Why Automated Eligibility Verification Systems Are Changing Healthcare Operations

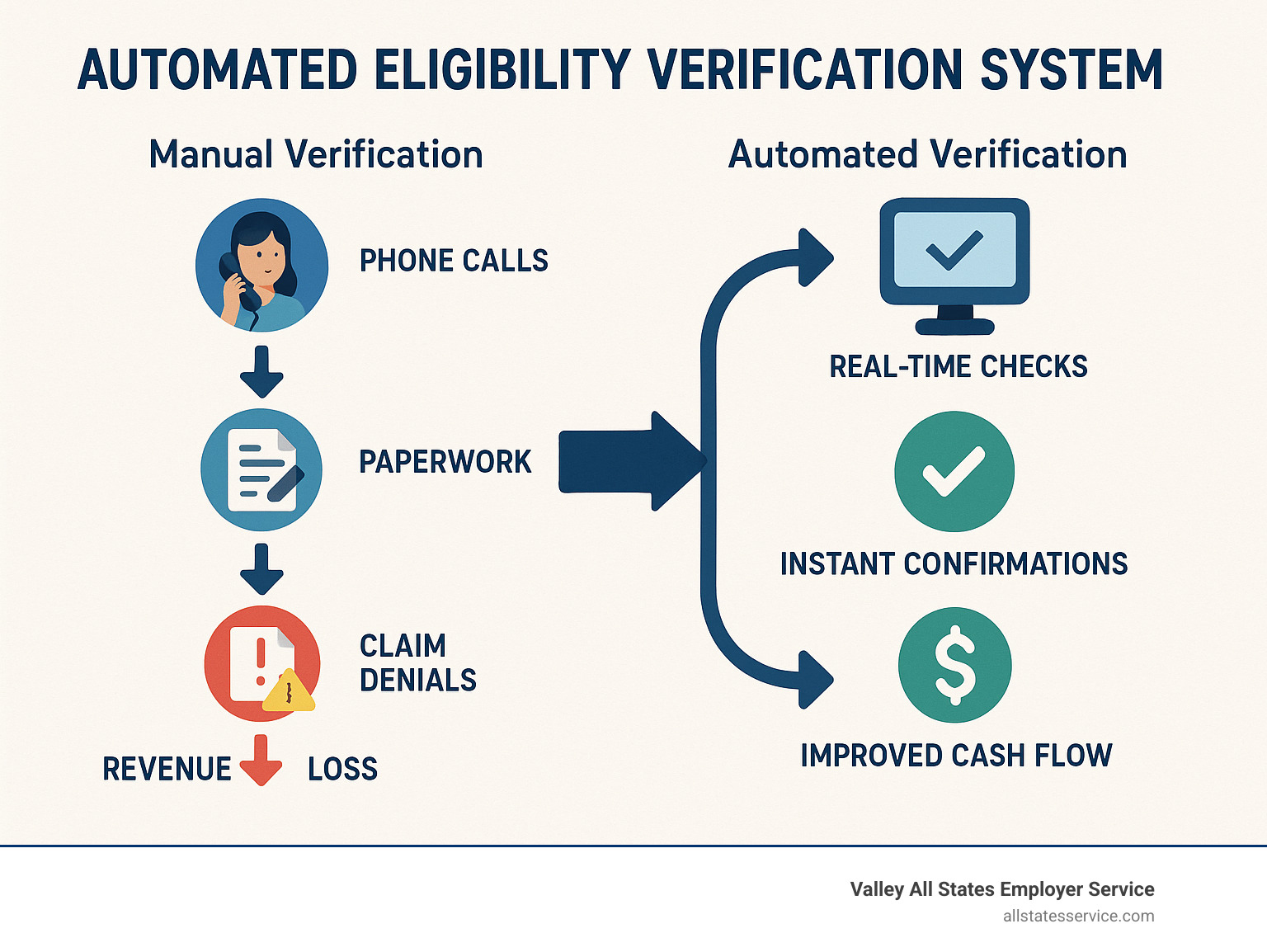

An automated eligibility verification system is a technology solution that automatically checks patient insurance coverage, benefits, and eligibility status in real-time or batch processing, eliminating manual phone calls and reducing claim denials by up to 27%.

