you could be verifying workers who’ve been with your company for years, simply because they’re now working on a federal project.

Subcontractors need to pay attention too. These requirements often flow down through the contract chain, depending on the specific contract terms. Federal employers face even stricter timelines, requiring verification no later than the third business day after a new employee begins work.

The consequences of non-compliance are severe. Federal contractors who fail to meet these requirements risk being deemed ineligible for future federal contracts, losing current contracts, or facing immediate contract termination. For businesses that depend on federal work, this can be devastating.

State-by-State E-Verify Employer Requirements

State mandates create an even more complex landscape. Some states require all private employers above a certain size to use E-Verify, while others only mandate it for public contractors or government employees.

The variation is striking. Alabama, Arizona, and Mississippi require all employers to use E-Verify, regardless of company size. Meanwhile, Utah only requires it for private employers with 150 or more employees, and Tennessee sets the threshold at 35 employees.

Florida and North Carolina both require E-Verify for private employers with 25 or more employees. Georgia drops that threshold to just 11 employees, while Virginia sets it at 50 employees.

| State | Who Must Comply | Specific Thresholds |

|---|---|---|

| Alabama | All employers | No minimum employee count |

| Arizona | All employers | No minimum employee count |

| Florida | Private employers | 25 or more employees |

| Georgia | Private employers | 11 or more employees |

| Mississippi | All employers | No minimum employee count |

| North Carolina | Private employers | 25 or more employees |

| Tennessee | Private employers | 35 or more employees |

| Utah | Private employers | 150 or more employees |

| Virginia | Private employers | 50 or more employees |

Some jurisdictions get even more specific. Woodland, Washington requires any company with a city contract exceeding $10,000 to use E-Verify. These local requirements often fly under the radar until it’s too late.

State requirements can change quickly, especially as immigration policy evolves. What’s optional today might be mandatory tomorrow. We recommend checking with your Employer HR Compliance resources regularly to stay current with evolving mandates.

The bottom line? Don’t assume you’re exempt from e-verify employer requirements just because you’re not a federal contractor. Your state or local government might have different ideas about what’s required for your business.

How to Enroll in E-Verify: A Step-by-Step Guide

Ready to get started with E-Verify? Good news! Enrolling is completely free and often takes just a few minutes. Think of it like a quick online application. The main thing to remember is that you’ll need to complete the entire enrollment process in one go. There’s no saving your progress and coming back later, so make sure you have everything ready before you dive in.

The enrollment journey involves a few key choices that will shape how your company uses E-Verify day-to-day. Understanding these options upfront can save you headaches and ensure your setup perfectly matches your business needs. It’s all about making sure your e-verify employer requirements are met smoothly from the start.

What You Need to Enroll

Before you click that “start enrollment” button, let’s gather your essentials. Having these details handy will make the process a breeze and help you avoid any unexpected delays:

First, you’ll need your company’s legal name and your Employer Identification Number (EIN), also known as your Federal Tax ID Number. Have your primary physical address and your mailing address (if it’s different) ready too.

Next, you’ll need to confirm your total number of current employees and, if you know it, your North American Industry Classification System (NAICS) code (this one’s optional but helpful). Don’t forget to list all the hiring sites that will be using E-Verify, including their physical addresses and contact information for each location.

Finally, make sure you have the contact details for your designated Signatory and your Program Administrator. This can be the same person, but you’ll need to specify these roles during enrollment. If you’re a federal contractor subject to the FAR E-Verify clause, you’ll also need your Unique Entity Identifier (UEI). This quick preparation will streamline your enrollment, helping you meet essential e-verify employer requirements. For a detailed list, check out the Official Enrollment Checklist.

Choosing the Right Access Method

E-Verify offers several ways for businesses to connect, and picking the right one is important. Choosing the wrong access method can actually delay your enrollment approval, so let’s make sure you get it right from the start!

