I-9 form management: Master 3-Day Error-Free

Why Effective I-9 Form Management Is Critical for Your Business

I-9 form management is the systematic process of completing, verifying, storing, and maintaining Form I-9 for every employee you hire. It’s a critical function that ensures your business complies with federal employment eligibility verification laws, protecting you from costly penalties and the disruption of a government audit.

Quick Answer: What You Need to Know About I-9 Form Management

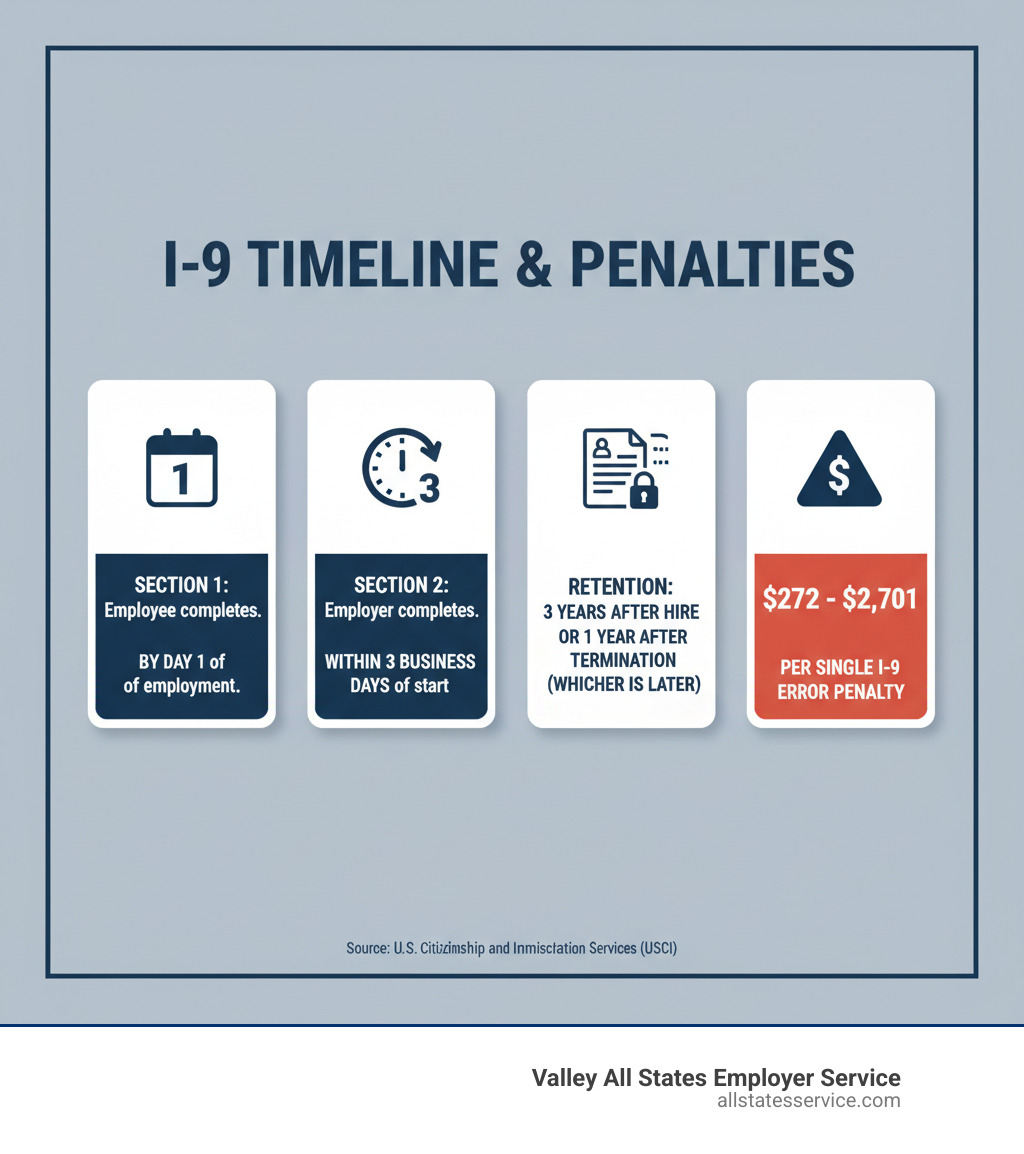

- Complete Section 1 by the employee’s first day of work. The employee must complete their portion on or before their first day of paid work. This deadline is strict and non-negotiable.

- Complete Section 2 within three business days of their start date. You, the employer, must physically or remotely examine their documents and complete your section within this tight window.

- Retain forms for three years after the hire date OR one year after the termination date, whichever is later. This unique calculation requires a robust tracking system to avoid premature destruction or keeping records for too long.

- Store securely in a separate file from other personnel records. This is crucial to prevent potential discrimination claims and to make audit responses faster and cleaner.

- Conduct regular self-audits to catch and correct errors before ICE does. Proactively finding and fixing mistakes demonstrates good faith and can significantly reduce potential fines.

- Use authorized representatives or new alternative procedures for remote employees. With a distributed workforce, you need a consistent and compliant process for verifying employees you don’t see in person.

Here’s the reality: U.S. Immigration and Customs Enforcement (ICE) has intensified its focus on employer compliance. Penalties for paperwork violations now range from a few hundred dollars to over $2,700 per form, and fines for knowingly hiring unauthorized workers can reach up to $28,619 per violation. Even simple, unintentional mistakes like a missing signature, a late completion, or an incorrect date can trigger these significant fines. With over 300 possible errors on a single form, the financial risk is real and growing.