Key Components of Automated Eligibility Verification Systems:

- Real-time verification – Instant coverage checks at point of service

- Batch processing – Verify multiple patients simultaneously

- Payer network integration – Connect to 2,300+ insurance providers

- EHR integration – Seamless workflow within existing systems

- Analytics dashboard – Track verification success rates and denial patterns

Healthcare providers are drowning in administrative tasks. Front-desk staff spend countless hours on hold with insurance companies, only to find coverage gaps after services are already delivered. The result? Approximately 27% of denied claims occur due to ineligibility issues, creating massive revenue leaks.

But here’s what’s changing the game: Providence Health saved $18 million in potential denials within just five months of implementing automated eligibility verification. They didn’t just reduce errors – they transformed their entire revenue cycle.

Manual verification processes are breaking down under pressure. When 43% of providers report that incomplete eligibility checks add at least 10 minutes per verification, you’re looking at serious productivity drains. Meanwhile, patients expect upfront pricing transparency, with over 80% saying cost estimates help them prepare financially.

The gap between patient expectations and provider capabilities is widening. More than 7 out of 10 providers believe they run eligibility checks quickly and accurately, yet only 59% think their revenue cycle technology meets current needs.

Why Eligibility Verification Matters to Your Bottom Line

Picture this: your front desk team just scheduled a week’s worth of appointments, confident they’ve verified everyone’s insurance. Then the claim denials start rolling in. Coverage expired. Benefits exhausted. Patient moved to a different plan. Each denial represents money walking out your door.

The numbers tell a sobering story. Since 2000, hospitals have provided nearly $745 billion in uncompensated care. While not every dollar stems from eligibility mix-ups, a huge chunk could be saved with better upfront verification. When you consider that 15% of providers point to eligibility problems as one of their top three reasons for claim denials, you’re looking at a problem that’s both widespread and fixable.

Here’s the math that keeps practice managers up at night: unaddressed claim denials can gobble up 5% of your net patient revenue. For a practice bringing in $10 million annually, that’s potentially $500,000 vanishing due to preventable eligibility errors. That’s real money that could fund new equipment, staff bonuses, or practice growth.

But the financial hit goes deeper than obvious revenue loss. Your staff spends precious time on claim appeals, chasing down patient payments, and doing administrative cleanup work. When your team is stuck in reactive mode, constantly fixing eligibility mistakes instead of preventing them, your whole operation suffers.

Patient satisfaction takes a beating too. Nobody likes surprise medical bills. When coverage gaps surface after treatment, trust crumbles fast. Patients who get upfront cost estimates feel more prepared and satisfied with their care experience. Yet many providers still operate blindly, finding coverage problems only when claims bounce back.

Scientific research on claim denials consistently shows eligibility issues ranking among the top denial reasons. The pattern couldn’t be clearer: proactive verification beats reactive damage control every single time.

Your revenue cycle management strategy needs to start the moment a patient calls for an appointment, not after services are delivered. When eligibility verification works properly, cash flow improves, patient relationships strengthen, and your team can focus on what they do best: providing excellent care instead of chasing paperwork.

From Manual to Automated: How an Automated Eligibility Verification System Works

The shift from manual to automated eligibility verification feels like upgrading from a horse-drawn carriage to a sports car. Both will get you there, but the experience couldn’t be more different.

Picture your front desk staff right now. They’re probably juggling phone calls, waiting on hold with insurance companies, scribbling notes on sticky papers, and hoping they heard the coverage details correctly. Meanwhile, patients are waiting, appointments are backing up, and somewhere in the back of everyone’s mind is the nagging worry that something important got missed.

Now imagine this instead: your staff pulls up a patient’s record, clicks one button, and within seconds has complete, accurate coverage information displayed on screen. No phone calls. No hold music. No frantic note-taking. That’s the power of an automated eligibility verification system.

| Manual Process | Automated System |

|---|---|

| Phone calls to insurance companies | Direct payer database queries |

| 10+ minutes per verification | Seconds for real-time results |

| High error rates from data entry | Automated data validation |

| Limited to business hours | 24/7 availability |

| No audit trail | Complete transaction logging |

| Single patient checks only | Batch processing capabilities |

The magic happens through something called ASC X12 270/271 transactions. Don’t worry about the technical jargon, here’s what matters: these are standardized electronic messages that let your system talk directly to insurance company databases. It’s like having a direct hotline to every major payer, except the conversation happens in milliseconds instead of minutes.