Here are your main options:

| Access Method | Who It’s Best For |

|---|---|

| Employer Access | Perfect for individual companies managing their own E-Verify cases directly. |

| Corporate Administrator | Ideal for larger organizations with multiple hiring sites needing central oversight. |

| Web Services | For companies looking to integrate E-Verify seamlessly into their existing HR systems. |

| E-Verify Employer Agent | Great if you prefer to outsource E-Verify processing to a trusted third party. |

The E-Verify system is designed to help you, and it will ask you four simple questions to guide you toward the best access method for your company. Take your time with these questions; accurate answers are key to a smooth approval process.

You’ll also need to pick your employer category. Are you a federal contractor (subject to the FAR E-Verify clause)? A government organization? Or do none of these categories apply? This choice affects your obligations and timelines, so pick the one that truly fits your business.

If navigating the enrollment process feels like a puzzle, don’t worry! Valley All States Employer Service is here to help. Our team specializes in guiding businesses through E-Verify enrollment and ensuring ongoing compliance. Explore our expert E-Verify Services to see how we can simplify your compliance journey. For more learning, USCIS also offers free E-Verify webinars for new users that provide valuable training and even professional development credits.

E-Verify Employer Requirements: Day-to-Day Compliance

Once you’re enrolled in E-Verify, mastering your daily compliance obligations becomes your next priority. Here’s something many employers don’t realize: E-Verify doesn’t replace Form I-9. Instead, it works as a powerful companion system that takes your employment verification to the next level by electronically confirming the information you’ve already collected.

The beauty of e-verify employer requirements lies in their straightforward nature, but the devil is in the details. You’ll need to complete Form I-9 for each new hire before creating an E-Verify case, then create E-Verify cases within 3 business days of an employee’s first day of work. Don’t forget to display the required E-Verify Participation and Right to Work posters where employees can easily see them, and always handle case results promptly and appropriately while maintaining proper records.

That 3-day rule isn’t just a suggestion. Federal employers face an even tighter timeline, requiring verification no later than the third business day after the employee begins work. Missing this deadline can result in compliance violations that nobody wants to deal with.

Understanding what you cannot do is equally important. You cannot use E-Verify to pre-screen job applicants, specify which Form I-9 documents an employee must present (except requiring photo ID for List B documents), or create cases for employees hired before your E-Verify enrollment unless you’re a federal contractor. Taking adverse action against employees based solely on a mismatch result is also prohibited, and you can’t use E-Verify selectively. Once you’re enrolled, you must verify all new hires.

These restrictions exist to protect employee rights and prevent discrimination. Violating these rules can result in penalties and legal headaches that no business wants to face. For comprehensive support with ongoing compliance, consider our I-9 Verification Assistance to keep your business on track.

The Verification Process and Photo Matching

Creating an E-Verify case involves entering information from Sections 1 and 2 of the employee’s completed Form I-9. The system provides initial results within 3-5 seconds, making it remarkably fast for such a comprehensive verification process.

Here’s where things get interesting: E-Verify includes a photo matching feature for certain documents. When an employee presents a U.S. Passport, U.S. Passport Card, Permanent Resident Card (Green Card), or Employment Authorization Document (EAD), you’ll need to compare the photo on the physical document with the photo displayed in E-Verify.

This comparison helps prevent document fraud and ensures the person presenting the document is the rightful holder. You’re comparing the document photo to the system photo, not to the actual employee. This distinction is crucial for proper compliance.

The photo matching process follows a straightforward path: review the photo displayed in E-Verify, compare it to the photo on the employee’s physical document, confirm whether the photos match, and complete the case based on your comparison. It’s that simple, but attention to detail matters.

Understanding E-Verify Case Results

E-Verify can produce several different case results, each requiring specific actions from employers. Think of these results as traffic lights for your hiring process.

Employment Authorized is the green light you want to see. It means the employee’s information matched records available to DHS and SSA. These cases are automatically closed, and you simply need to record the case number on the employee’s Form I-9.

