What Makes Employee Benefits Outsourcing Companies a Go-To Solution?

Employee benefits outsourcing companies lighten the HR load by taking over enrollment, carrier billing, and ever-changing compliance rules. With paperwork piling up and employees expecting richer perks, outside experts free your team to focus on hiring, culture, and growth.

Want the quick version? Here are four providers many U.S. businesses trust:

| Company | Best For | Core Services | Typical Cost |

|---|---|---|---|

| Valley All States Employer Service | Small/mid-size firms | Benefits admin, E-Verify, compliance | Custom/affordable |

| Insperity | Hands-on HR consulting | Benefits, payroll, HR support | $95–$150 PEPM |

| Paylocity | Tech-forward ease | Benefits, payroll, self-service | $50–$100 PEPM |

| Sequoia | VC-backed tech firms | Total rewards, analytics | Custom |

Mix and match what you need—most providers offer flexible packages.

Fast facts

- 75% of HR pros say their department is already stretched thin.

- 99% of companies that outsource benefits stick with their provider year after year.

Managing benefits today means ACA filings, COBRA notices, and a seamless employee experience, not just insurance forms. Let’s look at how the right partner makes that happen.

How Employee Benefits Outsourcing Companies Work & What You Can Hand Off

Ever wish you had an extra set of hands to tackle employee benefits? That’s where employee benefits outsourcing companies truly shine. They step in as your go-to team behind the scenes, taking care of all the paperwork, fine print, and compliance headaches—so you can focus on what actually moves your business forward.

What exactly can you hand off? Quite a lot, actually! Most employee benefits outsourcing companies handle the essentials like plan enrollment for new hires, annual renewals, and those life changes that pop up. They manage carrier billing by consolidating invoices, handling payments, and even chasing down those pesky reconciliations.

COBRA administration? Covered. From sending out notices to tracking elections and collecting premiums, they’ll keep you compliant even if you’d rather not think about it. They’re also experts at ACA filings, managing your 1094/1095 forms and keeping affordability calculations on track.

But there’s more. Leave management is a big one—think FMLA tracking, state leave laws, and making sure everyone returns to work smoothly. Need help with retirement plans like 401(k) administration? Or wellness perks, such as health screenings and wellness incentives? They handle those, too. Many companies also offer dependent audits to confirm eligibility, and can manage your full menu of voluntary benefits (life insurance, legal plans, even pet insurance for your four-legged “employees”).

The best part is flexibility. Maybe you just need someone to wrangle COBRA or sort out ACA compliance. Or maybe you want a full-service partner who can handle everything from enrollment to audits. It’s all on the table. You can even dive deeper into more Human Resources solutions to see how outsourcing can make your day-to-day smoother.

The Step-by-Step Process

So, how do employee benefits outsourcing companies actually get things rolling? The process usually starts with a findy phase—think of it as a friendly “getting to know you” session. Here, the provider reviews your current benefits, pinpoints your pain points, and helps set goals that actually make sense.

Next up: data migration. All your employee info, plan choices, and payroll details are carefully moved to the new system. The magic happens during system integration, where the benefits platform connects to your payroll and HR systems, checking that everything syncs up as it should.

After that, it’s portal setup time. Your employer and employee dashboards get customized with your branding, plan details, and communication preferences. Once this is ready, you go live—often launching right before open enrollment—with dedicated support and ongoing guidance so any bumps in the road are handled quickly.

Commonly Outsourced Employee Benefits Services

What do businesses hand off the most? Core medical benefits like medical, dental, and vision insurance top the list, along with HSAs and FSAs management, prescription drug plans, and telehealth setup. On the financial side, 401(k) administration, employee stock purchase plans, and financial wellness programs are popular pick-ups.

Don’t forget work-life benefits—from tuition assistance and EAPs (Employee Assistance Programs) to commuter benefits and childcare help, outsourcing makes it easier to offer more options to your team. Voluntary benefits are also in demand: supplemental life insurance, legal support, identity theft protection, even pet coverage and flexible accounts for dependent care.

In short, employee benefits outsourcing companies let you pick what you need—nothing more, nothing less. Whether your business is ready for full-service help or just wants a few complex tasks off its plate, you’ll find a solution that fits.

If you’re curious about which approach works best for your business, or want to see other ways to lighten your HR load, try exploring our Human Resources solutions.