When your system runs a verification, it creates an EVC number (that’s your Eligibility Verification Confirmation). Think of this 10-character code as your digital receipt. Unlike those handwritten notes from phone calls that somehow always go missing right when you need them, your EVC number provides permanent proof that you checked coverage.

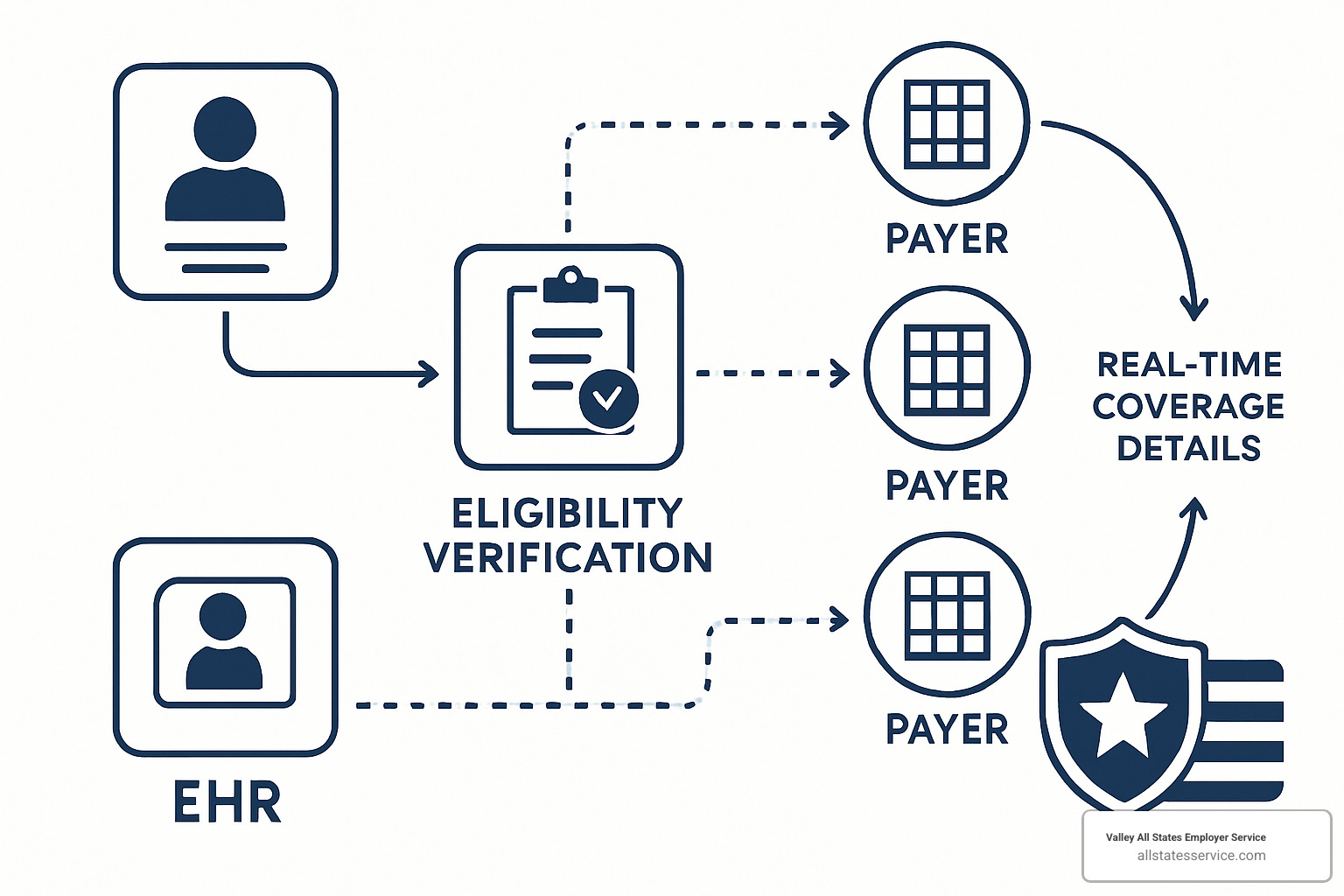

The real beauty lies in the integration. Your automated eligibility verification system doesn’t live in isolation. It connects seamlessly with your existing EHR or practice management system. Patient information flows automatically, verification happens behind the scenes, and results appear right where your staff expects to find them.

