Maryland new hire paperwork 2025: Master Compliance

Why Getting Maryland New Hire Paperwork Right Matters

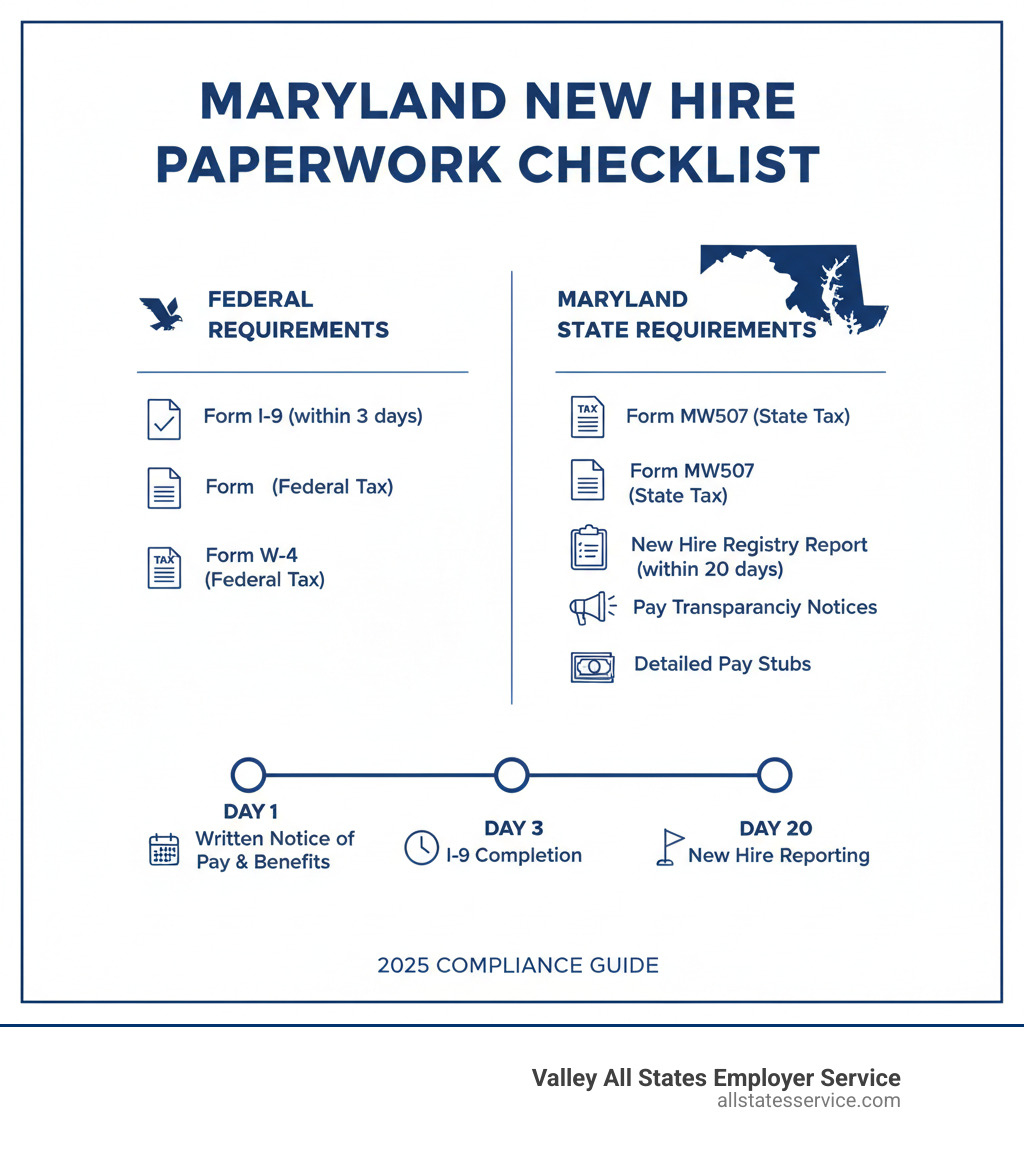

Maryland new hire paperwork includes both federal and state-specific forms that employers must complete for every new employee. Here’s what you need:

Federal Forms (Required for All Employers):

- Form I-9 – Employment Eligibility Verification (complete within 3 days of hire)

- Form W-4 – Employee’s Withholding Certificate (for federal income tax)