Pros, Cons, and Compliance Considerations

Let’s get real for a moment. Employee benefits outsourcing companies can seriously lighten your HR load, but they aren’t a miracle cure for every challenge. Here’s what you need to know before you hand over the keys to your benefits kingdom.

Why Businesses Choose Employee Benefits Outsourcing

Time savings are the big draw. Imagine your HR team getting back hours each week—time they can finally put into training, hiring, or building a better workplace culture. It’s not just about pushing paperwork aside. Every hour not spent wrangling benefits is an hour gained for the work that actually moves your business forward.

Cost control is another reason companies make the switch. There’s a monthly fee, but add up those hidden costs you’re already carrying: software, compliance mistakes, staff turnover, and endless training. With outsourcing, you get predictable pricing, plus a shot at lowering expensive errors that can come from manual processes. For many businesses, that’s a win.

Expert advice comes baked in. Laws change, forms change, and honestly, who has time to memorize all the acronyms? Your outsourcing partner keeps up with ACA, COBRA, and the alphabet soup of compliance so your business always plays by the rules.

Technology is a huge bonus. Even small and mid-size companies get access to tools that rival what big corporations use—think secure portals, mobile apps, and dashboards that make reporting a breeze.

And according to research on outsourcing efficiency, companies that use professional HR services see happier employees and dodge more compliance headaches.

Watch-Outs & How to Mitigate Them

Of course, there are some bumps to watch for with employee benefits outsourcing companies.

Data security is a big one. Your employee info is gold, so make sure your provider is serious about protecting it. Look for SOC 2 Type II certifications, strong encryption, and clear data handling rules.

Vendor lock-in can also be an issue. Some companies make it tough to leave by limiting data access or charging hefty exit fees. Always ask about data portability and contract details before you sign.

Service gaps are possible, especially if expectations aren’t clear. Nail down your needs on response times, support, and escalation right in the service agreement. The last thing anyone wants is to feel like just another number.

Change management can’t be ignored. Employees get used to old systems, even if they’re clunky. Transitioning to something new can cause stress. Choose a provider that offers hands-on training and clear communication, so your team feels supported at every step.

At Valley All States Employer Service, we get these concerns because we see them every day. That’s why we focus on transparent pricing, easy transitions, and flexible contracts. Want to see how we handle tricky compliance details? Learn about I-9 Verification Assistance.

Staying Compliant in Every Region

Let’s face it, compliance rules are everywhere—and they only get trickier as you grow or hire in new locations. Top employee benefits outsourcing companies tackle these challenges head-on.

For federal rules, they handle ACA reporting (like those 1094/1095 forms), manage COBRA events and notices, and stay on top of ERISA plan documents and fiduciary duties. No more losing sleep over a missed deadline.

When it comes to state and local laws, they keep track of requirements like paid family leave in states such as New York or California, plus unique local mandates on sick leave or health insurance.

Data protection matters, too—especially if you employ people outside the U.S. Providers make sure you stay compliant with GDPR, state privacy laws like CCPA, and HIPAA for health details.

And to top it off, professional providers keep a rock-solid audit trail for every action, communication, and compliance task. If auditors ever come calling, you’ll have all the proof you need, neatly organized and easy to access.

By leaning on a trusted partner, you gain not just efficiency, but also the peace of mind that every region’s rules are handled—no matter where your employees call home.