Core Steps Inside an automated eligibility verification system

Every verification follows the same reliable path, happening so fast your staff barely notices the process:

Patient intake and demographic capture starts the moment your system identifies a patient needing verification. The essential details get pulled automatically: name, date of birth, member ID, and insurance information. Built-in validation catches obvious errors like wrong date formats or missing digits before they cause problems.

Payer query initiation happens next, where your system identifies the correct insurance company and packages all the patient information into a standardized electronic inquiry. This 270 transaction contains everything needed for a complete benefit check.

Real-time database search occurs when the insurance company’s system receives your inquiry and searches their current enrollment files. They’re checking active coverage, benefit details, and any special conditions that might affect coverage.

Benefit information return delivers the goods through a 271 response packed with coverage details. You’ll see deductibles, copays, coinsurance rates, benefit maximums, and importantly, any pre-authorization requirements that could trip up your claims later.

Audit log creation wraps up each transaction with a permanent record. Every verification gets timestamped, assigned an EVC number, and stored with complete details. When auditors come calling or claims get questioned, you’ve got bulletproof documentation.

Automated Eligibility Verification System vs Manual Phone-Fax Loops

The numbers tell a stark story about efficiency gains.

Staff time represents the most obvious difference. Manual verification eats up 15-20 minutes per check when you factor in hold times, information gathering, and documentation. Your automated eligibility verification system completes the same work in under 30 seconds.

Human error elimination might be even more valuable than time savings. Phone-based verification creates multiple failure points: mishearing information, transcription mistakes, or incomplete documentation. Automation removes these human error opportunities entirely.

Confirmation speed matters when patients are standing at your front desk expecting answers. Manual processes depend on insurance company phone availability and representative knowledge. Automated systems access the same databases directly, delivering faster and more reliable results.

Cost-per-check analysis reveals the financial impact. Manual verification costs $15-25 per check when you include staff wages, phone time, and error correction expenses. Automated verification typically runs under $1 per inquiry, creating immediate return on investment that compounds with every verification you run.

Core Technologies and Features to Look For

Shopping for an automated eligibility verification system feels a bit like buying a car. You want something reliable, but the technical specs can be overwhelming. Here’s what really matters when you’re evaluating your options.

Real-time verification capabilities should be your first priority. Think about it: what good is knowing a patient’s coverage status after you’ve already provided care? The best systems give you instant answers right at the point of service. Your front desk staff can tell patients their copay amount and coverage details before they sit down in the waiting room.

But real-time isn’t everything. Comprehensive batch processing becomes your secret weapon for handling larger patient loads efficiently. Maybe you have 200 patients scheduled for next week, or you want to verify coverage for everyone with upcoming procedures. Quality systems let you upload entire patient lists and get results back while you sleep.