Maryland State Forms:

- Form MW507 – Employee’s Maryland Withholding Exemption Certificate (state income tax)

- Maryland State Directory of New Hires Report (submit within 20 days of hire date)

Additional Compliance Requirements:

- Pay transparency disclosures (effective October 1, 2024)

- Detailed pay stubs with specific information

- Written notice of pay rate, paydays, and leave benefits at hiring

- Background check compliance with Maryland’s “ban the box” law

Welcome to Team LABOR! Starting a new position can be challenging as you become acclimated to your new role. That’s how Maryland’s Department of Labor greets new state employees on their onboarding page, and it captures a truth every HR manager knows: onboarding is complicated.

But here’s the thing. While onboarding might be challenging for new employees, it can be downright overwhelming for the HR teams managing the process. Between federal requirements, state-specific forms, and Maryland’s evolving employment laws, missing a single form or deadline can result in penalties of up to $500 per affected employee.

The stakes are real. The Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 and Maryland Labor Code § 8-626.1 require all employers to report new hires within 20 days. Miss that deadline? You’re not just risking fines. You’re potentially complicating child support enforcement efforts and creating compliance headaches that take time away from what really matters: building a great team.

This guide cuts through the complexity. We’ll walk you through every federal form, every state requirement, and every recent law change that affects your Maryland new hire process. No legal jargon. No guesswork. Just a clear roadmap to compliant, efficient onboarding.

Essential Federal Forms for Every Maryland Hire

Before you even think about Maryland-specific requirements, you need to handle the federal paperwork that applies to every employer in America. Think of these as your onboarding foundation. Get these two forms right, and you’re already halfway to compliance success.

Completing Federal Maryland New Hire Paperwork: Form I-9

Form I-9 is the big one. Every employer in the country, including those handling Maryland new hire paperwork, must complete this Employment Eligibility Verification form for every single employee. No exceptions. It confirms that your new hire is legally authorized to work in the United States.

Here’s how it works. Your new employee completes Section 1 on or before their first day of work. They’ll provide basic information like their name, address, and date of birth, then attest to their employment authorization status. Pretty straightforward on their end.

Your job as the employer comes next. You must complete Section 2 within three business days of the employee’s start date. This is where you physically examine original documents that prove both identity and work authorization. You can’t skip this step or accept photocopies. The I-9, Employment Eligibility Verification – USCIS website lists exactly which documents are acceptable, and getting familiar with that list is time well spent.

What documents work? Employees can present one document from List A (like a U.S. passport or permanent resident card) that proves both identity and work authorization. Or they can combine one document from List B (proving identity, like a driver’s license) with one from List C (proving work authorization, like a Social Security card). Our I-9 Form Verification Maryland Guide walks through these document combinations in detail.

Now, about remote hires. The pandemic changed how we think about document verification, and USCIS has adapted. While in-person verification remains the standard, remote verification options exist under specific circumstances. The rules here can get technical fast, so if you’re hiring remotely, you’ll want expert guidance. That’s exactly why we created our I-9 Form Management services to help you handle these situations correctly.

Managing Tax Withholding with Form W-4

Right alongside the I-9, you’ll need every new employee to complete Form W-4, the Employee’s Withholding Certificate. This form tells you how much federal income tax to withhold from each paycheck. Get it wrong, and your employee either faces a surprise tax bill in April or gives the government an interest-free loan all year.

The W-4 walks employees through five steps to calculate their withholding. They’ll consider their filing status, whether they have multiple jobs, how many dependents they can claim, and any additional income or deductions they expect. If an employee works multiple jobs or their spouse works, there’s a specific worksheet to help them figure out the right withholding amount.

Here’s something many people don’t realize: the W-4 isn’t a one-and-done form. Life changes. Employees should update their W-4 whenever they get married, have a baby, buy a house, or experience any major financial shift. These updates ensure their withholding stays accurate throughout the year.

The IRS offers a handy online estimator at www.irs.gov/W4App that helps employees nail down their exact withholding. We always recommend employees use this tool, especially if their tax situation gets complicated. The Hiring employees | Internal Revenue Service page provides additional resources for employers navigating federal tax obligations.