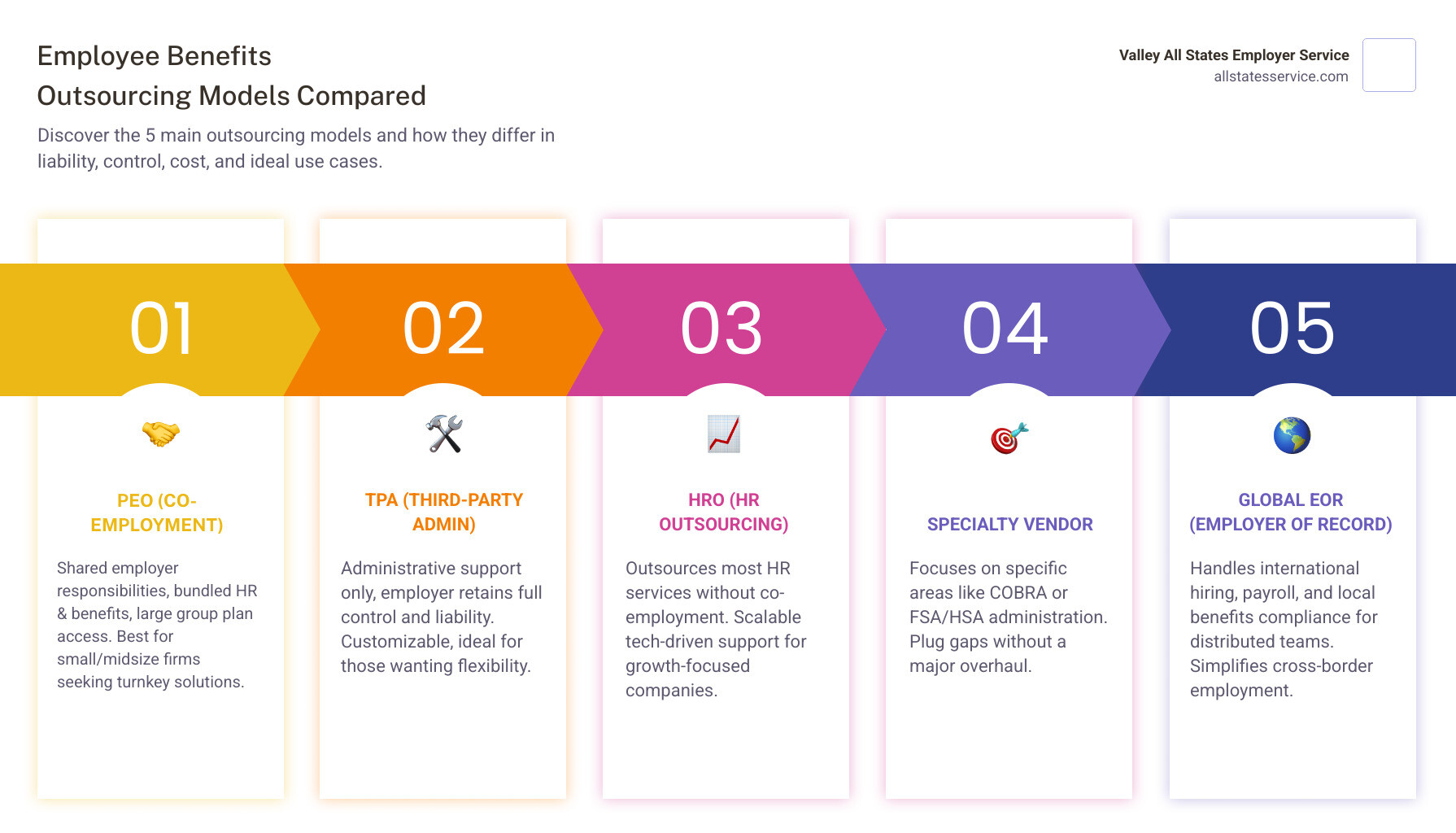

Choosing the Right Employee Benefits Outsourcing Model

Not all employee benefits outsourcing companies work the same way. Understanding the different models helps you pick the right fit for your business.

| Model Type | What It Means | Best For | Key Benefits | Considerations |

|---|---|---|---|---|

| PEO (Professional Employer Organization) | Co-employment model where PEO becomes employer of record | Small to mid-size companies wanting comprehensive HR | Access to large group health plans, shared liability, full-service support | Less control over HR policies, potential cultural fit issues |

| TPA (Third-Party Administrator) | Administrative services only, you remain the employer | Companies wanting to maintain control while outsourcing tasks | Flexibility, customization, retain employer status | More compliance responsibility, need internal HR expertise |

| HRO (HR Outsourcing) | Comprehensive HR services without co-employment | Mid to large companies wanting strategic HR support | Scalable services, technology access, expert guidance | Higher costs, potential service gaps |

When a Full-Service Model Makes Sense

Group Health Leverage

Smaller companies (under 100 employees) often struggle to negotiate competitive health insurance rates. PEOs pool multiple companies together, giving you access to the same group buying power as Fortune 500 companies.

Payroll Integration

When benefits and payroll are managed by the same provider, you eliminate data entry errors, streamline deductions, and simplify year-end reporting.

Small to Mid-Size Efficiency

Companies with 10-500 employees often lack dedicated HR staff but need professional-grade benefits administration. Full-service providers bridge this gap perfectly.