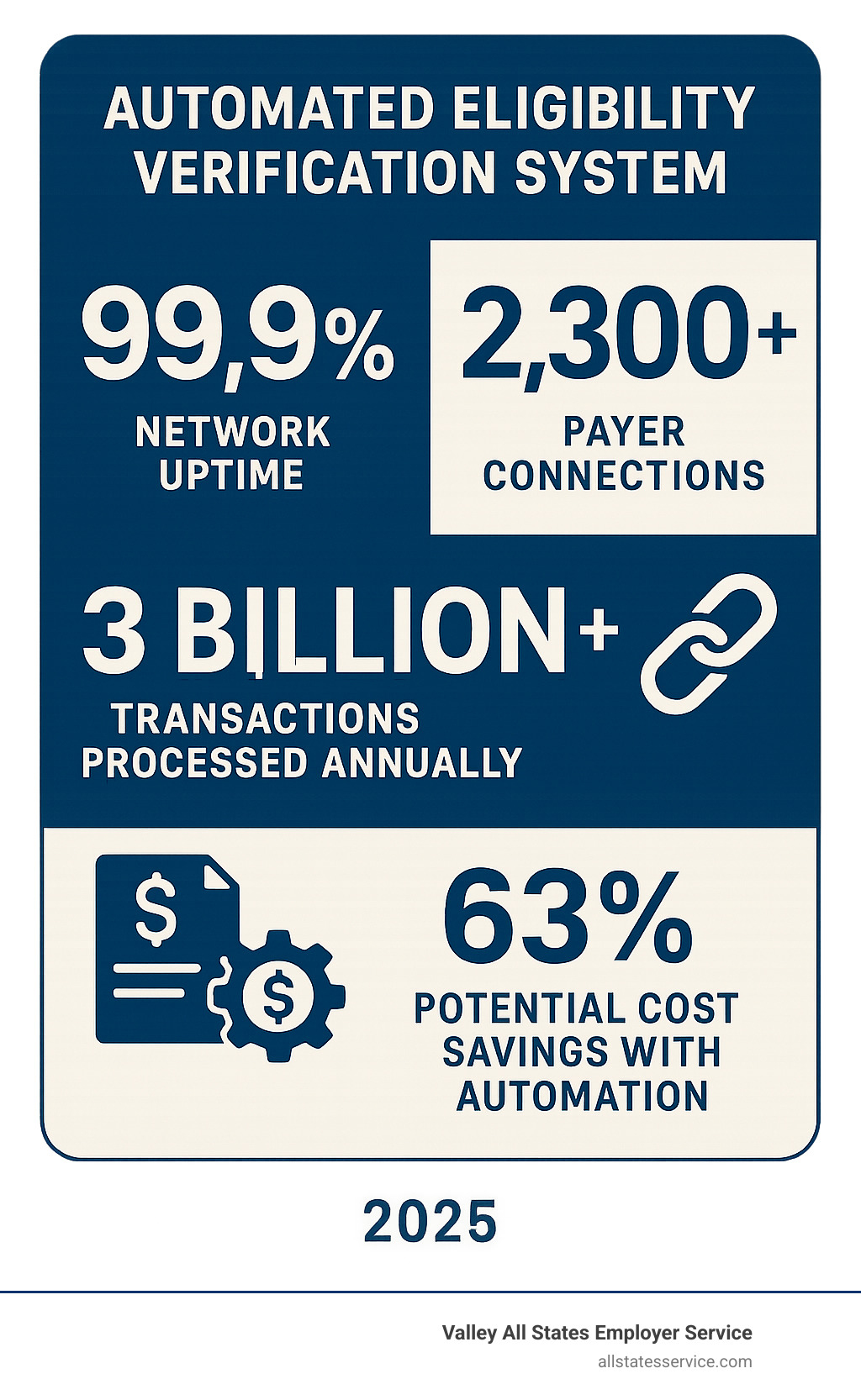

The size of the payer network makes or breaks your system’s usefulness. Leading platforms connect to 2,300+ payers, covering everything from major commercial insurers to Medicare, Medicaid, and those specialty programs that always seem to cause headaches. If your system can’t verify coverage for 80% of your patient population, you’re still stuck making phone calls.

Here’s where things get interesting: analytics dashboards and reporting turn your verification data into actionable insights. You’ll start noticing patterns like which payers consistently have coverage gaps, or which times of day give you the fastest response rates. This intelligence helps you make smarter operational decisions.

HIPAA security and compliance isn’t negotiable, obviously. Look for systems with robust encryption, role-based access controls, and SOC-2 compliance certifications. Your verification system should protect patient data with the same intensity as your EHR system.

Integration capabilities often get overlooked, but they’re crucial for staff adoption. The best systems pull patient information directly from your existing EHR and push results back seamlessly. Your team shouldn’t need to learn new workflows or juggle multiple screens.

More info about E-Verify Services shows how automation principles apply across different verification needs. Whether you’re verifying employment eligibility or insurance coverage, the goal remains the same: eliminate manual processes that drain time and create errors.

Smart features separate good systems from great ones. Automatic retry logic handles temporary payer outages gracefully. Duplicate check prevention saves money by avoiding unnecessary verification requests. Intelligent scheduling runs batch jobs when network traffic is lightest.

Insurance eligibility checks guide dives deeper into how these features specifically target denial reduction and operational efficiency.

The numbers tell the story: systems processing 3 billion+ transactions annually with 99.9% network uptime demonstrate the reliability and scale you need. When you’re looking at 63% potential cost savings through automation, the technology features become investments in your bottom line rather than just technical requirements.