Both the I-9 and W-4 form the bedrock of your Maryland new hire paperwork process. Master these federal requirements, and you’re ready to tackle the state-specific forms that come next. Want to make sure you’re covering all your bases? Check out our guide on Employee Onboarding Compliance for a complete picture of what compliant onboarding looks like.

Core State-Level Maryland New Hire Paperwork

Beyond federal mandates, Maryland has its own set of requirements for new hires. These state-specific forms ensure compliance with local tax laws and contribute to important state programs like child support enforcement. Think of them as the state’s way of making sure everything runs smoothly, from payroll to community support systems.

Maryland Employee’s Withholding Exemption Certificate (MW507)

Think of Form MW507 as Maryland’s answer to the federal W-4. While the W-4 handles federal income tax withholding, the Employee’s Maryland Withholding Exemption Certificate tells you exactly how much state tax to take from each paycheck. It’s an essential piece of Maryland new hire paperwork that every employee working in the state needs to complete.

Your new hire will declare their exemptions on this form based on personal allowances and dependents. They can also request additional withholding if they want to avoid a surprise tax bill come April. Here’s something that catches many employers off guard: Maryland also has local income taxes that vary by county. While the MW507 primarily focuses on state withholding, these local taxes can significantly impact take-home pay.

What about employees who live in one state but work in Maryland, or vice versa? These situations add a layer of complexity to withholding calculations. Out-of-state residents working in Maryland still need to complete the MW507 for Maryland state tax purposes, though they may also have obligations to their home state. The good news is that Maryland has reciprocal tax agreements with some neighboring states.

You can find the most current version of Form MW507, along with detailed instructions, on the Federal Withholding form( W-4 )and State Withholding form (MW507) page from the Maryland Comptroller’s office. This resource walks through the form line by line, making it easier for your employees to get their withholding right the first time.

Reporting to the Maryland State Directory of New Hires

Here’s a requirement that often surprises new Maryland employers: you must report every newly hired and rehired employee to the Maryland State Directory of New Hires. This isn’t optional paperwork. It’s mandated by the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 and backed up by Maryland Labor Code § 8-626.1.

Why does this matter? The primary purpose is child support enforcement. When you report new hires, you’re helping Maryland’s child support agencies locate parents who owe support and establish or enforce payment orders. It’s one of those behind-the-scenes processes that makes a real difference in kids’ lives.

The timeline is tight. You have 20 days from the employee’s date of hire or rehire to submit your report. Missing this deadline can result in penalties, and more importantly, it delays critical child support services that families depend on.

What information do you need to gather? For each employee, you’ll need their full name, Social Security Number, address, date of birth, and gender. On the employer side, you’ll provide your Federal Employer Identification Number (FEIN), company name, address, and State Unemployment Insurance Number (SUIN). If your SUIN is still pending, just write “APPLIEDFOR.” If you’re exempt from unemployment insurance, write “EXEMPT.”

The form also asks whether health care benefits are available to the employee and requests salary information (whether hourly, monthly, or yearly). You can find the actual reporting form, like the Microsoft Word – Maryland New Hire Reporting Form rev21.doc, directly from the Maryland State Directory of New Hires website.

The easiest way to stay compliant? Use the online reporting portal at www.mdnewhire.com. It’s faster than paper forms, provides immediate confirmation, and helps you avoid those pesky penalties for non-compliance. Plus, you can submit multiple employees at once, which is a lifesaver during busy hiring periods.

Don’t underestimate this requirement. While it might seem like just another form to fill out, penalties for non-compliance can add up quickly. Beyond the financial hit, you’re also disrupting important community services. It’s a simple step that takes just a few minutes but makes a meaningful impact.

Navigating Maryland’s Evolving Employment Laws

Maryland doesn’t sit still when it comes to employment legislation. The state regularly updates its laws to protect workers and promote fairness in the workplace. For employers, this means staying on top of requirements that go well beyond basic tax forms and eligibility verification.

Understanding Other Maryland New Hire Paperwork and Policies

The core Maryland new hire paperwork like I-9s and W-4s are just the foundation. A truly compliant onboarding process includes communicating essential company policies and benefits to every new team member.

During those crucial first days, new hires should receive and acknowledge several key documents. An employee handbook acknowledgment confirms they’ve received and understand your workplace policies. Your attendance policy should clearly spell out expectations for work hours, punctuality, and how to report absences. If you have a dress code, now’s the time to explain it. The same goes for your ethics and conduct standards, which cover everything from professional behavior to harassment prevention.