Valley All States Employer Service specializes in this sweet spot, offering comprehensive benefits support without the complexity of co-employment arrangements.

When a Flexible, Modular Approach Works

Existing Infrastructure

If you already have strong HR systems and just need help with specific functions like COBRA or ACA reporting, à-la-carte services make more sense.

Technology Integration

Companies with established HRIS platforms might prefer providers that integrate seamlessly rather than replacing existing systems.

Customized Solutions

Unique industries or benefit structures often require custom approaches that full-service models can’t accommodate.

Specialty Vendors for Unique Needs

COBRA Experts

Companies like CobraHelp and Leave Management Solutions focus exclusively on continuation coverage, offering deep expertise and competitive pricing.

FSA/HSA Administrators

Specialized providers like TASC offer sophisticated account management, debit card programs, and mobile apps for flexible spending accounts.

Compliance Specialists

Firms focusing on ACA reporting, ERISA compliance, or specific state mandates can be ideal for companies with complex regulatory requirements.

Solutions for Distributed Teams

Multi-State Complexity

Remote work has created new challenges for benefits administration. Employees in different states may have different insurance options, tax implications, and compliance requirements.

Statutory Benefits Coordination

State disability insurance, unemployment taxes, and workers’ compensation vary significantly by location. Professional providers steer these differences seamlessly.

Case Study: Multi-State Compliance

A tech company with employees in 15 states was spending 30+ hours per month just tracking different state requirements. After partnering with a specialized provider, they reduced compliance time to under 5 hours monthly while improving accuracy.

Top Employee Benefits Outsourcing Companies to Know

Below is a curated list, trimmed to the providers most frequently recommended for small and mid-size organizations.

Best for Hands-On Support

Valley All States Employer Service

Practical, compliance-first help without corporate red tape. Ideal for owners who want real people answering the phone.

Insperity

Dedicated HR consultants and a 99% client retention rate, but expect premium pricing.

Best for Modern Technology

Paylocity

Clean user interface, strong mobile apps, and solid integrations at $50–$100 PEPM.

Sequoia

Combines benefits, compensation, and analytics in one dashboard—popular with fast-growing tech firms.

Niche & Specialty Vendors

- CobraHelp – deep COBRA expertise.

- TASC – full FSA/HSA administration with debit card programs.

- AbsenceSoft – leave management automation.

These specialists plug specific gaps if you already like your current HR stack.

Need to see how outsourcing fits multi-state hiring? Check our short case study on compliance time savings that shows a 30-hour monthly reduction after switching providers.

Costs, Onboarding & Employee Experience

Most employee benefits outsourcing companies charge a per-employee-per-month (PEPM) fee:

- Basic benefits admin: $50–$75 PEPM

- Full HR support: $85–$150 PEPM

One-time implementation can run $5k–$50k, though many waive the fee for multi-year contracts. Businesses usually recoup costs within a year through lower software spend, fewer penalties, and happier employees.

A Four-Month Transition Roadmap

- Plan & findy (Weeks 1-4) – audit current data, pick services, set deadlines.

- Build & test (Weeks 5-8) – migrate data, run payroll/benefit tests in parallel.

- Go live (Weeks 9-12) – soft launch with a pilot group, then company-wide rollout.

- Optimize (Weeks 13-16) – 30-60-90-day reviews, activate extra features, fine-tune workflows.

Keeping Employees Happy

- Decision-support tools compare plans side by side.

- Chat, phone, and email support run year-round.

- Branded open-enrollment microsites cut down on repetitive questions.

Want a deeper dive into smooth rollouts? Learn more about our E-Verify services to see how Valley All States makes compliance painless.

Frequently Asked Questions about Employee Benefits Outsourcing

Let’s tackle the questions we hear most often from businesses considering employee benefits outsourcing companies. These are the real concerns that keep HR managers up at night.

How long does it take to transition?

Here’s the honest truth: most transitions take 60-90 days from signing to go-live. But that timeline can shift dramatically based on what you’re working with today.

If you’re a smaller company (under 100 employees) with straightforward benefits, you might be up and running in just 30-45 days. It’s like moving from a studio apartment – there’s just not that much stuff to pack.

On the flip side, if you’ve got 500+ employees spread across multiple states with custom benefit plans and legacy systems that haven’t been updated since the Clinton administration, you’re looking at 4-6 months. Think of it more like relocating a museum – everything needs careful handling.