Implementation Roadmap and Best Practices

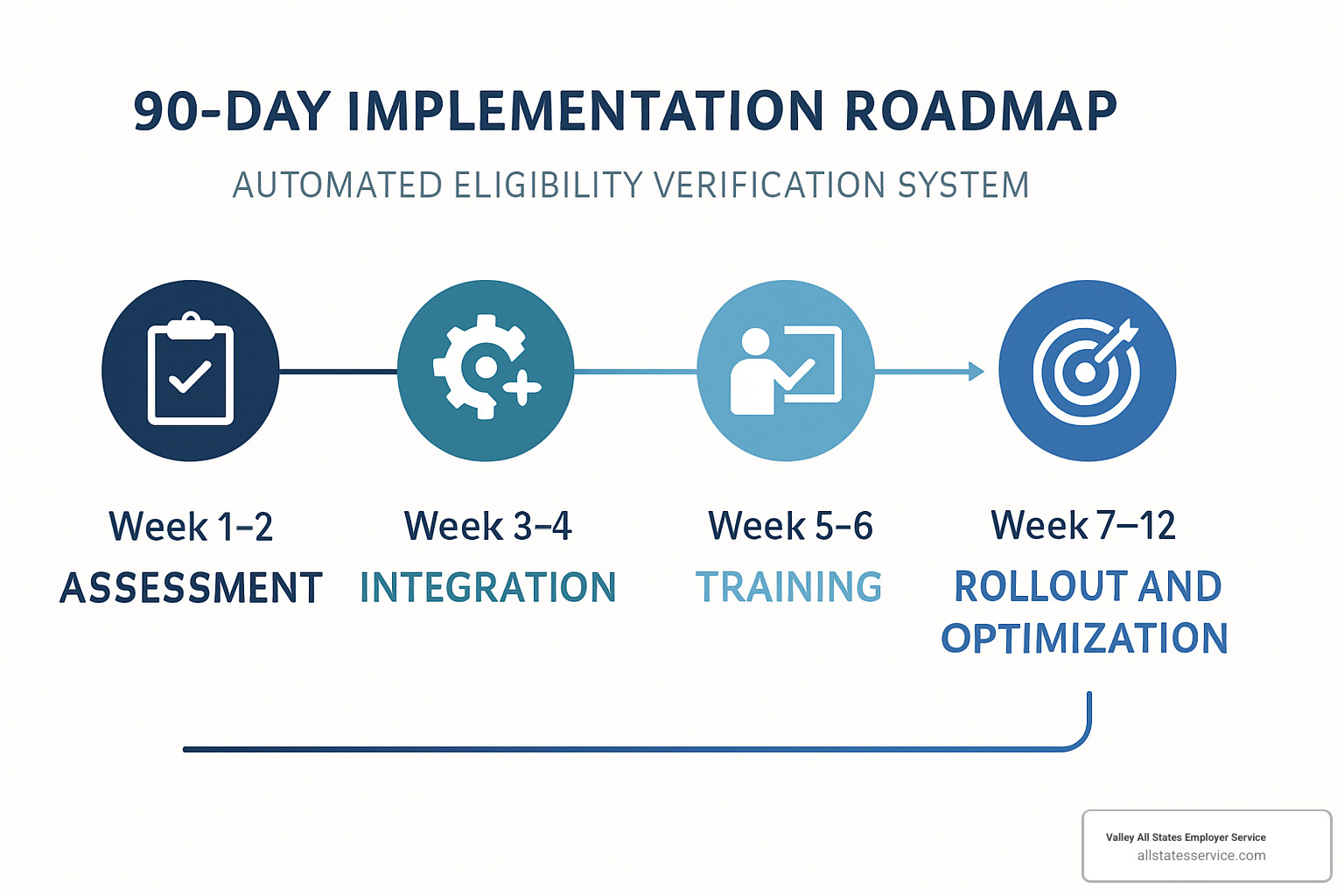

Getting your automated eligibility verification system up and running doesn’t have to feel overwhelming. Think of it like renovating your kitchen while still cooking dinner every night. You need a plan that keeps operations running smoothly while changing how you work.

The secret sauce? Breaking everything into manageable phases that build momentum rather than create chaos.

Start with a reality check. Before you change anything, document exactly what’s happening now. How many verifications does your team handle each day? Which insurance companies give you the most headaches? What’s the real cost when you factor in staff time, phone bills, and those frustrating claim denials?

This baseline becomes your North Star. Six months from now, when you’re celebrating reduced denials and happier staff, you’ll want to remember just how painful the old way really was.

Next comes the technical heavy lifting. Your IT team (or vendor) will establish secure connections between your EHR and the verification system using APIs. This sounds complicated, but it’s really just creating a digital bridge so information flows automatically between systems.