The challenge isn’t just completing the form once. True I-9 form management involves overseeing the entire lifecycle for every employee. This includes navigating the complexities of remote verifications, tracking reverification deadlines for employees with temporary work authorization, preparing for potential audits, and staying current with constantly changing regulations. For busy HR managers, this creates a persistent compliance burden that pulls valuable time and resources away from strategic hiring, employee engagement, and business growth.

The good news? With the right approach, systems, and knowledge, you can transform I-9 management from a source of anxiety into a streamlined, confident process. Whether you’re onboarding your fifth employee or your five-hundredth, understanding the fundamentals and modern best practices makes all the difference.

The Core Components: Understanding Form I-9 and E-Verify

Let’s start with the basics. Before you can master I-9 form management, you need to understand what you’re actually managing and why it matters. Think of Form I-9 as the foundation of your employment verification process. It’s not just another form to file away; it’s your legal documentation that every person you hire is authorized to work in the United States.

And then there’s E-Verify, which often gets mixed up with Form I-9. While they work together in the employment verification world, they’re actually two different tools with distinct purposes. Getting clear on what each one does will save you confusion down the road and help you build a solid compliance strategy.

What is Form I-9 and Why Is It Mandatory?

The Employment Eligibility Verification form, better known as Form I-9, is your legal proof that you’ve verified each employee’s identity and their authorization to work in the U.S. Every employer in America must complete one for every person they hire. No exceptions. It doesn’t matter if you’re hiring a U.S. citizen who’s lived here their whole life or someone with a work visa. The rule applies equally to everyone.

This requirement goes back to the Immigration Reform and Control Act (IRCA) of 1986. This landmark law made it illegal for employers to knowingly hire or continue employing people who aren’t authorized to work here. At the same time, IRCA also introduced anti-discrimination provisions to protect authorized workers from being treated unfairly during the hiring process. Form I-9 is the tool created to help employers meet the first requirement without violating the second. It’s your shield against accusations of hiring unauthorized workers.

Here’s what makes this serious: you’re not just filling out paperwork. You are creating a documented record that protects your business from federal law compliance violations. When you complete Form I-9 correctly, you’re actively preventing unauthorized employment and demonstrating your commitment to maintaining a legal workforce. It’s an employer obligation that carries real weight, and your responsibility includes examining documents that “reasonably appear to be genuine and to relate to the person presenting them.” This standard requires careful, consistent judgment without over-scrutinizing or discriminating.

Think of it this way: Form I-9 is your business saying, “Yes, we checked. This person showed us valid documents proving who they are and that they can legally work here.” That simple act of verification, when done right, keeps you on the right side of Federal law Compliance and protects you from penalties that can reach tens of thousands of dollars per violation.

Understanding New Hire Eligibility starts with this form. If you’re wondering What is an I-9 Form? in more detail, we’ve covered the complete breakdown elsewhere, but the key takeaway is this: it’s mandatory, it’s federal, and getting it right matters.

Form I-9 vs. E-Verify: A Clear Comparison

Now let’s clear up a common point of confusion. Form I-9 and E-Verify are not the same thing, even though they’re both part of employment verification. They work together, but they have different requirements and different purposes.

Form I-9 is mandatory for every employer. You must complete it for every new hire. It’s a physical or electronic document where you examine the employee’s original documents and record what you saw. You’re verifying identity and work authorization with your own eyes, using documents the employee presents from the government’s approved lists.

E-Verify, on the other hand, is an electronic system run by the Department of Homeland Security (DHS) and the Social Security Administration (SSA). It takes the information from the completed Form I-9 and cross-checks it against federal databases to confirm that the data matches official records. After you enter the employee’s information, E-Verify returns a result, usually “Employment Authorized.”

Sometimes, however, it returns a “Tentative Nonconfirmation” (TNC), which means there is a mismatch. This is where the process can get complicated. A TNC requires a specific, time-sensitive process where the employee must be notified and given the opportunity to resolve the issue with the relevant government agency. Mishandling a TNC can lead to discrimination claims or other violations.

Here’s where it gets important: E-Verify is voluntary for most employers. However, it is required for federal contractors and in a growing number of states. For those who use it, E-Verify offers a powerful benefit: it creates a “rebuttable presumption” that you have not knowingly hired an unauthorized worker, offering a strong defense in an audit.

| Feature | Form I-9 | E-Verify |

|---|---|---|

| Requirement | Mandatory for all employers | Voluntary for most employers (required in some states or for federal contractors) |

| What it does | Verifies identity and work authorization through document examination | Confirms Form I-9 data against government records electronically |

| Format | Paper or electronic form | Electronic system only |

| When it’s used | For every new hire, completed within 3 business days of start date | After Form I-9 Section 2 is completed, typically within 3 business days of hire |

| Who manages it | Employer responsibility | Electronic verification through DHS/SSA databases |

Understanding the relationship between E-Verify and I-9 helps you see the complete picture of workforce verification. Form I-9 comes first. It’s your foundation. E-Verify is an optional (but increasingly common) tool that adds an extra verification step. Managing the E-Verify process, especially the complexities of TNCs, is where an expert service can provide immense value by ensuring every step is handled correctly and efficiently.

If you’re looking to understand both systems in depth, our I-9 & E-Verify Ultimate Guide walks through how they work together and when you might need to use both. The key is recognizing that strong I-9 form management is essential regardless of whether you use E-Verify. You can’t skip the I-9, but you can choose to add E-Verify on top of it for improved verification and compliance confidence.