In today’s digital workplace, IT and data security policies are essential. New employees need to know the rules for using company equipment, accessing the internet, and protecting sensitive information. Beyond state-mandated leave, your leave policies should detail vacation time, personal days, and other time-off options.

Healthcare matters, too. New hires need clear information about available health insurance plans, when they’re eligible, and how to enroll. While the specific enrollment forms vary by provider, make sure employees know exactly where to find this information and who can answer their questions.

If you offer retirement plans, include details about eligibility and enrollment during onboarding. Depending on your plan type, this might involve an Application for Membership or Designation of Beneficiary form.

These aren’t just nice-to-haves. Clear communication about policies and benefits sets expectations from day one and helps protect both you and your employees down the road.

Pay Transparency and Pay Stub Requirements

Circle October 1, 2024 on your calendar. That’s when Maryland started enforcing two significant employment laws that directly impact how you hire and pay employees.

The Pay Transparency Law requires Maryland employers to include wage ranges in every job posting. This applies to internal postings, external advertisements, and even remote positions if the work can be performed in Maryland. You need to provide both the minimum and maximum pay range in good faith, based on your actual pay scales or allocated budget. Beyond salary, you’ll also need to include a general description of benefits and other compensation like bonuses, stock options, or paid time off.

This changes the conversation around compensation. Instead of salary discussions happening late in the hiring process, candidates now know the pay range before they even apply.

The Pay Stub and Pay Statement Law adds new requirements for what you must provide employees. When you hire someone, give them written notice detailing their pay rate, regular paydays, and leave benefits. Then, on each payday, provide a written or electronic pay statement that includes your registered business name, address, and contact information. The statement needs to show the payment date, pay period dates, hours worked (for non-exempt employees), all pay rates and forms of compensation, gross and net pay, and detailed deductions.

The penalties for missing these requirements are real: up to $500 per affected employee. Make sure your payroll systems can generate compliant pay statements and that your team knows what’s required. For help navigating these changes, our More info about Maryland Employment Law resources break down what you need to know.

The Maryland Healthy Working Families Act

Sick leave isn’t optional in Maryland. The Maryland Healthy Working Families Act guarantees that most employees earn sick and safe leave starting from their very first day of work.

The law requires employees to accrue at least one hour of leave for every 30 hours worked, up to 40 hours per year. Employees can use this leave when they’re sick, injured, or need preventative medical care. They can also use it to care for a family member dealing with illness, injury, or medical appointments. The law even covers absences related to domestic violence, sexual assault, or stalking.

Your new hires need to understand these rights from day one. Include the accrual rates, how to request leave, and any usage policies in your Maryland new hire paperwork and onboarding materials. Clear communication prevents confusion and keeps you compliant. Our More info about Human Resources Compliance resources can help you develop policies that work.

Background Checks and “Ban the Box” Laws

Background checks are a standard part of hiring, but Maryland has specific rules about when and how you can ask about criminal history. These “ban the box” laws exist to give applicants with past convictions a fair shot at employment.

Maryland’s statewide law applies to employers with 15 or more full-time employees. You cannot ask about an applicant’s criminal history until after the first in-person interview. This restriction applies to regular employees, temporary workers, and even independent contractors. That means your initial application forms shouldn’t include questions about criminal convictions.

Some Maryland counties go further. Montgomery and Prince George’s Counties have additional requirements. In these jurisdictions, you may need to provide candidates with a notice identifying the specific criminal conduct that could disqualify them from the position.

Every background check you run must also comply with the federal Fair Credit Reporting Act (FCRA). You need written consent from the applicant before ordering a background check. If the results lead you to consider not hiring someone, you must follow specific pre-adverse and adverse action procedures, including giving the candidate a chance to respond.

These requirements can feel complex, but getting them right protects both you and job seekers. Our More info about Pre-Employment Background Check Companies can guide you through responsible screening practices that comply with Maryland law.

Frequently Asked Questions about Maryland New Hire Compliance

We get it. When you’re trying to manage Maryland new hire paperwork while also running your business, questions are bound to pop up. Here are the ones we hear most often, along with straightforward answers to help you stay on track.

What is the difference between the Maryland State Directory of New Hires and the New Hire Registry Form?