The biggest factors that speed things up or slow them down? Clean employee data makes everything faster. If your current records are a mess, expect extra time for cleanup. Integration complexity matters too – some systems play nicely together, others require custom programming. And timing around open enrollment can either help or hurt, depending on when you start.

Most employee benefits outsourcing companies will give you a realistic timeline after reviewing your current setup. Don’t trust anyone who promises miracles without understanding your situation first.

Can we keep our current broker?

Absolutely, and most providers actually prefer it this way! Your broker isn’t going anywhere unless you want them to.

Think of it like this: your broker is the architect who designs your benefits strategy, while the outsourcing company is the contractor who builds and maintains it day-to-day. Your broker handles the big picture stuff – negotiating with carriers, analyzing market trends, designing plans that fit your budget and culture. They know your industry, your employee demographics, and what works in your local market.

Meanwhile, the employee benefits outsourcing companies take care of the operational headaches – enrolling new hires, processing COBRA elections, answering employee questions at 8 PM, and making sure all those compliance reports get filed on time.

This partnership usually works beautifully because both parties can focus on what they do best. Your broker brings strategic expertise and carrier relationships, while the outsourcing provider delivers operational excellence and technology.

The only time this gets complicated is when brokers feel threatened or when communication breaks down. The best providers work hard to build collaborative relationships with your existing advisors.

What security certifications should a provider have?

This is where you absolutely cannot compromise. Your employees’ personal and health information is incredibly sensitive, and a data breach could destroy your business reputation overnight.

SOC 2 Type II certification should be non-negotiable. This isn’t just a piece of paper – it means an independent auditor spent months verifying that the provider has proper controls for security, availability, and privacy. They test everything from how employees access systems to how data gets backed up.

HIPAA compliance is equally critical since you’re dealing with health information. The provider should have business associate agreements, encryption for data transmission and storage, and strict access controls. If they can’t produce current HIPAA documentation, walk away.

Look for SSAE 18 certification too, which covers internal controls over financial reporting and data processing. ISO 27001 is the gold standard for information security management – it shows they’re serious about protecting data.

But certifications are just the starting point. Ask about multi-factor authentication for all users, regular penetration testing, 24/7 security monitoring, and how they handle security incidents. Do they conduct background checks on employees who handle your data? How often do they update their security protocols?

Don’t just take their word for it. Ask to see current certification documents and recent security audit reports. Any reputable provider will share this information gladly – they’re proud of their security investments.

At Valley All States Employer Service, we understand that trust is earned through transparency. We’re happy to discuss our security measures and compliance protocols because protecting your data is just as important to us as it is to you.

Ready to Simplify Your Benefits?

Let’s be real for a moment. You didn’t start your business to become an expert in COBRA calculations or ACA reporting deadlines. You have bigger goals, and your HR team has more important work to do than wrestling with benefits paperwork every day.

The good news? You don’t have to figure it all out on your own anymore. Employee benefits outsourcing companies have evolved far beyond basic administrative support. Today’s providers become genuine partners who understand your business, care about your employees, and actually deliver on their promises.

Finding the right fit matters more than finding the biggest name. Some companies need comprehensive PEO services with full co-employment support. Others just want help with specific pain points like COBRA administration or multi-state compliance. The beauty of modern benefits outsourcing is that you can get exactly what you need without paying for services you don’t use.

At Valley All States Employer Service, we’ve built our reputation on understanding what growing businesses actually need. We know you want expert guidance without corporate bureaucracy. You want transparent pricing without hidden fees. Most importantly, you want a partner who picks up the phone when you call and gives you straight answers.

We specialize in making the complex stuff simple. Whether it’s E-Verify processing, benefits administration, or navigating the maze of employment compliance, we handle the details so you can focus on what you do best. Our clients tell us they sleep better at night knowing their compliance is handled by people who genuinely care about getting it right.

The change happens faster than most business owners expect. Within weeks of partnering with the right provider, you’ll notice your HR team has time for strategic projects again. Employee questions get answered quickly by experts. Compliance deadlines stop causing panic because someone else is tracking them for you.

Ready to see what this looks like for your business? Learn more about our E-Verify services and connect with our team today. We’ll take the time to understand your specific situation and show you exactly how we can help.

Don’t let benefits administration hold your business back any longer. The right outsourcing partner can turn your biggest HR headache into a competitive advantage. Let’s talk about making that happen for you.