The key here is thorough testing. Run verification checks in a safe environment before going live. Better to catch integration hiccups during testing than find them when patients are waiting at your front desk.

Your staff needs to feel confident, not confused. Even though automation handles the heavy lifting, your team still needs to understand how everything works. Train them on new workflows, show them how to handle exceptions, and explain how to interpret verification results.

Address the elephant in the room early. Some staff might worry that automation means job cuts. Reassure them that this technology eliminates tedious phone calls so they can focus on more meaningful patient interactions.

Roll out gradually, not all at once. Start with one payer or a specific patient population. Maybe begin with your most reliable insurance companies to build confidence in the system. Once everything runs smoothly, expand to more challenging payers.

Track your wins from day one. Set up dashboards that show verification completion rates, claim denial reductions, and staff time savings. These numbers tell the story of your success and help identify areas that need fine-tuning.

Don’t forget patient satisfaction scores. When patients receive accurate cost estimates upfront, their entire experience improves. That’s worth measuring and celebrating.

Staying Current with Payer Rules Using an automated eligibility verification system

Insurance companies change their rules more often than teenagers change their minds. Keeping up manually feels impossible, but that’s where automation really shines.

Your system stays updated automatically. Leading verification platforms receive real-time updates from payers about policy changes, new coverage requirements, and benefit modifications. No more wondering if that coverage information is still accurate or scrambling to research policy updates.

Pre-authorization alerts save the day. When verification reveals pre-authorization requirements, smart systems flag these immediately. Some can even kick off the authorization process automatically. This proactive approach prevents those frustrating situations where patients show up for scheduled procedures only to find their insurance needs additional approval.

Medicare changes get handled seamlessly. Medicare Beneficiary Identifier updates used to create major headaches for billing departments. Modern verification systems include MBI lookup services that ensure you’re always using current identifiers. No more claim rejections because someone’s Medicare number changed.

Each payer’s quirks get managed behind the scenes. Blue Cross wants information formatted one way, Aetna prefers another approach, and Medicare has its own special requirements. Your verification system handles these variations automatically, ensuring compliance with each payer’s specific protocols without burdening your staff.

Data Security, HIPAA, and Compliance Must-Haves

Healthcare data security isn’t just important, it’s absolutely critical. Your verification system handles some of your most sensitive patient information, so security features can’t be an afterthought.

Everything gets encrypted, always. Data traveling between your systems and insurance companies must use strong encryption protocols. Look for systems that encrypt information both while it’s moving and while it’s stored. Think of it as putting patient data in a locked, armored truck rather than sending it through regular mail.

Access controls keep information safe. Not everyone needs access to all verification functions. Your front desk staff might need basic verification capabilities, while your billing manager requires full reporting access. Role-based access controls ensure people only see what they need for their specific job responsibilities.

Audit trails provide accountability. Every verification attempt, whether successful or not, should generate detailed logs with timestamps and user information. These records prove you’re following proper procedures during compliance audits and help troubleshoot any verification issues that arise.

Data retention policies prevent problems. Establish clear guidelines for how long verification data stays in your system and how it gets securely deleted when no longer needed. Your automated system should support these policies with built-in retention management features.

More info about I-9 Verification Assistance demonstrates how systematic, automated approaches work across different types of compliance requirements. Whether you’re verifying employment eligibility or insurance coverage, the principles of accuracy, efficiency, and compliance remain the same.

Frequently Asked Questions about Automated Eligibility Verification Systems

Healthcare providers ask great questions when they’re considering automated eligibility verification. Let’s tackle the most common concerns we hear.

How is a “real-time” automated eligibility verification system different from batch processing?

Think of real-time verification as your instant answer service. When Mrs. Johnson walks in for her appointment, you can check her coverage and give her a cost estimate before she even sits down. The whole process takes about 30 seconds, which means no waiting around and no surprises.

Batch processing works more like doing your laundry. You gather up all tomorrow’s scheduled patients, send their information through the system overnight, and wake up to complete verification results. It’s perfect when you don’t need immediate answers but want to handle lots of verifications efficiently.

Most smart practices use both approaches. Real-time handles the urgent stuff, while batch processing takes care of routine appointments without eating up staff time during busy periods.

The speed difference is dramatic. Real-time gives you results in 5 to 30 seconds, while batch processing typically delivers results within 15 minutes to 2 hours depending on how many patients you’re checking.