This question comes up all the time, and honestly, it’s easy to see why. Here’s the simple truth: they’re not actually two different things. The Maryland State Directory of New Hires is the official state database where all new hire information gets collected. It’s the system itself, created to help with child support enforcement. The New Hire Registry Form is just the tool you use to submit your information to that directory, whether you’re filling out the paper form found at Microsoft Word – Maryland New Hire Reporting Form rev21.doc or using the online portal at www.mdnewhire.com.

Think of it this way: the directory is the destination, and the form is your vehicle for getting there. You’re not submitting to two different places. You’re just using a form to report to the one required directory. Same reporting obligation, different names for parts of the same process.

Do I need to use E-Verify for new hires in Maryland?

Short answer: probably not, unless you fall into specific categories. For most private employers in Maryland, E-Verify isn’t required by law. But there are important exceptions you should know about.

If you’re a federal contractor, your contract may require you to use E-Verify for new hires and sometimes even existing employees. Some Maryland state agencies also have E-Verify requirements. Beyond these mandates, any employer can choose to use E-Verify voluntarily, and many do because it provides an extra layer of verification for employment eligibility.

Here’s where we come in. At Valley All States Employer Service, we specialize in providing outsourced E-Verify workforce eligibility verification services. We handle the details, minimize errors, and take the administrative burden off your plate, whether you’re required to use E-Verify or choosing to do so voluntarily. If you want to learn more about how E-Verify works in Maryland, check out our Maryland E-Verify Pilot Complete Guide and Maryland E-Verify resources.

What are the record-keeping requirements for new hire paperwork in Maryland?

Keeping good records isn’t just smart business. It’s required by law, and it can save you during an audit. Different types of Maryland new hire paperwork have different retention requirements, so let’s break it down.

Your Form I-9 must be kept for three years after the date of hire, or one year after employment ends, whichever comes later. For Form W-4 and MW507, the federal and state tax withholding certificates, you should hold onto them for at least four years after the tax year they relate to. When it comes to your Maryland State Directory of New Hires Reports, while the state maintains the official directory, it’s wise to keep copies of your submission confirmations for at least three to five years as proof that you met your reporting obligations.

Other employee records like offer letters, policy acknowledgments, performance reviews, and termination documents typically should be kept for three to seven years, depending on the document type and other applicable laws like the ADA or FMLA. These retention periods matter because they protect you if questions arise down the road.

Always remember that employment law can be complex and changes frequently. When in doubt, consult with legal counsel or an HR compliance expert to make sure your record-keeping practices meet all current federal, state, and local requirements. Our HR Compliance Audit Guide 2025 can also help you assess whether your current practices are up to par.

Master Your Maryland Onboarding with Confidence

You’ve made it through the maze of Maryland new hire paperwork, and that’s no small feat. From federal forms like the I-9 and W-4 to Maryland-specific requirements like the MW507 and the New Hire Report, you now have a solid roadmap. You understand the October 2024 pay transparency changes, the importance of sick leave under the Maryland Healthy Working Families Act, and how to steer background checks without running afoul of “ban the box” laws.

Here’s the truth: compliance isn’t just about avoiding penalties (though those $500-per-employee fines for pay statement violations are certainly motivating). It’s about building a foundation of trust with your new hires from day one. When your onboarding is smooth, accurate, and timely, you’re telling your employees that you’re organized, you care about the details, and you respect their rights.

The secret to getting it right every time? Consistency. Create a standardized process that your HR team can follow for every single hire. Double-check everything. A missing signature or an incorrect date can create headaches down the road. Respect those deadlines, whether it’s the three-day window for I-9 verification or the 20-day requirement for new hire reporting. And perhaps most importantly, stay current. Maryland’s employment laws continue to evolve, and what’s compliant today might need adjustment tomorrow.

That’s where Valley All States Employer Service comes in. We get it. Managing Maryland new hire paperwork while juggling a hundred other HR responsibilities isn’t easy. Our outsourced E-Verify workforce eligibility verification services take one major compliance burden off your plate. We minimize errors, streamline your processes, and give your team the breathing room to focus on what really matters: building a great workplace culture and supporting your employees.

You don’t have to steer this alone. Whether you need help understanding the latest law changes or want to simplify your E-Verify compliance, we’re here to make your life easier. Ready to transform your onboarding process from overwhelming to effortless?

More info about our Maryland Employment Law Compliance Guide