E-Verify Needs More Time is like a yellow light. Sometimes DHS needs additional time to verify information, which means your case has been automatically referred for further verification. You cannot take any adverse action against the employee during this time. Most cases receive a response within 24 hours, though some may take up to 3 federal government working days.

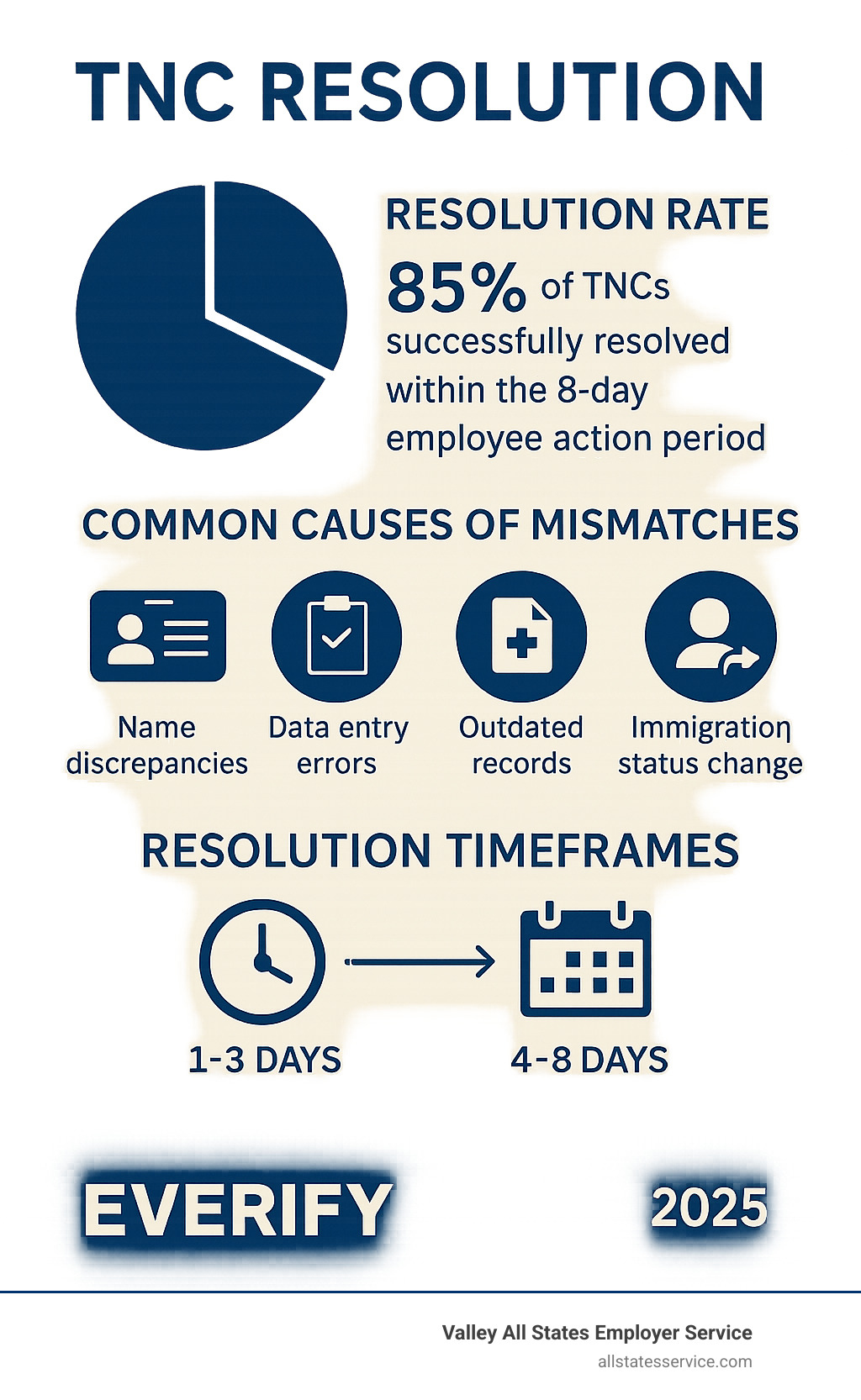

Tentative Nonconfirmation (TNC) requires careful attention. This means the information on the Form I-9 doesn’t match government records, but it doesn’t necessarily mean the employee is unauthorized to work. It could result from name changes, data entry errors, or outdated government records.