Here’s where real-time really shines: patient cost estimates. When you can tell patients upfront what they’ll owe, you eliminate those awkward billing conversations later. Plus, you catch coverage problems before delivering services, which stops claim denials before they start.

What information is required to run an automated eligibility verification check?

An automated eligibility verification system needs some basic information to work its magic, but it’s pretty forgiving if you’re missing a piece or two.

The essential information includes the patient’s full name exactly as it appears on their insurance card, their date of birth, and their member ID or Social Security Number. You’ll also need the insurance carrier information, the service date for future appointments, and your provider NPI number.

Additional helpful details include the group number, the patient’s relationship to the subscriber (like self, spouse, or child), specific procedure codes if you want benefit-specific verification, and place of service codes.

Here’s what’s really nice about modern systems: they’re smart enough to work with incomplete information. Missing a member ID? No problem. The system can often find the patient using just their name and date of birth. Of course, the more complete information you provide, the more accurate your results will be.

Data quality matters though. Clean, accurate information produces better verification results. The best systems include built-in data validation that catches common mistakes like transposed digits or formatting errors before sending the verification request.

Can an automated eligibility verification system verify Medicaid and Medicare coverage?

Absolutely, and this is where automated systems really outperform manual methods. Government program verification can be tricky, but modern automated eligibility verification systems handle it beautifully.

Most states run their own Automated Eligibility Verification Systems for Medicaid programs. The leading verification platforms connect directly to these state systems, giving you real-time Medicaid eligibility confirmation that’s often more current than what you’d get from a phone call.

Medicare coverage verification includes both traditional Medicare and Medicare Advantage plans. These systems can verify coverage, check benefit periods, and identify supplemental insurance coverage all in one go.

The Medicare Beneficiary Identifier lookup service is particularly valuable. It helps ensure you’re using current Medicare identifiers, which is crucial as Medicare continues moving away from Social Security-based identifiers.

Here’s why automation is especially important for government program complexity: Medicaid eligibility can change monthly. When you call manually, you might get outdated information. Automated systems access real-time eligibility databases, so you’re getting the most current status available.

Many patients have coverage from multiple sources like Medicare plus Medicaid, or commercial insurance plus Medicaid. Automated systems can identify all coverage sources, ensuring proper coordination of benefits and maximizing your reimbursement potential.

The payer network coverage for government programs is extensive, connecting to state AEVS feeds and Medicare databases nationwide. This comprehensive coverage means you can verify virtually any government program eligibility automatically.

Conclusion

The change is happening right now in healthcare organizations across the country. Automated eligibility verification systems aren’t just changing how providers check insurance coverage – they’re revolutionizing entire revenue cycles and patient experiences.

Think about it: Providence Health saved $18 million in potential denials in just five months. That’s not pocket change. That’s the kind of money that funds new equipment, expands services, or simply keeps the lights on during tough times.

But here’s what really matters beyond the impressive numbers. Your front desk staff won’t spend their days on hold with insurance companies anymore. Your patients won’t get surprise bills weeks after treatment. Your cash flow won’t suffer from preventable claim denials.

The technology has matured beautifully. With connections to 2,300+ payers and 99.9% network uptime, these systems handle billions of transactions every year without breaking a sweat. The days of “the system is down” excuses are pretty much over.

At Valley All States Employer Service, we see the same change happening in employment verification. Just like healthcare providers need reliable, automated ways to verify insurance eligibility, employers need streamlined E-Verify processing that eliminates errors and administrative headaches. The automation mindset works across industries because the underlying problem is the same: manual processes are expensive, error-prone, and frustrating for everyone involved.

Your patients already expect the kind of transparency and efficiency they get everywhere else in their lives. When they can check their bank balance instantly on their phone, waiting three days to find out if their procedure is covered feels pretty outdated.

Your staff deserves better tools too. Nobody goes into healthcare to spend their day navigating phone trees and deciphering coverage details from harried insurance representatives. They want to focus on patient care, not administrative busy work.

The return on investment practically calculates itself. Reduce administrative costs, eliminate human errors, accelerate cash flow, and improve patient satisfaction – that’s not just a wish list, it’s what happens when you let technology handle the routine stuff so your people can focus on what really matters.

Ready to simplify your eligibility verification processes and protect your revenue cycle? The same automation principles that streamline employment compliance can transform your healthcare operations.

Learn more about our E-Verify services and find how systematic automation can work across all your compliance needs.