Case in Continuance appears when an employee has contacted the appropriate agency to resolve a TNC and needs more time. You must continue to check for updates and cannot take adverse action during this period.

Final Nonconfirmation means E-Verify cannot confirm the employee’s work authorization. You may terminate employment based on this result without civil or criminal liability, as noted in the E-Verify Memorandum of Understanding.

Handling a Tentative Nonconfirmation (TNC)

TNCs require careful handling to protect both your business and employee rights. The process involves specific steps and strict timelines that you must follow to stay compliant.

When you receive a TNC, you must notify the employee privately and provide the Further Action Notice within 10 federal government working days after E-Verify issues the mismatch result. The employee then has 10 federal government working days to decide whether to take action to resolve the mismatch.

During this period, you cannot terminate or take any adverse action against the employee. If the employee chooses to contest the TNC, they have 8 federal government working days to contact DHS or SSA. Once the employee provides the Referral Date Confirmation, you must refer the case in E-Verify and monitor for updates.

The key is maintaining detailed documentation throughout this process. Keep records of when you notified the employee, their decision, and any actions taken. This documentation protects your business and ensures you’re following proper procedures.

Common TNC causes include name discrepancies (maiden names, nicknames, spelling variations), data entry errors, outdated government records, Social Security number mismatches, and immigration status changes not yet reflected in databases.

Many TNCs can be resolved quickly once the employee contacts the appropriate agency. However, some cases may result in Final Nonconfirmation if the employee cannot resolve the discrepancy or fails to take action within the required timeframe.

For detailed guidance on employee rights during the TNC process, refer to Employee Rights and Responsibilities and More on TNCs.

E-Verify FAQs: What Employers Ask Most

Navigating the ins and outs of e-verify employer requirements can bring up a lot of questions. That’s totally normal! We hear the same concerns from employers all the time. Let’s tackle some of the most common ones to clear up any confusion and help you feel more confident in your compliance journey.

Can I use E-Verify for existing employees?

Generally, the answer is no. E-Verify was created specifically for new hires. Using the system to check up on employees who are already on your payroll is usually not allowed. This rule is in place to make sure E-Verify is used fairly and isn’t a tool for unfairly checking up on current workers.

However, there’s a big exception for federal contractors. If your business holds federal contracts and is subject to the Federal Acquisition Regulation (FAR) E-Verify clause, you will need to verify existing employees. This applies to those employees specifically assigned to work on that federal contract. You’ll need to complete this verification within 90 days of the contract being awarded, or within 30 days of that employee being assigned to the contract.

What about rehires? That’s a common scenario! If you rehire someone, you have a couple of options. If their original Form I-9 is still valid and their work authorization hasn’t expired, you might be able to rely on their previous E-Verify case. But if you need to complete a brand-new Form I-9 for any reason – perhaps their work authorization expired – then you’ll need to create a fresh E-Verify case for them. The key is to always follow proper Form I-9 procedures first, which then guides your E-Verify obligations.

What if an employee doesn’t have a Social Security Number yet?

Ah, the missing Social Security Number (SSN) – a frequent question! An SSN is absolutely essential to create an E-Verify case. You simply can’t process the verification without it. This situation often pops up with newly arrived immigrants who have legal work authorization but are still waiting for their SSN to be issued.

So, what’s the right way to handle it? Here’s the step-by-step:

First, the employee is legally authorized to work, so you should allow them to begin working. Next, complete their Form I-9 as usual, using any other appropriate documentation they have. Make a clear note on the Form I-9 that the SSN is pending. Once that SSN arrives, you can then create the E-Verify case. When the system asks about the delay, you’ll select “Awaiting Social Security Number” as the reason. This process ensures you’re compliant while allowing your new team member to get started.

Does E-Verify replace Form I-9?

This is perhaps the most important question for employers to understand, and the answer is a firm no, absolutely not! E-Verify doesn’t replace the Form I-9; it works hand-in-hand with it. Think of E-Verify as a very helpful companion system, designed to take your employment verification to the next level.

You are still required to:

- Complete a Form I-9 for every single new hire.

- Carefully examine their identity and work authorization documents, either in person or through approved remote procedures if you’re an E-Verify participant.

- Maintain all your Form I-9 records according to federal requirements.

- Follow every existing I-9 compliance procedure.

So, what does E-Verify add to the mix? It brings electronic verification of the information from your Form I-9, cross-referencing it with government databases. It offers extra layers of fraud detection, like the photo matching feature. It gives you much greater confidence in your employees’ work authorization. Imagine Form I-9 as the strong foundation of your employment eligibility process, and E-Verify as the crucial electronic confirmation built right on top of it. Both are vital for participants following e-verify employer requirements.

If you ever find yourself needing a little extra help with Form I-9 compliance alongside E-Verify, our team is here to assist. Our I-9 Verification Assistance service can help ensure you’re meeting all these crucial requirements correctly and confidently.

A few other common questions often pop up! For instance, if you get a Tentative Nonconfirmation (TNC) result, can you just terminate the employee right away? The answer is no. You must follow the full TNC process, giving the employee a chance to resolve the mismatch. Only after a Final Nonconfirmation can you consider termination based on E-Verify results.

What if you make a mistake when entering information? If you catch an error before submitting the case, you can simply correct it. If it’s after submission, you might need to close the incorrect case and create a new one, depending on the type of error. And how long should you keep E-Verify records? These should be retained alongside the employee’s Form I-9, typically for three years after the hire date or one year after termination, whichever is later. Finally, E-Verify is only for employees, not independent contractors. If you’re unsure about how to classify a worker, it’s always best to consult with employment law experts.

Make E-Verify Compliance Simple for Your Business

Phew! We’ve covered a lot about e-verify employer requirements, haven’t we? Understanding these vital rules is how you keep your business safe from penalties and ensure you’re building a truly legal workforce. E-Verify offers incredible protection, but let’s be honest, figuring out all the rules, timelines, and procedures can feel like a real maze.

Think about it: you’ve got enrollment decisions, daily case management, handling those tricky Tentative Nonconfirmations (TNCs), and all those record-keeping requirements. E-Verify compliance truly has many moving parts. And unfortunately, even a small mistake can lead to fines, legal headaches, or big compliance issues.

If all of this feels a bit overwhelming, please know you’re definitely not alone. Many businesses find that teaming up with experienced professionals makes E-Verify compliance much simpler. It reduces your risk, lightens your administrative load, and frees you up to focus on what you do best.

That’s where Valley All States Employer Service steps in. We’re experts at helping businesses steer e-verify employer requirements efficiently and accurately. Our team knows the ins and outs of both federal and state mandates, making sure your enrollment and daily obligations are handled smoothly. We offer expert support and unbiased, third-party verification services. This means your business stays on track without all the usual administrative headaches.

Whether you’re just getting started with E-Verify or looking to fine-tune your current processes, professional guidance can save you precious time, cut down on errors, and give you the peace of mind that you’re meeting every requirement correctly.

Ready to ensure your business is fully compliant without the headache? Learn more about our E-Verify services.

E-Verify compliance isn’t just about avoiding penalties. It’s about building a legal, trustworthy workforce that truly protects your business and supports American workers. With the right approach and a little expert support, you can turn E-Verify from what might feel like a burden into a genuine competitive advantage.